Home Depot (HD) is slated to release its second-quarter earnings results today, before the market opens.

Based in the U.S., Home Depot is a home improvement retailer, which sells building and construction materials, home decor, flooring, appliances, lawn and garden products, and other merchandise and services.

For Q2, analysts expect Home Depot to post earnings of $4.95 per share. The company had posted earnings of $4.53 per share in the year-ago quarter.

Meanwhile, revenues are pegged at $43.36 billion, higher than the previous quarter’s tally of $36.43 billion.

During the first-quarter earnings call, Home Depot stated that it anticipated FY2022 total sales growth and comparable sales growth of approximately 3%.

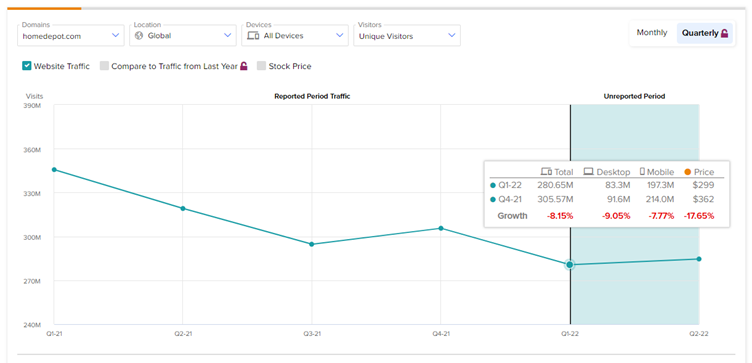

Declining Website Traffic Trends Raise Concerns for Home Depot

As per TipRanks’ website traffic tool, the momentum in Home Depot’s e-commerce business shows a declining trend. According to the tool, the number of visits to homedepot.com declined 8.15% quarter-over-quarter in Q2. Further, the footfall on the company’s website has declined 10.82% year-over-year.

The decline in website visits hints at a slowdown in household spending, which could have some impact on the company’s second-quarter revenues. Learn how Website Traffic can help you research your favorite stocks.

Is Home Depot a Buy or Sell?

Ahead of HD’s second-quarter earnings results, Steven Zaccone of Citigroup warned investors that home retail space has its own set of concerns, which include “shift to services and travel, inflation tightening consumer budgets for big-ticket, higher rates, home prices starting to decline, and recession risk negatively affecting the employment picture.”

Despite the looming concerns, Zaccone retains a Buy rating on Home Depot with a price target of $348 (10.61% upside potential).

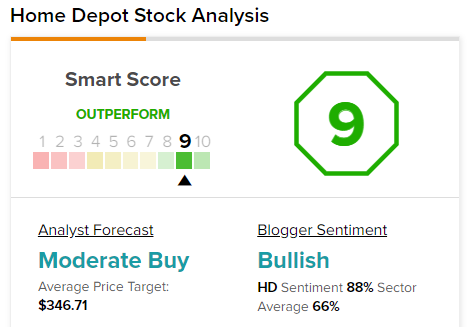

However, the rest of the Street is cautiously optimistic about the stock and has a Moderate Buy consensus rating based on 16 Buys and six Holds. Home Depot’s average price forecast of $346.71 implies 10.2% upside potential.

Positively, HD scores a 9 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Final Thoughts

Home Depot stock is down 23.1% year-to-date. While the stock has somewhat recovered in the last month, HD’s second-quarter results (to be announced today) are expected to decide the future course of its stock price.

Read full Disclosure

Questions or Comments about the article? Write to editor@tipranks.com