Finding the right stocks is the only real ‘trick’ to successful investing, but it can be quite a trick. There are thousands of publicly traded stocks, and thousands of active traders, which adds up to millions of daily stock transactions – and an imposing wall of data for the retail investor to sort through.

What’s needed is a clear signal, something that can cut through the noise and show just what stocks are right to buy. Fortunately, there are several such signals. One of the best comes from the corporate insiders, the company officers holding C-suite positions or seats on the Boards – and having access to the kind of confidential information that will point toward future share performance. These insiders would be less than human if they didn’t trade on their knowledge (which they are obliged to make public), but keep in mind that the only reason they have to buy is quite simple: they are sure the shares will rise.

Right now, some insiders are picking up beaten-down stocks, a clear case of ‘buy the dip’ in preparation for coming gains. Using the TipRanks Insiders Hot Stocks tool, we can look up some details on two of their transactions in particular, stock buys in the million-dollar range that definitely deserve a closer look from investors.

The view from the Street shows plenty of upside on both of these stocks. Let’s find out what else these shares have to offer.

Gogo (GOGO)

Gogo, the first stock on our list, fills an interesting niche in the world of broadband connectivity – the company is the leading provider of online connectivity services in the business aviation market. The company offers a suite of cabin systems, off-the-shelf or customized, allowing passengers to access integrated connectivity, in-flight entertainment, and even voice solutions. Thousands of aircraft, at all scales, from short-hop turboprops to globe-spanning jets, have Gogo’s solutions installed. And, the company’s products are used by a wide range of operators, including fractional owners, charter airlines, corporate flight departments, and private individuals.

While the private business air travel market may sound small and specialized, it encompasses a large customer base. As of the end of 2023, Gogo’s broadband services were in use on 7,205 business aircraft, and the company’s narrowband satellite connectivity was installed on 4,341 planes. The 7,205 broadband installations represented a 4% increase year-over-year.

The business aviation market has also proven stable, and Gogo’s revenues commonly hold steady at or near $100 million per quarter. For the last reported period, 4Q23, the company had a top line of $97.8 million. While down 9.6% y/y, this was $1.32 million better than had been expected. The company’s earnings, at $0.11 per share in GAAP measures, came in a penny below expectations.

Gogo has had some boosts from the news recently. In January of this year, the company won an appellate court decision that prevented an injunction against it from the competing firm SmartSky. And in February, Gogo signed an agreement with the private jet provider NetJet to extend their existing 20-year relationship.

Despite these positive news releases, shares in Gogo are down 66% over the last 12 months and one insider has decided the time is right for loading up.

Recent insider activity shows that Board member Charles Townsend made two large purchases, totaling 289,654 shares. Townsend laid out over $2.4 million for the stock, and now has a stake in the company worth almost $34 million.

