Two analysts from renowned Wall Street research firms have garnered a 100% success rate on their recommendations for Boston-based Compass Therapeutics (NASDAQ:CMPX) and Canadian energy company Tourmaline Oil (TSE:TOU). Notably, both companies have been gaining an advantage in their respective fields, and the analysts’ in-depth research has enabled them to make appropriate calls on both stocks. Let’s take a look at both companies and the analysts’ impressive recommendations on these stocks.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

Compass Therapeutics (NASDAQ:CMPX)

Compass Therapeutics is a clinical-stage biopharmaceutical company with a focus on developing antibody therapeutics for the treatment of solid tumors and hematological malignancies. Last week, CMPX reported a Q3FY22 diluted loss of $0.12 per share, two cents wider than the prior year period.

Notably, the company issued and sold an additional 25 million common stock in private investment in public company (PIPE) financing. Compass Therapeutics now has a solid financial foundation thanks to the gross cash raised of about $80 million.

Analyst Andrew Berens of SVB Securities has given consistent Buy ratings on CMPX stock since December 2021. Remarkably, Berens boasts a 100% success rate on his calls and has generated 98.02% average return per call to date. Berens has a price target of $11 on CMPX, implying an impressive 147.2% upside potential to current levels.

Is CMPX a Good Stock to Buy?

With three unanimous Buys, CMPX stock has a Strong Buy consensus rating. On TipRanks, the average Compass Therapeutics stock prediction of $9.67 implies 117.3% upside potential to current levels. Year to date, CMPX stock has gained 27.1%.

Tourmaline Oil (TSE:TOU)

Tourmaline Oil engages in the exploration, development, and extraction of crude oil and natural gas. Recently, Tourmaline reported Q3FY22 diluted earnings of C$6.11 per share, significantly higher than the prior-year period’s figure of C$1.10 per share.

Moreover, the solid cash flow generation allowed the company to announce a special dividend of C$2.25 per share as well as increase its base dividend to C$0.25 per share.

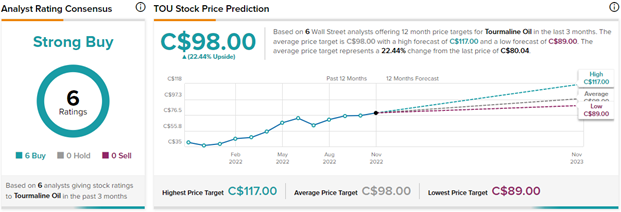

Analyst Dan Payne of National Bank has appropriately tracked and recommended TOU stock since May 2020. Payne has all Buy ratings on the stock and has earned an average return per rating of 93.24% to date. Payne’s price target of $100 on TOU implies 24.9% upside potential to current levels.

Is Tourmaline Stock a Buy?

With six unanimous Buys, TOU stock has a Strong Buy consensus rating. Also, the average Tourmaline Oil stock prediction of C$98 implies 22.4% upside potential from current levels. Meanwhile, the stock has exploded by 113.7% so far this year.

Concluding Thoughts

Both Berens and Payne have earned solid average returns for their views on both companies. Interestingly, if an investor had followed either of these analysts’ views on CMPX or TOU, he or she would have earned a similar average return on their investments to date. Notably, TipRanks accumulates the recommendations of several Top Experts, which can be considered while making investment choices to maximize returns. Investors may choose to follow analysts’ calls to make informed investment decisions.