ImmunityBio (NASDAQ: IBRX) plans to fast track a second-generation COVID-19 vaccine through a joint partnership with Amyris (NASDAQ: AMRS).

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

The vaccine, slated to be distributed sometime in 2022, will be an oral dosage and tailored for global distribution to help underprivileged communities.

ImmunityBio is a clinical stage, immunotherapy company, which is currently developing different treatments, using manufactured NK and T cells, for lung, bladder, and pancreatic cancer as well lymphoma. The company also conducts clinical research on vaccines and manufactures its own proprietary T Cells.

As a pre-clinical stage research company, ImmunityBio is not at the revenue stage, although it brings in proceeds from IP licensing, equipment sales, and T Cell manufacturing.

The company’s stock price has been on a one-year downtrend, and its recent merger with NantKwest has increased operating costs. The company’s stock price began uptrending on the news of the joint venture with Amyris, despite the NASDAQ sell-off.

I rate the stock as bullish for now and believe a steeper uptrend will emerge, after the vaccine is in production and sees distribution

New Vaccine

ImmunityBio and Amyris are bringing unique technologies together for rapid development of an oral second-generation COVID-19 vaccine.

Amyris is a synthetic API manufacturer and supplier, as well as a biotech research company. Amyris will contribute its proprietary adjuvant, allowing for oral ingestion and efficient uptake, as well as its RNA sequencing technology and its AI technology for rapid development and scaling of products.

ImmunityBio will bring its specialty in running human clinical studies and its own adenovirus vaccine candidate to the venture. Together, the two companies plan rapid scale and development of the vaccine.

As an oral dosage, the vaccine does not need medical administration, allowing for self-dosage with communities without access to modern medical systems.

ImmunityBio’s vaccine promotes an immune response, even when the patient is already vaccinated or immune to the virus. The vaccine also provides against some future variants of the virus.

ImmunityBio’s Other Research, Financial Performance

ImmunityBio has been conducting clinical trials for over a decade and the company specializes in effective alternative cancer treatment. Its “Ankitiva Superagonist Antibody Cytokine Fusion Protein” aims to reduce cancerous tumors in patients whose cancer has become immune to current treatment. The company has experienced success with its human trials for cancer treatment.

The company does not have any products at market and raises revenues through the selling of its IP and equipment for producing T Cells. The company has never been at the revenue stage, and according operates at a $1.9 billion-accumulated deficit.

It currently operates at a net loss and will have to raise proceeds to bring its products to market. The company has seen negative free cash flow in the past.

The company must be valuated based on its potential. ImmunityBio does not estimate the potential market value of its COVID-19 vaccine candidate nor its cancer treatments.

It plans to produce one billion vaccine doses, according to Amyris’ last earning statement.

Wall Street’s Take

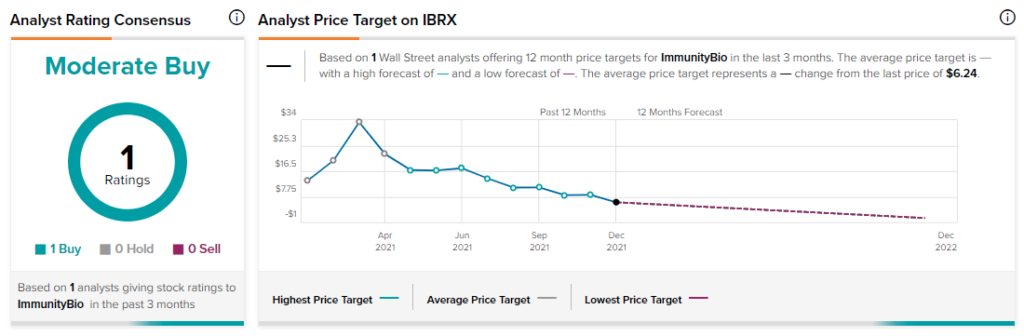

According to Wall Street, ImmunityBio has a Moderate Buy consensus rating, based on one Buy assigned in the past three months.

There is no average ImmunityBio price target.

Conclusion

ImmunityBio has joined forces with Amyris to produce an orally ingested Gen 2 COVID-19 vaccine.

The company plans to distribute the vaccine globally with an eye to underprivileged communities that may not have access to modern medical systems.

The company brings its extensive experience running human clinical trials and its method of producing T Cells. Amyris brings its proprietary adjuvant, its RNA analysis technology, and its AI technology for quickly scaling up the production and manufacture.

There is no firm estimate to what ImmunityBio will gain in proceeds if the project is successful. The news of the planned vaccine development has caused the company’s stock to begin a new uptrend.

Download the TipRanks mobile app now

Disclosure: At the time of publication, Alan Sumler was long ImmunityBio.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >