The world’s macroeconomic situation might well be described as “strange” right now, and it’s hitting business computing companies like International Business Machines (IBM) hard.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

In fact, IBM is down almost 7% today after reporting earnings, thanks to the strength of the dollar and Russia/Ukraine headwinds causing the company to cut its forecasts. IBM’s earnings report did feature solid outcomes. However, they weren’t sufficiently solid to prevent the company from sliding.

While I was moderately bullish on IBM before, thanks to some new deals it was making, I’m pivoting to neutral. The deals are still there, but if IBM is hit this hard by a strong dollar, then it’s likely to continue being hit. The dollar losing ground isn’t likely to happen any time soon.

IBM posted earnings of $2.31 per share against a Refinitiv consensus that called for $2.27. The company also beat revenue projections, turning in $15.54 billion against Refinitiv projections that called for $15.18 billion.

As good as this was, it didn’t help when IBM noted that it was trimming its full-year forecasts. Management now looks for $10 billion in free cash flow, down slightly from the earlier-projected range of between $10 billion and $10.5 billion.

The last 12 months for IBM are up overall, but it took quite a ways to get there. IBM dropped as low as $113 per share back in November 2021 but recovered to over $140 as recently as three weeks ago. A recent pullback took shares down to around $128.

Wall Street’s Take on IBM Stock

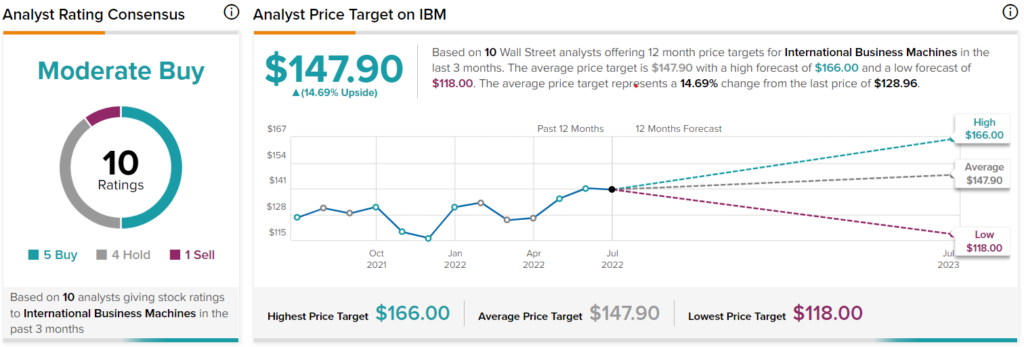

Turning to Wall Street, IBM has a Moderate Buy consensus rating. That’s based on five Buys, four Holds, and one Sell assigned in the past three months. The average IBM price target of $147.90 implies 14.7% upside potential.

Analyst price targets range from a low of $118 per share to a high of $166 per share.

Investor Sentiment is Starting to Turn South

On the surface, IBM would seem to be doing well with investor sentiment. After all, IBM has a ‘Perfect 10’ Smart Score on TipRanks, which is the highest score possible. Essentially, this means that out of all stocks, IBM has one of the best chances to outperform the overall market. Broader investor sentiment, however, has its doubts.

One of the biggest doubters here is hedge funds. Based on the results of the TipRanks 13-F Tracker, hedge funds cut back on IBM purchases in a big way. They went from holding 925,979 shares to holding just 221,644 shares between March 2022 and June 2022. This represents the sixth consecutive quarter that hedge funds have pared back IBM holdings.

Insider trading at IBM isn’t much better. While there was a big surge in Buy transactions in the last three months—they led Sell transactions by 13 to one—reports note that IBM insiders still sold $222,500 worth of stock in the last three months.

However, Buy transactions led Sell transactions by 25 to eight over the last 12 months. Nonetheless, insider sentiment is still negative, as shown in the image below:

Meanwhile, retail investors holding portfolios on TipRanks are starting to turn against IBM as well. While the number of TipRanks portfolios holding IBM stock is up 0.1% over the last 30 days, it’s down 0.1% over the last seven days.

Finally, there’s IBM’s dividend history. IBM held a very regular dividend over the last 30+ years, which even includes the pandemic period. That’s a mark in its favor, of course—particularly for income investors—although increases in the dividend have been largely trivial.

Over the last three years, IBM has hiked its dividend by $0.01 once per year. The hikes usually arrive every May.

The Thorn in the Lion’s Paw

Here’s the bad news right off the bat. If IBM is getting hit this hard over dollar strength, then the hits will likely keep on coming for the foreseeable future. A weaker dollar in this environment isn’t likely. It’s possible, of course, and it’s a bet worth hedging, but the odds of it actually taking place to any significant degree are fairly long.

The company posted its highest sales growth levels in a decade. That would be great in any normal environment. These days, however, the news is not all that great. Every bit of “sales growth” news needs to be properly tempered by remembering that this is an inflationary environment.

Oil company profits are climbing not because they’ve done something miraculous with their expense figures. They’re climbing because people are taking out mortgages to fill a gas tank, figuratively.

When prices of goods climb due to an inflationary environment, it’s little surprise to see growth in sales. However, it’s vital to note that expenses are likely to grow too.

Worse yet, strong dollar figures aren’t the only thing hitting the company. The loss of Russian business, which was the common reaction to the Russia-Ukraine war, will also cut into IBM’s cash flow.

Don’t count IBM out completely just yet, though. The company recently revealed a new error mitigation technique that should help it with quantum computing. While the new technique won’t put a quantum computer in every home, it will help move IBM closer to that point.

The new systems, reports note, are designed to check system processes for “noise” that might get in the way of computation. The systems can then step in to alter the circuits involved and ultimately create environments free of noise. If that sounds complex, it is, but it works. These systems are already at work in some IBM operations.

Conclusion: IBM is Under Pressure, but Don’t Write It Off

Basically, IBM is taking a beating from the strong dollar. That’s not good news because it’s a safe bet that the dollar will continue to be strong for at least the next quarter and likely beyond. The dollar simply represents too much economic diversity to be discounted readily.

It’s not that the dollar is invincible, but rather that the dollar just has more utility than other currencies. After all, 80% of all dollars in existence were printed in the last two years. That has to rankle investors.

IBM will likely continue suffering at the hands of a strong dollar. A strong dollar is in the cards for at least the next few months, in my opinion. Definitely don’t count IBM out, however. It’s got some very exciting prospects in the pipeline for the future, and having a piece of the same might be a good plan overall.

IBM trading above its lowest price target but below its average target may serve as an encouraging element as well.

However, the conditions that are currently hurting the company won’t improve very soon. The growing disaster in investor sentiment doesn’t help either. So look for some further decline on IBM’s part, which may prompt a good entry point down the line.

I’m neutral on IBM right now, thanks to the short-term pressure it is facing, but watching for a good point to get in likely won’t go amiss.