Traveller-hosting platform Airbnb (NASDAQ:ABNB) is set to report third-quarter (Q3) 2022 results after the market closes on November 1. Ahead of the earnings, the Street expects the company to report adjusted earnings per share of $1.47, which is a 20.5% year-over-year increase. Moreover, revenue estimates are pegged at $2.84 billion, which is around 26.8% more than the year-ago quarter’s reported figure.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Importantly, Airbnb has reported earnings beats for five consecutive quarters. Let us see how the company is placed to be able to drive results to meet expectations this time.

In its last reported earnings call, Airbnb had guided Q3 revenues between $2.78 billion and $2.88 billion. The work-from-home era, which has continued to dominate the world even as economies opened after the pandemic, has enabled more travel throughout the year.

Stays of 28-plus days have been gaining momentum with Airbnb travelers as there is more flexibility to work and travel simultaneously. This is likely to have boosted bookings in Q3.

Moreover, the company has been experiencing steady demand in its Nights and Experiences Booked unit, which is likely to have remained stable at about 25% year-over-year growth in Q3, going by management’s expectations.

Going by Airbnb’s guidance, the adjusted EBITDA is also likely to have increased in Q3, paving the way for higher profitability than in the year-ago quarter.

Is Airbnb a Good Stock to Buy?

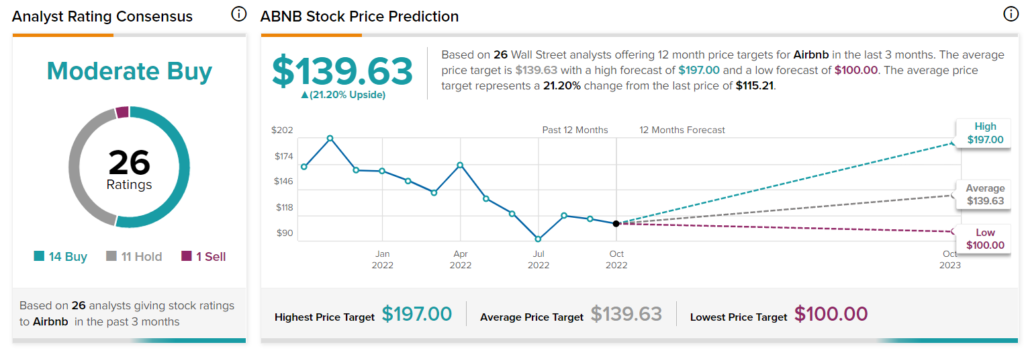

Wall Street consensus opinion tilts towards a Moderate Buy, based on 14 Buys, 11 Holds, and one Sell. Analysts also expect the stock price to go up 21.2% over the next 12 months to reach $139.63.

Ending Thoughts

Airbnb has recovered remarkably after the disruptions during the initial days of the pandemic and now is seeing a slowing revenue growth rate complemented by rising profitability. Thus, Q3 is expected to have reflected encouraging profits. Moreover, strong trends in travel thanks to the work-from-anywhere cult should have given a boost to the top line.