I’ve been bullish on Intuitive Surgical (ISRG) for years, recognizing its dominance in the robotic-assisted surgery market and praising its sustained double-digit growth. Nevertheless, Intuitive’s recent share price gains have expanded its valuation to absurd levels that warrant caution. While Intuitive continues to post outstanding results, including accelerating revenue growth and expanding margins, its valuation multiples may post notable downside risks. Consequently, I have now adopted a neutral stance on the stock.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

ISRG’s Revenue Growth Accelerates Again in Q3

Although I maintain a neutral stance on Intuitive’s stock, there are positive highlights from the company’s recently released Q3 results. Notably, the continued acceleration in revenue growth builds on the trend seen in the prior Q2 report. In particular, Intuitive achieved revenue growth of 17% to hit a record $2.04 billion. This implies an acceleration compared to both the preceding quarter’s growth of 14.5% and last year’s growth of 12.0%.

More specifically, Intuitive’s impressive growth was powered by the expansion of its installed base and higher procedure volumes. The da Vinci systems, for instance, continue to see robust adoption, with 379 systems installed during the quarter, up from 312 a year ago. Notably, 110 were the new da Vinci 5 systems, showcasing strong demand from hospitals to adopt Intuitive’s latest technology.

Intuitive’s higher procedure volumes were evident in its Instrument and Accessory sales, representing the company’s recurring revenue stream and growing 18% in Q3. In fact, during the earnings call, CEO Gary Guthart noted that cumulative da Vinci procedures have now exceeded 16 million globally, with 10 million of those performed in just the last five years, which definitely shows the system’s accelerating adoption. Moreover, the Ion system, launched as recently as in Q3 of 2019 and used for lung biopsies, saw a 73% increase in procedure volume. It’s easy to see, therefore, that Intuitive Surgical is firing on all cylinders.

Intuitive’s Expanding Margins Drive Tremendous Earnings Growth

Another key factor behind Intuitive’s recent share price gains, especially its post-earnings rally, has been its expanding margins, supported by its razor-and-blade business model, which contributes positively to my neutral stance on the stock. Its model capitalizes on selling high-margin instruments and accessories that complement the da Vinci systems. Therefore, as a result of an ever-growing installed base and procedure volumes now increasing at a faster rate than new device installations, Intuitive’s gross margin in Q3 reached 69.1%, up from 68.8% in the same period last year.

Now, as you would expect, when you combine Intuitive’s accelerating revenue and expanding margins, you get tremendous earnings growth. Adjusted net income for Q3 rose to $669 million, up from $524 million in the same quarter last year, with adjusted EPS advancing from $1.46 to $1.84, marking a year-over-year growth of 26%.

Given Intuitive’s consistent top-and-bottom-line growth over the years and the fact that both metrics continue to impress, you can see why investors remain eager to chase the stock higher. However, the question I raised in the introduction remains: has the market’s enthusiasm outpaced the company’s underlying performance? As I will now explain, the answer is likely yes.

Intuitive Surgical’s Valuation Has Become Outrageous

Now that I’ve provided an overview of Intuitive’s latest, admittedly remarkable results, let’s shift gears to the real risk in the stock’s investment case: its outrageous valuation. While I maintain a neutral stance on Intuitive’s stock, I’m not bullish due to these valuation concerns. Sure, quality companies like Intuitive, which hold near-monopolistic positions, often command premium multiples. This is particularly true for medical device companies, where innovation and regulatory approvals form high barriers to entry. And yet, Intuitive’s current valuation metrics are hard to justify, even for a company of its stature.

To elaborate, ISRG is trading at over 20 times its forward sales and nearly 70 times its forward EPS today. These figures display the market’s expectation of continued high growth, but they also indicate that investors may face limited upside from the current share price levels. Even if Intuitive keeps growing rapidly, it could take several years to grow into these multiples. Investors are effectively betting on flawless execution and uninterrupted growth, leaving little to no margin of safety in the event of any slowdown or setback.

Is Intuitive Surgical Stock a Buy, According to Analysts?

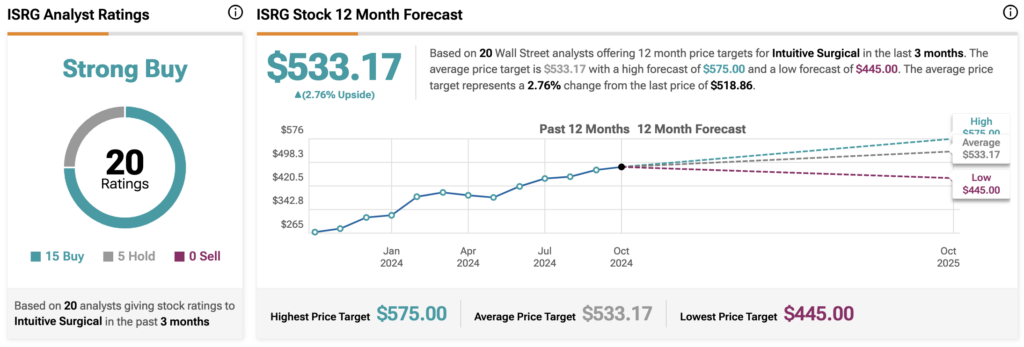

Glancing at Wall Street’s view on the stock, Intuitive Surgical continues to feature a Strong Buy consensus rating despite its lengthy rally. This sentiment is supported by 15 Buys and five Holds assigned in the past three months. At $533.17, the average ISRG share price target suggests 2.8% upside potential.

If you are uncertain which analyst to follow for trading ISRG stock, consider Richard Newitter from Truist Financial. He is the most profitable analyst covering the stock (on a one-year timeframe), with an average return of 33.15% per rating and a 94% success rate. Click on the image below to learn more.

Key Takeaway

While Intuitive Surgical continues to excel with impressive revenue growth and expanding margins, its valuation has become excessively high, posing significant downside risks. Despite its leading market position, top-line acceleration, and snowballing earnings growth, the stock’s lofty multiples are hard to justify. For this reason, I believe investors should remain cautious, as even minor setbacks could trigger a significant correction. As a result, I have shifted from a bullish stance to a neutral one, reflecting the increased risk profile of Intuitive.