A number of names are beginning to look attractive in the current environment, and this week, we are putting the spotlight on Ziff Davis (ZD), which just might be the next hidden gem investors are looking for. One might wonder why we are highlighting a stock that has lost more than a quarter of its value so far in 2022 and still has a short interest of nearly 8%, which indicates that bears are still in the play here. The answer lies in ZD’s business model and strategy.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

ZD is a digital media and internet company with a portfolio that has entertainment, shopping, cybersecurity, MarTech, and technology brands under its umbrella.

What Kind of Companies Does Ziff Davis Own?

Over the past years, ZD has adopted an acquisition strategy that very well resembles what Mr. Warren Buffett has been doing at Berkshire Hathaway (BRK.A). ZD invests in companies that have predictable and increasing free cash flows, scales them, and puts the accumulated cash to use in future investments. It looks for targets with key attributes, including a large and increasing total addressable market (TAM), recurring revenues, robust margins, low capital intensity, and a high-value vertical.

ZD has been following this approach since 2013 and has amassed a collection of digital media and software companies. In 2022, it has so far acquired Lose It and Emma’s Diary in the health & wellness space. Last year it made 10 acquisitions in the cloud, connectivity, cybersecurity, and health & wellness space.

Importantly, some of the companies it has acquired over the years have now become leaders in their own markets. Some of these include Mashable, BlackFriday.com, Ookla, Humble Bundle, and IGN. Last month, Ookla, a leading name in network intelligence and connectivity, acquired Sweden’s Cell Rebel, which offers data visualization to improve mobile network performance.

Is Ziff Davis Overvalued or Undervalued?

ZD has been a steady performer, with its top line ticking upwards from $1.16 billion in 2020 to $1.42 billion in 2021. The figure is expected to rise to $1.51 billion by 2023. Earnings per share (EPS) are expected to expand to $7.16 in 2023 from ~$6.08 in 2021. A price-to-earnings ratio of 10.6x and a price-to-sales ratio of 2.7x indicate that shares are trading at reasonable levels. Additionally, a price-to-cash-flow ratio of 9.2x means that cash flow generation remains robust.

Further, a trailing twelve-month gross margin of 86.8% and a net margin of 27% indicate that its focus on profitability is paying off.

So far, ZD has deployed $2.9 billion for M&A in the past decade, and its $849 million cash pile at the end of June suggests the company has plenty of gunpowder to seize opportunities.

Is ZD Stock a Good Buy?

The stock has scored Buy ratings from four analysts this month, and overall, the consensus rating remains a Strong Buy. Further, the average ZD stock price target of $107.50 implies 31.1% upside potential from current levels. A TipRanks Smart Score of 8 out of 10, too, shows that ZD could deliver market outperformance in the coming periods.

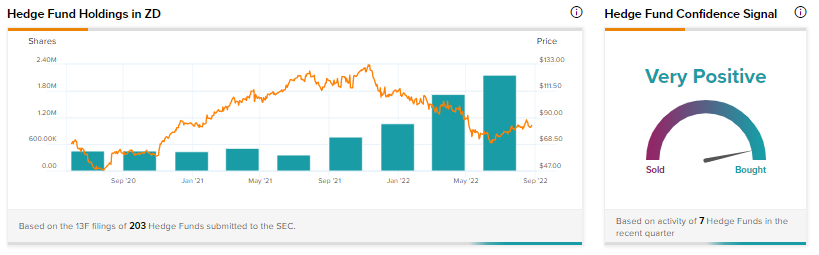

Investors and Hedge Funds are Buying Ziff Davis

TipRanks data indicates that hedge funds have been buying up ZD stock for the past year and have increased their holdings by 434,600 shares in the last quarter alone. Furthermore, Andrew Law’s Caxton Associates has boosted its ZD position by a whopping 329% recently.

What’s more, the number of TipRanks portfolios that hold ZD stock increased by 9.2% in the last 30 days. This implies a very positive investor sentiment regarding ZD.

Conclusion: ZD Stock Could be a Winner

Ziff Davis has continued its steady performance despite a difficult macro backdrop. Additionally, as valuations across the board sour, the company may come out as a winner in a “buyer’s market.”

Additionally, here is another hidden gem that focuses on Cannabis real estate, which you may want to check out.