The housing market has long been one of the major supports of the US economy. More than a decade of low interest rates made mortgages more affordable, in both the residential and commercial markets, and real estate properties were considered solid investments. But is that changing?

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The real estate landscape is definitely shifting and has been for the past year. The Federal Reserve’s tighter monetary policy and significantly higher interest rates – all in the service of tackling inflation – are increasing mortgage costs, making homes less affordable.

In the eyes of Elon Musk, this represents a real problem on the horizon, which he has described as the “most serious looming issue.”

“The massive jump in monthly payments for a 30-year mortgage, due to significantly higher interest rates, obviously greatly reduces home affordability. Mortgage portfolios are at risk if housing prices drop significantly,” Musk added.

On the other hand, taking a controversial stance, Deutsche Bank analyst Joe Ahlersmeyer has become decisively bullish on new residential construction.

“Optimism was palpable in January around new resi, and this has been largely substantiated by company outlooks and homebuilder results and commentary through the first five months of the year,” Ahlersmeyer explained.

Against this backdrop, Ahlersmeyer has been pointing out homebuilder stocks that investors should consider now. Here are the details on three of his top picks.

DR Horton (DHI)

The first Deutsche Bank pick is DR Horton, the Texas-based construction firm that leads the pack in the US homebuilding sector. By business volume, DHI is the nation’s largest homebuilder, and has held that position for over 20 years now. The company operates in 33 states and 110 residential markets, and builds multi-family apartment complexes as well as single-family homes.

In the single-family home market, DHI operates in every income bracket, building smaller, low-end homes priced near $150,000 and working up to mansions for $1 million or more. DR Horton has subsidiaries to back up its core homebuilding business; these companies provide vital homebuyer services such as mortgage financing, title services, and home insurance.

A look at DR Horton has to start with the share performance. DHI stock has outperformed the broader markets in the past year, and by a wide margin. It’s up some 42% in the past year, compared to just 2% on the S&P 500. Narrowing the focus just to 2023, when the S&P has posted better gains, DHI is still ahead, with a 17% year-to-date gain compared to 10% on the S&P index.

This share performance has been backed up by solid financial results. The last reported quarter, the fiscal 2023 second quarter, showed a top line of $8 billion in total revenue. While flat year-over-year, this result beat the analyst forecasts by $1.49 billion. The company’s income was just as strong. DHI reported an EPS figure of $2.73 per diluted share, 82 cents ahead of expectations.

These results were based on 19,664 home sale closures during the quarter, for home sale revenues, the core of the company’s business, of $7.4 billion.

Looking ahead, DHI has net sales orders for 23,142 homes, to an order value of $8.6 billion. The company has bumped up its fiscal year 2023 revenue guidance into the $31.5 billion to $33 billion range – where analysts had been expected guidance of about $28.5 billion.

In his coverage of DHI, Deutsche Bank’s Ahlersmeyer paints an upbeat picture of the firm’s future: “Several years from now, we see DHI with a greater number of Top 3 market positions in the fifty largest markets, possessing higher share in each of those markets as well as higher overall national share, and we also expect stronger volume growth than any other builder under our coverage…. We also see upside to valuation as the company continues to outperform peers in the marketplace and demonstrate sustainably higher returns on inventory and equity.”

Ahlersmeyer goes on to rate DHI shares as a Buy, with a $150 price target that suggests a gain of ~39% in the next 12 months. (To watch Ahlersmeyer’s track record, click here)

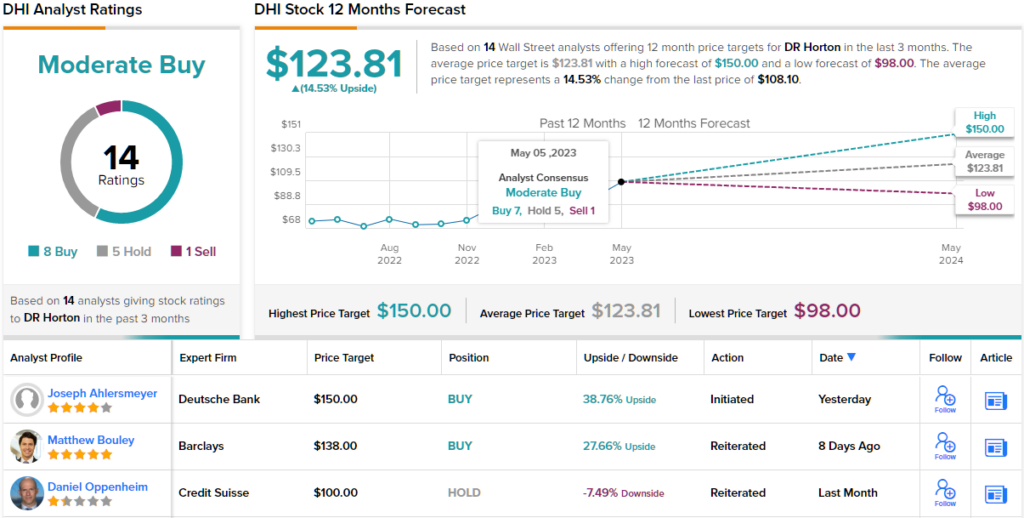

Overall, Wall Street rates this stock as a Moderate Buy. DHI has 14 recent analyst reviews, with a breakdown of 8 Buys, 5 Holds, and 1 Sell. The current trading price of $108.08 and the average price target of $123.81 combine to give a 14.5% one-year upside potential. (See DHI stock forecast)

Meritage Homes Corporation (MTH)

The second stock on our list, Meritage, shows that it’s not just the very top US homebuilders who are succeeding in today’s market. Meritage is the fifth largest of the country’s home construction companies, with a significantly smaller market share than DHI above. But, Meritage has still seen its shares grow more than 35% in the past year, and 23% this year along.

