The investing game can appear complicated as there are many issues to consider before leaning into a stock: Is the time right to load up? Are the shares overvalued? Will a beaten-down stock ever recover?

All of these concerns are valid, but there are ways to simplify the process, such as examining insiders’ actions. By insiders, we refer to corporate officers who operate “on the inside” and are responsible for the performance of the companies they work for. After all, they have knowledge not available to the casual investor. And when they are seen picking up shares of their own firms’ stock, especially in bulk, it sends a clear message to investors they think the shares offer good value at current levels.

If that is not convincing enough, when the same stocks get the thumbs up from analysts working at one of the world’s biggest banks, such as J.P. Morgan, it certainly warrants a closer look.

So, we’ve done just that. Using TipRanks’ Insiders Hot Stocks tool, we have homed in on two names into which insiders have been pouring millions recently, and which JPMorgan stock experts also believe have room for further growth – with one potentially boasting an upside of a significant 175%. Moreover, the analyst consensus rates both of them as Strong Buys. So, let’s see why you might want to pay attention to these two stocks right now.

Akoya Biosciences (AKYA)

We’ll first head to the life sciences space and get the lowdown on Akoya Biosciences, a firm that calls itself “the Spatial Biology company.” That is, it is a pioneer in spatial phenotyping technology that enables researchers and clinicians to gain deeper insights into the complex biology of diseases at the cellular level.

Combined, the company’s single-cell imaging products, such as The PhenoCycler (previously known as CODEX), and the PhenoImager (known before as Phenoptics), offer a complete solution that caters to the wide-ranging needs of researchers in the fields of discovery, translational, and clinical research.

The products have been steadily gaining traction, and that was the case again in the most recently reported quarter – for 1Q23. Revenue increased by 26.7% year-over-year to $21.4 million, surpassing the forecast by $1.08 million. At the other end of the scale, EPS of -$0.49 met Street expectations. For the outlook, the company maintained its prior full-year 2023 guidance, with revenue projected to be in the range of $95-98 million. The midpoint of this range is above the consensus estimate of $95.92 million.

Despite the decent readout, AKYA shares have suffered badly this year, shedding 32% year-to-date. It seems time for the insiders to act, and there are a total of six of them. Evidently, several in the C-suite believe the shares are undervalued. This week, board members Thomas Raffin, Matthew Winkler, and Chairman Robert Shepler have all been loading up, purchasing 2,020,000, 203,388, and 120,000 shares, respectively. Additionally, board members Myla Lai-Goldman and Scott Mendel, along with CFO Johnny Ek, bought smaller amounts of 20,000 shares each. Combined, these purchases are currently valued at $15.74 million.

They are not the only ones showing confidence. Scanning the latest print, J.P. Morgan analyst Julia Qin has plenty of good things to say about the Spatial Biology company.

“AKYA delivered another strong quarter on the back of PhenoCycler-Fusion new product cycle, with multiple products in the pipeline such as PhenoCycler Fusion 2.0 field upgrade, PhenoCode panels and RNA menu expansion to accelerate growth in 2023 and beyond… With a large $17B TAM for spatial biology, differentiated value proposition, strong positioning in the clinical market, and a strong management team, we believe AKYA is well positioned to execute and deliver attractive revenue growth and margin expansion,” Qin opined.

Qin backs up those comments with an Overweight (i.e., Buy) rating and an $18 price target, indicating the stock has room for growth of 175% over the next year. (To watch Qin’s track record, click here)

That take is no anomaly. All 6 other recent analyst reviews are positive, naturally making the consensus view here a Strong Buy. Analysts see shares rising by a hefty 142% in the months ahead, considering the average target stands at $15.86. (See AKYA stock forecast)

Topgolf Callaway Brands (MODG)

For our next insider/JPM-backed name will pivot away from medical devices to instruments of an altogether different hue. Topgolf Callaway Brands is a leading name in the global golf industry. Formed from the 2021 merger of high-quality golf equipment maker Callaway Golf and golf entertainment brand Topgolf, the company’s portfolio of brands offers a range of products that cater to both amateur and professional golfers – spanning golf equipment, apparel, and entertainment.

This golf specialist delivered beats on both the top-and bottom-line in its latest quarterly readout. Revenue reached $1.17 billion, amounting to a 12.5% year-over-year increase and outpacing the Street’s call by $30 million. Adj. EPS of $0.17 beat the $0.15 forecasted by the analysts.

However, the company provided a disappointing outlook, with Q2 revenue expected in the range between $1.175 to $1.195 billion, some distance below consensus at $1.22 billion.

Management emphasized that they have several initiatives anticipated to drive growth in the latter part of the year, but they did not provide too much info regarding these.

That did not offer much consolation for investors, who sent shares down sharply once they digested the details. However, director Adebayo Ogunlesi must think the future bodes well for MODG, as he recently scooped up 100,000 shares, which are now worth $1,966,000.

Also confident in the company’s ongoing success is JPM analyst Matthew Boss, who thinks Topgolf Callaway stands out in its field.

“Management sees ‘extremely strong’ demand within the social/walk-in business (80% of sales mix), continued tailwinds to experiential activities, and benefits from PIE, with CFO Lynch confident in the FY23 SVS (same-venue-sales) outlook and multi-year growth potential of Topgolf (low-single-digit SVS long-term with plentiful new unit white space)… We believe the company represents the ‘growth’ name in golf with an accelerating multiyear financial profile including ~10-12% revenue growth translating to +Mid/High-Teens EBITDA growth,” Boss opined.

Accordingly, Boss rates MODG an Overweight (i.e., Buy) while his $25 price target suggests the shares will climb 27% higher over the coming months. (To watch Boss’s track record, click here)

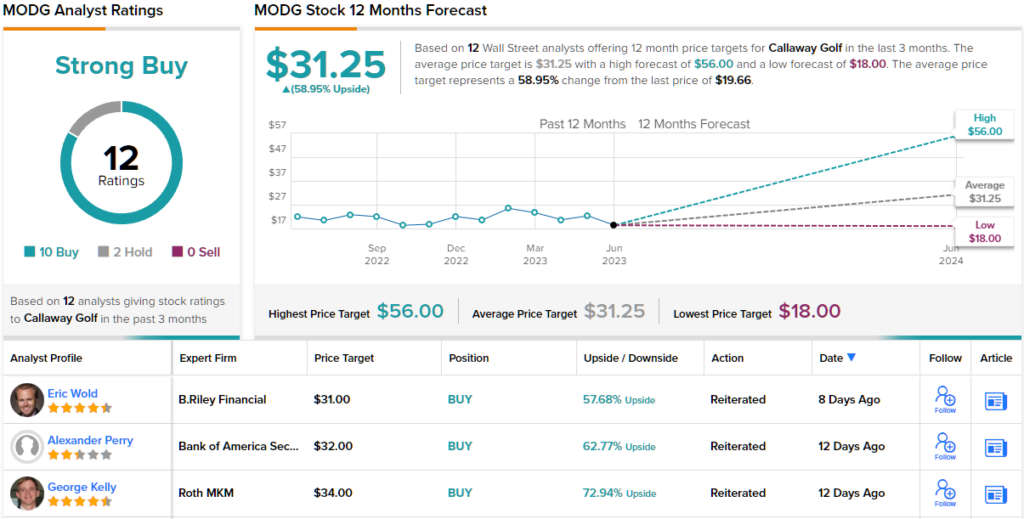

The JPMorgan view may turn out to be the conservative look at Valens – the stock’s Strong Buy consensus rating, and the average price target of $31.25 suggests ~59% upside from the current share price of $19.66. (See MODG stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.