Investors with a long-term horizon could consider investing in the Invesco QQQ Trust (NASDAQ:QQQ) ETF. This appealing ETF tracks the NASDAQ 100 Index (NDX) and provides an opportunity to hold stocks from 10 different sectors. Remarkably, the QQQ ETF has advanced more than 39% year-to-date thanks to the AI-related boom. Moreover, the ongoing rally may persist due to falling inflation, the economy’s resilient recovery, and the pause on the Fed’s benchmark interest rate hike.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

What Makes QQQ ETF Attractive?

The QQQ ETF stock is a growth-focused index fund with about $197.83 billion in assets under management. Interestingly, the QQQ ETF has beaten the S&P 500 Index (SPX) in nine out of the last ten years, with the trend continuing in 2023 so far.

Additionally, the QQQ ETF stock has delivered an average annualized return of 17.7% in the past decade, ending in March 2023. Also, the ETF has a low expense ratio (cost of managing the ETF) of 0.20%, which makes it a promising investment.

Is Invesco QQQ a Good Buy?

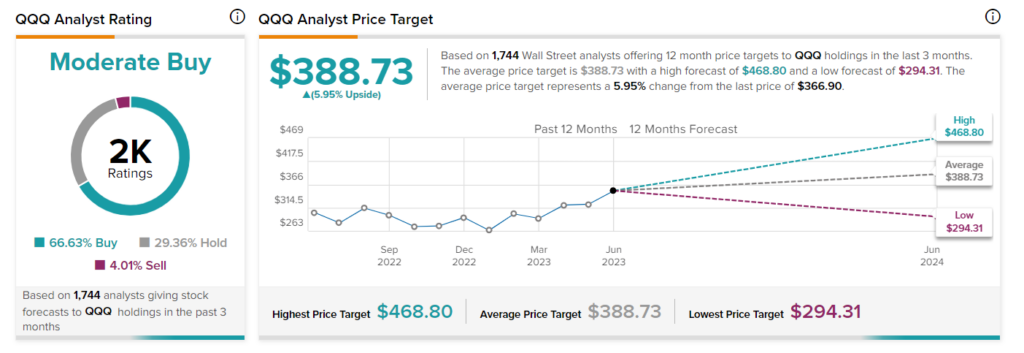

Per the recommendations of 1,744 analysts giving stock forecasts for the 102 holdings of the Invesco QQQ ETF, the 12-month average price target of $388.73 implies 6% upside potential from current levels. Also, the QQQ ETF has a Moderate Buy consensus rating on TipRanks.

Apart from analysts’ consensus, TipRanks’ easy-to-read technical summary signals indicate that QQQ ETF stock is a Buy at current levels.

Importantly, the Invesco QQQ ETF has an Outperform Smart Score of eight on TipRanks, suggesting it could deliver market-beating returns in the future.

Top 10 Performing Stocks in QQQ ETF

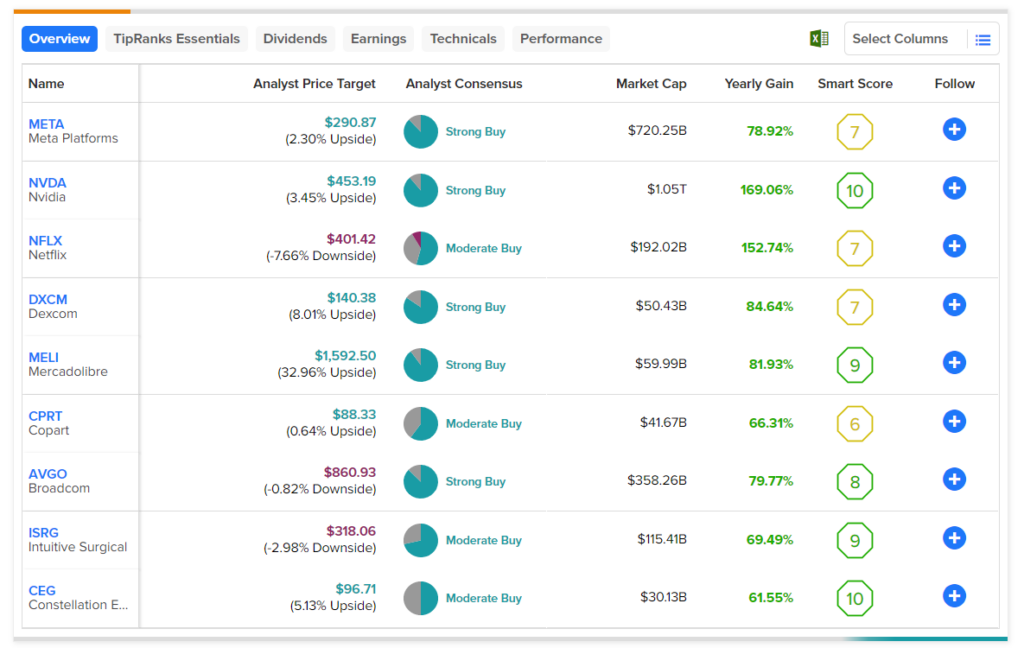

The rally in top technology stocks drove the index fund to a new high last month. While several of the ETF’s holdings witnessed strong returns over the past year, there remain a few stars, having gained over 60%. Let’s take a look at the ten best-performing stocks in the ETF:

- Nvidia Corporation (NVDA)

- Netflix Inc. (NFLX)

- Dexcom (DXCM)

- Mercadolibre, Inc. (MELI)

- Broadcom Inc. (AVGO)

- Meta Platforms, Inc. (META)

- Intuitive Surgical (ISRG)

- Copart, Inc. (CPRT)

- Constellation Energy Corporation (CEG)

- Workday (WDAY)