The atmosphere today is much different than it was a year ago when technology stocks were peaking. Fortunately, the stock market has two ends to it, meaning that 2022’s bear market won’t last forever and presents numerous oversold stocks. Using a combination of both methods mentioned below, I discovered the following three oversold tech stocks — SNAP, ORCL, and NVDA — that I’m bullish on.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Identifying Oversold Tech Stocks

There are two ways to identify oversold technology stocks. The first is a market-based approach, which bears judgment on past prices. Secondly, one could utilize a fundamental growth analysis to identify disconnects between company growth metrics and their recent stock performance. Without further ado, let’s take a look at the three oversold stocks mentioned earlier.

Snap Inc. (NYSE: SNAP)

SNAP is one of the most underappreciated social media platform stocks on the market. Recently, Bank of America (NYSE: BAC) reiterated its Buy rating on the stock, claiming that “Snapchat Plus is likely seeing better-than-expected traction, and easier revenue growth comps ahead, a material macro improvement may not be necessary to achieve Snap’s goals.”

Even though global macroeconomic factors aren’t completely in-check, SNAP operates in an industry with high barriers to entry and significant pricing power. As such, it’s unlikely that it’s as sensitive to economic headwinds as most enterprises due to the lack of available substitutes.

Furthermore, the company’s second-quarter financial report conveys significant organic growth as the company’s continued its successful Gen-Z and Gen-X conversion rates to reach an active user base of 347 million.

SNAP ticks all the boxes from a fundamental vantage point. The company’s free cash flow has surged by 237% in the past year. In addition, SNAP sports a price-to-sales ratio of 4.2x, a 76.7% discount to its five-year average, suggesting it’s an oversold asset.

Is SNAP Stock a Buy, According to Analysts?

Turning to Wall Street, SNAP earns a Hold consensus rating based on nine Buys, 23 Holds, and two Sells. SNAP stock’s average price target of $14.32 implies 26.7% upside potential.

Oracle (NYSE: ORCL)

Oracle’s cloud-based business structure is highly lucrative in today’s consumer market. The company’s experiencing hypergrowth in key segments, with its Cloud and Cloud Infrastructure divisions skyrocketing by 50% and 58% in the past year.

Oracle generated operating cash flow of $10.54 billion on a trailing-12-months basis. The cash flow allows it to roll out an array of cloud-based offerings in the coming years, which could add substance to the company’s future cash flow. Moreover, Oracle’s 77.8% gross profit margin suggests that it’s achieved economies of scale, allowing it to exercise its pricing power and subsequently retain a price-driven competitive advantage.

Reputable investment banking analysts have recently sung their praises of Oracle. For instance, after Oracle released its first-quarter results, Philip Winslow of Credit Suisse (NYSE: CS) stated: “Oracle’s strong results and guidance commentary reinforces our view that Oracle is well positioned to emerge as the [third or fourth] vendor in the [platform-as-a-service/infrastructure-as-a-service] market and as the [second] vendor in the [software-as-a-service] market—enabling the company to continue to reaccelerate revenue growth into the double digits.”

BMO (NYSE: BMO) Capital’s Keith Bachman also made his bullish sentiment heard as he opined: “Oracle has maintained [Fiscal 2023] guidance of 30% [constant year-over-year currency] organic cloud growth, which we think highlights the durability and healthy market demand for Oracle’s cloud solutions.”

Fundamental metrics suggest Oracle’s stock is undervalued. For example, the stock’s price-to-sales ratio of 4.3x is at a 16.8% discount to its five-year average. Additionally, Oracle’s dividend yield of 1.77% provides lucrative total-return potential to market participants, which adds appeal to the stock’s overall investment profile.

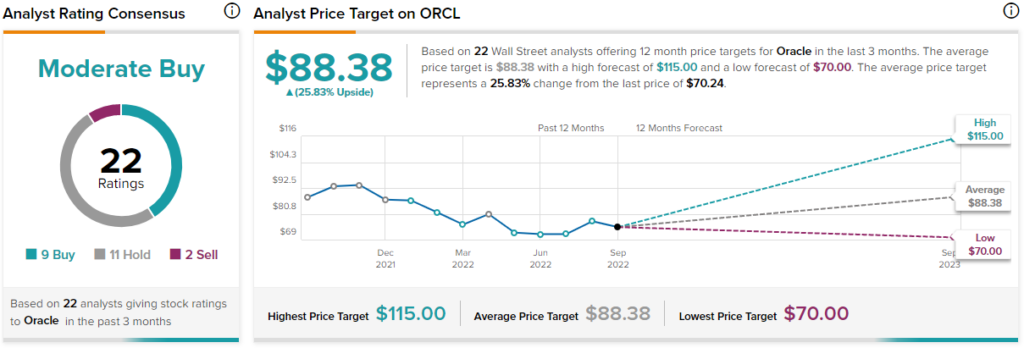

Is ORCL Stock a Buy, According to Analysts?

Turning to Wall Street, Oracle earns a Moderate Buy consensus rating based on nine Buys, 11 Holds, and two Sells. Oracle stock’s average price target of $88.38 implies 25.8% upside potential.

NVIDIA (NASDAQ: NVDA)

NVDA is a stock that’s garnered much attention lately. Supply-chain disruptions and talk of government support packages for semiconductor manufacturers have created a vacuum of volatility. However, objectively speaking, the stock is set for significant long-term upside as its key influencing variables are signed with a secular growth trajectory.

The company’s key value proposition lies within its approximate 82% GPU market share, as GPU usage is set to grow at a staggering 33.6% per year until 2027. GPUs serve industries such as gaming, cryptocurrency mining, and any domain that derives from image recognition artificial intelligence. An exciting add-on for the GPU space is the evolution of artificial neural networks, which is a market growing at an annual rate of 21.4%.

NVIDIA’s broad-based growth rates summarize its promising segmental exposure, as it exhibits a five-year EBITDA CAGR (compound annual growth rate) of 30.65%. In addition, NVIDIA’s return on common equity of 34.41% highlights the company’s robust bottom line, which generates plenty of value for its shareholders.

Is NVDA Stock a Buy, According to Analysts?

Turning to Wall Street, NVIDIA earns a Moderate Buy consensus rating based on 24 Buys and nine Holds. NVDA stock’s average price target of $208.06 implies 57.65% upside potential.

Conclusion: SNAP, ORCL, and NVDA Present a Diversified Opportunity

Based on fundamental and numerous market-based metrics, SNAP, Oracle, and NVIDIA are oversold and could be set for a bounce. Furthermore, all three stocks present similar growth rates but hold differentiated target markets. Therefore, assembling a portfolio of these three tech stocks could add much-desired diversification attributes.

Lastly, there’s no guarantee that the assets mentioned in this article will outperform. However, they’re at significant discounts to their historical multiples, meaning that long-term investors would likely be wise to invest while these stocks are at their current price levels.