The story for Tesla (NASDAQ:TSLA) this year has been about growing sales against lower margins. That is because in order to stimulate waning demand, the EV leader has enacted a series of price cuts on its models.

Don't Miss our Black Friday Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The effort has had the intended effect; Tesla has indeed been selling more cars. Yet, it has come at a price. The side effect of lower prices has resulted in a lower margin profile. And that, says Needham analyst Chris Pierce, requires looking at Tesla from a different angle.

“TSLA’s valuation implies continued share gains, combined with a return to higher margins,” Pierce explains. “Unfortunately, we view these as opposing forces, with TSLA competing on price to drive units and gain share, making it difficult to have confidence in consensus’ margin trajectory.”

Specifically, while consensus models a 200bps increase for 2024 sales gross margin ex reg credits, Pierce now sees that as flat year-over-year compared to up ~100bps beforehand.

While Pierce points out that Tesla has been a winner in the ICE to EV transition, now, with the company using discounting as a lever, its “strategic differentiation vs mass-market OEMs has compressed.”

Tesla’s latest operating margins still maintained a slight advantage compared to traditional ICE competitors, but Pierce believes this advantage could decrease further. This expectation is based on the assumption that the margins of legacy peers are “currently inflated by eroding pricing power as new vehicle inventories grow.”

“If TSLA is showing a willingness to compete at or near peers margin levels, and peer margins move lower,” opines the analyst, “we struggle to see TSLA margins moving appreciably higher.”

Thus, Pierce sees Tesla as on a path towards becoming a mass-market OEM faster compared to prior expectations, and given the potential longer term margin profile, he views that as “multiple-limiting.”

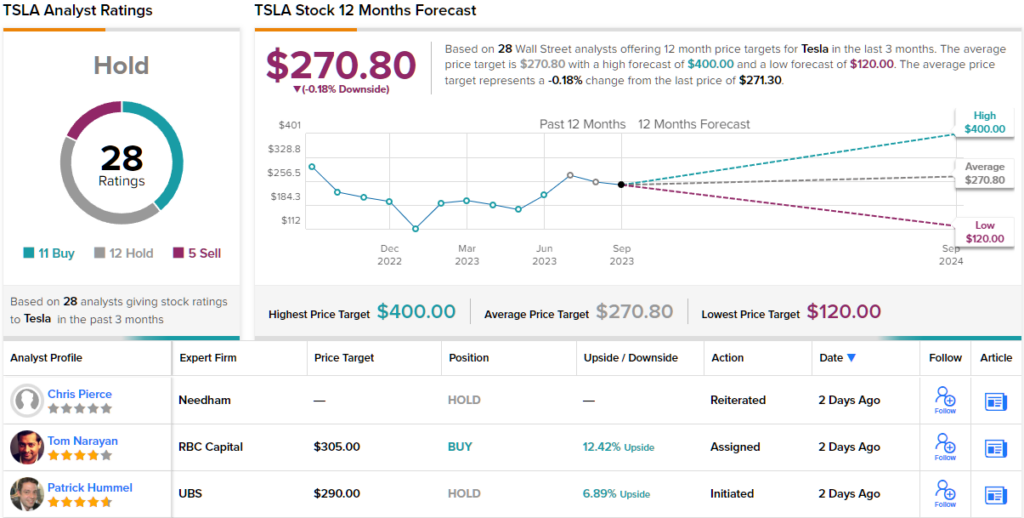

As such, Pierce remains on the sidelines with a Hold (i.e., Neutral) rating and no specific price target in mind. (To watch Pierce’s track record, click here)

On balance, TSLA shares also command a Hold consensus rating from the Street’s analysts, based on a mix of 12 Buys and Holds, each, plus 5 Sells. The $272.50 average target implies shares are currently changing hands for just about the right price. (See Tesla stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.