On paper, PepsiCo (NASDAQ:PEP) doesn’t seem the most compelling opportunity available, given its ho-hum performance this year. Nevertheless, the consumer goods giant can still drive beyond its all-time high. Fundamentally, the unique narrative that the COVID-19 pandemic imposed on society bodes very well for its snacks and beverages business. Therefore, I am bullish on PEP stock.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

PEP Stock May Benefit from the Trade-Down Effect

While PepsiCo may admittedly be a boring enterprise – let’s face it, the core business of soft drinks isn’t breaking new ground – it stands poised to benefit from the trade-down effect. This intuitive phenomenon centers on consumers electing cheaper alternatives to commonly purchased items when faced with financial pressures.

Perhaps most conspicuously, PEP stock might rise as the underlying entity steals market share (tangentially) from businesses like Starbucks (NASDAQ:SBUX). True, Starbucks represents a popular culture icon. Customers continue to swing through its doors to get their caffeine fix. Even with inflationary dynamics pressuring profitability and thus forcing price hikes, the addicts continue to open their wallets.

In addition, the latest jobs report – which came in hotter than anticipated – implies that Starbucks can do whatever it wants, and people will buy their (arguably overpriced) beverages. However, everything has an upside limit.

Basically, with U.S. household debt reaching an all-time high of over $17 trillion, consumers can’t continue to be profligate with their finances. At some point, people will have to cut back, and what better way than to dramatically reduce their Starbucks expenditures? In its place, consumers can get their caffeine from Pepsi, potentially yielding sizable gains for PEP stock.

What’s more, the jobs report itself suggests more encouraging tidings for PepsiCo. Specifically, jobs that require on-site physical attendance – healthcare, leisure and hospitality, construction, transportation, and warehousing – saw significant gains. Eventually, even white-collar workers may be forced to return to the office.

Put another way, demand for caffeine should soar as workers cope with normalization trends. However, the pandemic-fueled circumstances should truly incentivize cheap caffeine, thus lifting PEP stock.

PepsiCo Enjoys More Fuel in the Tank

To be fair, PepsiCo doesn’t attract overwhelming bullishness because of the nuances of its financial performance. For example, in the company’s fiscal first quarter of 2023, it reported earnings per share of $1.50. In contrast, analysts anticipated an EPS of $1.38. However, much of the results centered on price increases. Unit-wise, the company sold less food and barely improved on beverage sales. Therefore, PEP stock might seem like a bull trap.

However, if you consider the aforementioned fundamentals (that post-pandemic dynamics will spark increased caffeine demand), then PEP stock translates to a buy. In other words, PepsiCo still has more fuel left in the tank. And the volatility of the trailing one-month period, where PEP gave up nearly 5% of value, implies a discount.

Looking at the granularity of the most recent earnings report, PepsiCo’s food-related North American enterprises – Frito-Lay and Quaker Foods – saw sizable increases on a year-over-year basis. For Frito-Lay, sales increased 15.4% to $5.58 billion, while Quaker Foods gained 9% to $777 million.

To be sure, PepsiCo Beverages also saw improvements, in this case, up 8.3% to $5.8 billion. However, compared to the performance of the snacks and food units, the beverage segment was disappointing. Nevertheless, as workplace dynamics gradually return to pre-pandemic norms, the beverage unit should see larger-scale increases.

Again, people will need their caffeine fix to deal with the drudgery of on-site work. In addition, stubbornly high consumer prices mean that consumers need to be judicious with their wallets. Cynically, this backdrop should benefit PEP stock as consumers trade down.

Is PEP Stock a Buy?

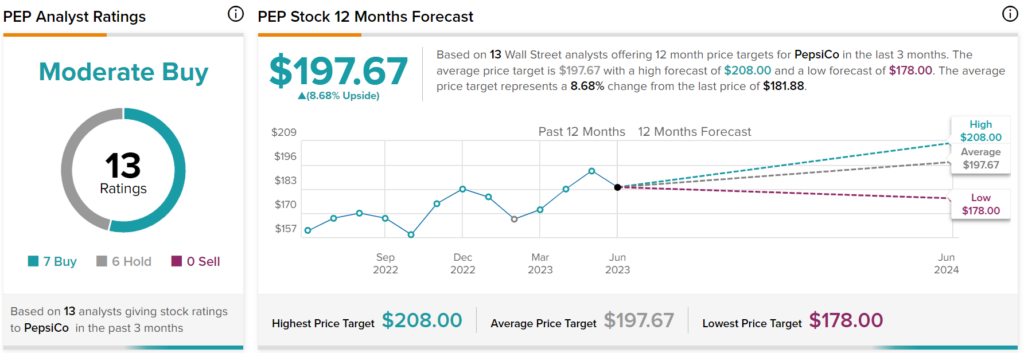

Turning to Wall Street, PEP stock has a Moderate Buy consensus rating based on seven Buys, six Holds, and zero Sell ratings. The average PEP price target is $197.67, implying 8.68% upside potential.

The Takeaway: PEP Stock Just Needs Some Patience

Undeniably, PepsiCo isn’t breaking new ground. Therefore, it’s tempting to ignore PEP stock for other, more enticing opportunities. However, investors that do this don’t seem to appreciate workplace fundamentals that could lift PEP higher. Basically, the workplace environment is gradually normalizing to align with pre-pandemic realities such as on-site labor. At the same time, stubbornly high consumer prices impact premium caffeinated beverage providers. This framework makes PepsiCo the cheaper alternative, thus providing a legitimate upside for PEP stock.