The company has built this success through 37 years of operations in 9 states. Meritage is known as a leader in building energy-efficient homes, and to date has built some 165,000 houses. In 2021, the company saw total revenues of $5.14 billion; that number grew to $6.29 billion in 2022.

A look at the company’s recent 1Q23 results, released at the end of April, shows that Meritage is doing better than the analysts predicted. The firm’s top line revenue figure, of $1.28 billion, slipped one percent y/y but was $245 million ahead of the estimates. The bottom line EPS, of $3.54 per share, was down 39% from the previous year but was 90 cents better than the forecast.

On two important positive notes, Meritage reported that the 2,897 home closings it had in Q1, and the nearly $1.3 billion in quarterly home closing revenue, represented company records for a first quarter.

In the eyes of Deutsche Bank’s Ahlersmeyer this company deserves a second look from investors. The analyst writes: “We expect Meritage to continue to execute well on its strategy to nearly exclusive build spec-built entry-level homes, and we believe that greater scale and standardization will continue to lead to better margins as well as quicker sales turnover in each community. This should lead to higher returns on inventory, which we believe could settle out in the range of 15%+.”

These comments back up Ahlersmeyer’s Buy rating, while his $200 price target implies a robust 70% gain on the one-year time horizon.

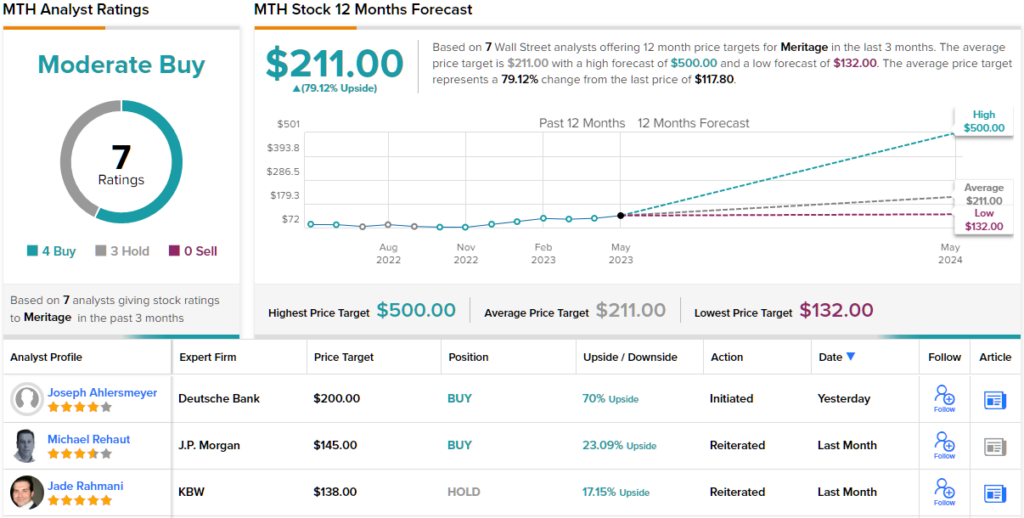

Overall, MTH has a Moderate Buy rating from the analyst consensus, with 4 Buys and 3 Holds set in recent weeks. The stock is selling for $117.80, and at $211 the average price target suggests a 79% upside potential. (See MTH stock forecast)

PulteGroup (PHM)

Wrapping up, we’ll take a look at PulteGroup. This firm, founded in 1950, has since become America’s #3 homebuilder, and can rake in more than $16 billion in annual revenue. PulteGroup has an active presence in over 40 major metropolitan areas, and its assets include ownership of important brand names like Centex, American West, and, of course, Pulte. The company has built more than 800,000 homes in its lifetime.

Over its long history, PulteGroup has built a reputation for bringing returns to investors – a trend that has continued in the past year. The company’s 12-month share appreciation is more than 49%, and the shares are up 43% for 2023. PulteGroup has shown consistent year-over-year revenue gains for the past year, despite headwinds in the real estate sector. PulteGroup last year invested some $17 billion into land acquisition – an important point of positioning for a home construction firm.

PulteGroup’s current position is solid. The company’s 1Q23 revenues grew 14% year-over-year, to reach $3.58 billion, and came in $310 million ahead of expectations. On earnings, PulteGroup reported $2.35 in non-GAAP EPS, a figure that was 53 cents better than the forecast. Those numbers were backed up by a 6% y/y increase in quarterly home closings, to 6,394. The company saw a 9% increase in the average home price, to $545,000.

Looking ahead, PulteGroup has a ‘unit backlog’ of 13,129 homes, valued at approximately $8 billion.

Given all of the above, Deutsche Bank’s Joe Ahlersmeyer has high hopes. Along with a Buy rating, he gives PHM a $95 price target, which puts the upside potential at 42%.

Backing his stance, Ahlersmeyer writes: “PHM can pull the right growth and returns levers to drive higher TBV/sh, as land investments in recent years underpin the outlook for growth in communities and greater spec sales will drive higher absorptions…. We envision PHM sustaining higher margins, driven once again by efficiency gains and only modestly offset by further mix headwinds from entry level product. PHM should exhibit a smooth transition as strong profitability in backlog flows through while the company puts a floor under returns with increases in specs.”

Overall, PulteGroup gets a Strong Buy consensus rating based on 12 recent reviews that include 9 Buys against 3 Holds. The shares have a current selling price of $66.75, and the average price target of $78.67 implies ~18% increase from that level. (See PHM stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.