It’s not all been exclusively about tech this year. Take Eli Lilly (NYSE:LLY) for instance. Shares of the pharma giant are up by an impressive 61% year-to-date, bringing the company’s market cap above $552 billion, thereby making it the world’s most valuable healthcare firm.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The company now has the opportunity to drive further growth. Last week, it was announced that the FDA had given its nod of approval for the company to sell Zepbound (tirzepatide) as a treatment for chronic weight management. Tirzepatide is already commercially available as a treatment for type 2 diabetes, sold under the brand name Mounjaro.

The company plans to bring the drug to market before the end of the year, a move that could have a positive impact on both its top and bottom lines. Zepbound is expected to compete with Novo Nordisk’s Wegovy (injectable semaglutide), and LLY will have something of a pricing advantage. Zepbound’s monthly list price of $1,059.87 suggests it will be offered at a 20% discount compared to Wegovy’s pricing.

But that’s not the only factor working in its favor, says Goldman Sachs analyst Chris Shibutani.

“We continue to view Zepbound’s clinical data package as superior to Wegovy’s – headlined by labeled weight loss of up to ~21% (vs Wegovy’s ~15%) in overweight/obese individuals after ~18 months, and a tolerability profile with overall lower rates of GI-related AEs,” the 5-star analyst explained. “We think the favorable pricing dynamic compared to Wegovy, combined with the tirzepatide’s best-in-class weight loss profile (among approved agents) will solidify Zepbound as the preferred anti-obesity medication, and supports our projected ~33% overall obesity market share by 2030.”

That said, Shibutani says the approval marks an “important landmark for the company’s commercial franchise,” but given his belief investors generally expected approval by the end of the year, he anticipates “relatively limited impact” on the share performance for now.

Nevertheless, on the back of “multiple regulatory missteps” for the company’s late-stage portfolio throughout the year (these include a CRL/delay for donanemab, and CRLs for mirikizumab [approved now], and lebrikizumab), the approval is “reassuring.”

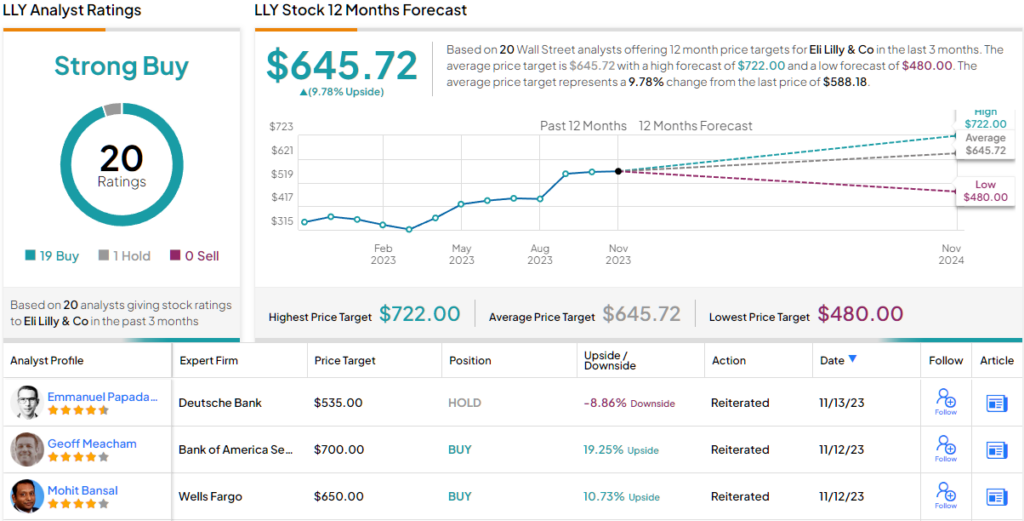

All in all, Shibutani stays on the sidelines for now, maintaining a Neutral rating along with a $480 price target, which implies ~18% downside from current levels. (To watch Shibutani’s track record, click here)

We’ll have to agree to disagree, appears to be the sentiment amongst Shibutani’s colleagues; all 19 other recent analyst reviews say Buy, naturally culminating in a Strong Buy consensus rating. The average price target stands at $645.72, suggesting upside potential of ~10% in the year ahead. (See LLY stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.