Ahead of regular trading on July 28, Honeywell International (HON) reported its second quarter 2022 financial results, which showed an increase in sales, higher earnings, and an improved outlook. Based on the encouraging Q2 report and the Federal Reserve’s determination to lower inflation, I am bullish on Honeywell International’s stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Honeywell Has a High Smart Score

On TipRanks, HON has a 9 out of 10 on the Smart Score rating. This indicates solid potential for the stock to outperform the broader market.

Honeywell Shares Gain 3.7% Following Earnings Release

Honeywell’s stock price finished the trading session up 3.7% on July 28, closing at $190.44 per share. Clearly, the market welcomed the results. Nevertheless, the stock price continues to trade at reasonable levels relative to prices seen over the past 12 months. The 52-week range for HON is $167.35 to $236.86, and the 200-day simple moving average is $197.66.

About Honeywell International Inc

Honeywell International Inc, based in Charlotte, North Carolina, is a conglomerate operating in four primary industries: Aerospace, Building Technologies, High-Performance Materials and Technologies, and Safety and Productivity solutions.

Honeywell Exceeds Earnings Expectations Despite a Challenging Macroeconomic Backdrop

For the second quarter of 2022, Honeywell reported better-than-expected net income and total revenues. The net income increased 1.13% to $1.437 billion, up from $1.421 billion in the year-ago quarter. This equates to an earnings per share figure of $2.10, an increase of 4% from the prior year’s quarter. Analysts were expecting earnings per share of $2.03.

Total revenue was $8.953 billion, up 2% year-over-year and $283 million above the average analyst revenue forecast. On an organic basis, revenue increased 4% year-over-year, surpassing the upper range of the company’s earlier guidance.

By segment, year-over-year variations in organic sales were as follows: Aerospace was up 5% to $2.898 billion, while Performance Materials and Technologies was up 10% to $2.694 billion. In addition, Safety and Productivity Solutions fell 10% to $1.829 billion, while Building Technologies rose 14% to $1.531 billion.

In addition, the company reported a 12% increase in orders received, as the backlog grew 12% year-over-year to $30 billion.

Honeywell Raises Guidance on Top of Strong Results

Looking ahead to the full 2022 fiscal year, Honeywell International has raised the lower end of its earnings per share forecast range. Therefore, the new range is now $8.55-$8.80 compared to the previous $8.50-$8.80.

It also raised the lower end of its organic revenue growth forecast range, as it now stands at 5%-7% compared to the previous $4% – 7%.

Finally, the company raised the lower and upper bounds of its forecast range for segment margin to 21.3% – 21.7% from the previous 21.1% – 21.5%. For Q2 2022, segment margin was 20.9% (up 50 basis points year-over-year).

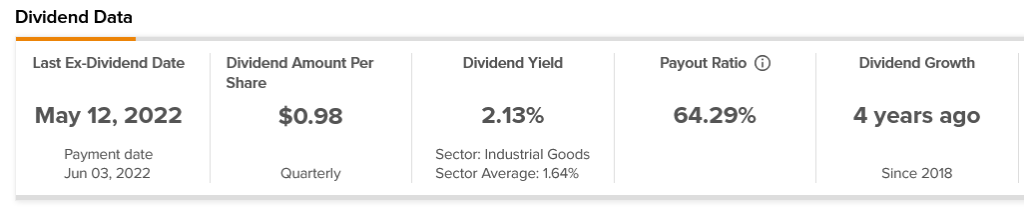

Dividends Could Rise Further if Company Continues to Deliver

As organic growth continues to accelerate while the financial position remains stable, it is reasonable to expect further increases in dividend per share. Also, Honeywell International Inc’s payout ratio of 64.29% suggests there’s plenty of room to pad with increases in the dividend.

The company currently pays $0.98 per common share as a quarterly dividend. The most recent payment was made on June 3, reflecting a 5.4% year-over-year increase.

Higher Fed Funds Rate Could Support Honeywell’s Stock Price

I believe growing optimism about the Federal Reserve’s effective monetary policy to curb runaway inflation will gradually overcome headwinds from elevated inflation and the impact of geopolitical tensions stemming from the war in Ukraine.

Investors will return to the stock market with less suspicion and more willing to take additional investment risk than they do now amid the threat of high inflation rather than the possibility of a recession following monetary tightening.

Investing in Honeywell International is definitely not that risky compared to many other stocks on the market. However, there’s no question that a lower level of investor caution will create more favorable market conditions in which the stock can thrive much easier.

Wall Street’s Take on HON Stock

In the past three months, 13 Wall Street analysts have issued a 12-month price target for HON. The stock has a Moderate Buy consensus rating based on eight Buys and five Holds.

The average Honeywell International price target is $205.08, implying 7.7% upside potential.

Conclusion – Honeywell is a Resilient Business

The recent financial results paint a strong picture of resilient operations, even in light of the current business environment that is quite challenging for conglomerate companies. Honeywell has the ability to leverage a well-known brand across all industries around the world. As a result, it will most likely continue to deliver favorable results to investors going forward.