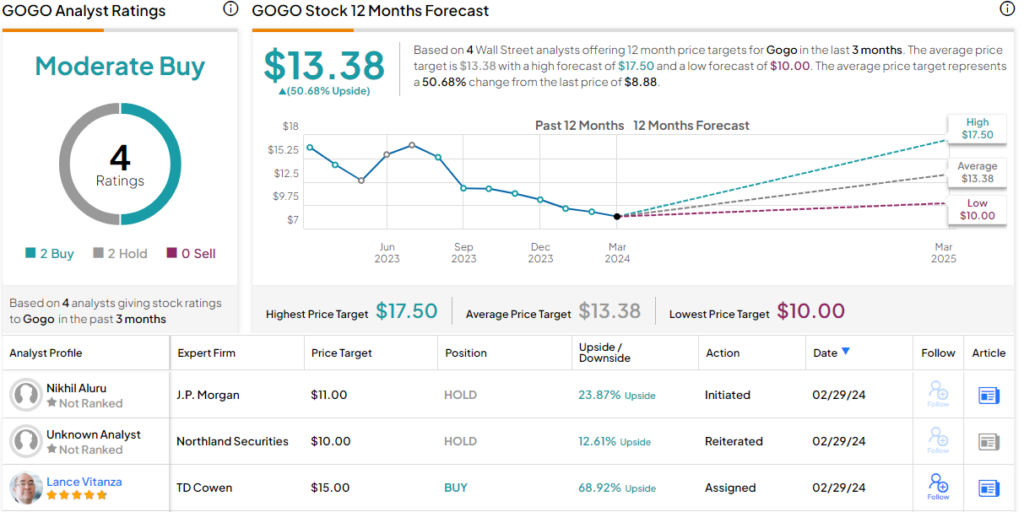

The Board member is not the only bull here. TD Cowen analyst Lance Vitanza also takes an upbeat view of Gogo, citing the company’s leading market share, among other factors: “Gogo has set its 5-year revenue CAGR target at ~17%, driven largely by unit growth as Gogo pursues in particular a ‘greenfield’ opportunity in light jets. We estimate a US fleet of ~7k light jet units, of which ~20% are currently equipped with broadband; we think it’s only a matter of time before most of these jets (plus whatever new units are manufactured) are installed with broadband, with the lion’s share likely falling to Gogo. Gogo’s LT financial targets suggest FCF of $1.15 per share by 2025 with substantial growth from there.”

Vitanza goes on to rate the shares as Outperform (Buy), with a $15 target price to suggest a 69% gain in the coming months. (To watch Vitanza’s track record, click here)

GOGO shares have a Moderate Buy consensus rating from the Street’s analysts, based on an even split among the ratings – 2 Buys and 2 Holds. The stock is selling for $8.88 and its $13.38 average price target implies it will gain 51% over the course of the year. (See Gogo stock forecast)

Sunnova Energy International (NOVA)

Next up, Sunnova, is one of the leaders in the US residential solar power market. The company builds and installs solar power systems in private homes, and has its hands on all stages of the installation business, from setting up rooftop panels to connecting the solar power system into the home’s existing electrical system to installing the storage batteries needed as back-up for solar power generation. Sunnova is also well-known for providing solid support to its customers, including ongoing service, maintenance, and repairs as needed, as well as providing spare parts and making system upgrades.

Sunnova has made some recent announcements that should interest potential investors. In January, the company announced the upcoming opening of its first Adaptive Technology Center, a facility that will enhance the development and testing of new solar energy technologies such as microgrids and inverters. The facility will include a full-scale functional model home, for more realistic testing.

Also of note, in February the company announced plans to implement an ATM, an at-the-market offering for $100 million. The company has stated that the ATM will be used for ‘good housekeeping purposes,’ and that it does not plan to implement it before the next earnings call. Management, in its 4Q23 earnings call, described putting the ATM in place now as a ‘luxury, rather than a necessity.’

Meanwhile, Sunnova reported its 4Q23 results last month, and missed the forecasts for both revenues and earnings. The revenue total came to $194.18 million, relatively flat y/y but $29.83 million less than the estimates, while the bottom line figure, a GAAP loss of $1.53 per share, was much deeper than the 18-cent EPS loss reported in 4Q22 and missed expectations by $1.28 per share. NOVA shares were already under pressure before the print, but they have shed another 54% since the readout.

However, turning to the insiders and their trades, we find that Board member Akbar Mohamed must think they have retreated by too much. He recently purchased 152,450 shares of NOVA – a stock buy that was valued at $1,054,954 and brought his full stake in the company to $1.34 million.

This brings us to the comments from Truist analyst Jordan Levy, who acknowledges the downbeat sentiment has been further exacerbated by the ATM. However, he remains long-term upbeat on the stock, writing of it, “As evidenced by the sell-off in NOVA shares, in line with current negative sentiment for resi solar (& resi installers more specifically), any mention of corporate capital carries potential to snowball into a short narrative of imminent demise. However, we see minimal fundamental change in the NOVA story and view the ATM commentary as a costly misread of the current mkt. Focusing in on NOVA’s 2024 guidance, new cash generation tgts, and associated opex reduction goals, we see our bullish thesis largely intact as resi mkts recovery off the bottom.”

Levy is bullish indeed. He goes on to put a Buy rating on Sunnova’s shares and a $16 price target that implies the stock will nearly triple in value over the next 12 months. (To watch Levy’s track record, click here)

Sunnova claims a Moderate Buy consensus rating, based on 16 recent reviews that include 11 Buys and 5 Holds. The shares are selling for $5.35, and their $17.60 average price target is even more bullish than Levy’s objective, pointing toward a 229% gain for the year ahead. (See Sunnova’s stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.