Has the clean energy movement stalled out in 2022? Not really, though economic problems have taken a toll on promising businesses like Fuelcell Energy (NASDAQ:FCEL). Still, the U.S. government hasn’t given up on alternative fuel sources, and I am bullish on Fuelcell Energy stock as the company managed to increase its revenue despite this year’s financial headwinds.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Hailing from Connecticut, Fuelcell Energy provides fuel cell energy platforms that produce hydrogen. If you’re looking for an affordable stock that offers pure-play exposure to the hydrogen production market, FCEL stock is among the most obvious picks.

Don’t get the wrong idea here – FCEL stock is a fast mover with a five-year monthly beta of 3.58. In other words, this is a volatile investment and is only appropriate for a small position size. On the other hand, it has great long-term potential as Fuelcell Energy’s deal with the U.S. military could enhance the company’s top and bottom lines.

Fuelcell Energy Has High-Level Government Connections

Working with other private businesses is fine, but having connections to the U.S. government can provide a notable competitive edge. Not just one but two different news items indicate that Fuelcell Energy has government connections that should benefit the company and its stakeholders.

First of all, Fuelcell Energy has a “government operative” of sorts. I’m exaggerating a little bit here, of course, but Fuelcell does actually have an advisor in an important U.S. government committee.

Specifically, the Department of Commerce added Fuelcell Energy Senior Counsel Alexandrea Isaac to its Renewable Energy and Energy Efficiency Advisory Committee (REEEAC). This committee advises the U.S. Secretary of Commerce on renewable and energy-efficiency products and services.

As part of REEEAC, Isaac vowed to “advocate for American businesses to be more competitive in the global energy market.” She will also advance the “understanding of the value of clean hydrogen and carbon capture,” and naturally, her input should put Fuelcell Energy in a positive light.

Meanwhile, Fuelcell Energy is “bringing cleantech innovation to our country’s most critical infrastructure” and supporting “the Navy’s decarbonization goals,” according to President and CEO Jason Few. How so? It’s simple: Fuelcell Energy just commenced commercial operations at a clean energy project on the U.S. Navy Submarine Base in Groton, Connecticut.

This project is projected to operate at around six megawatts during its first year of operation and add 7.4 megawatts to Fuelcell Energy’s generation operating portfolio. Without a doubt, this represents a win-win scenario for the U.S. military and for Fuelcell Energy.

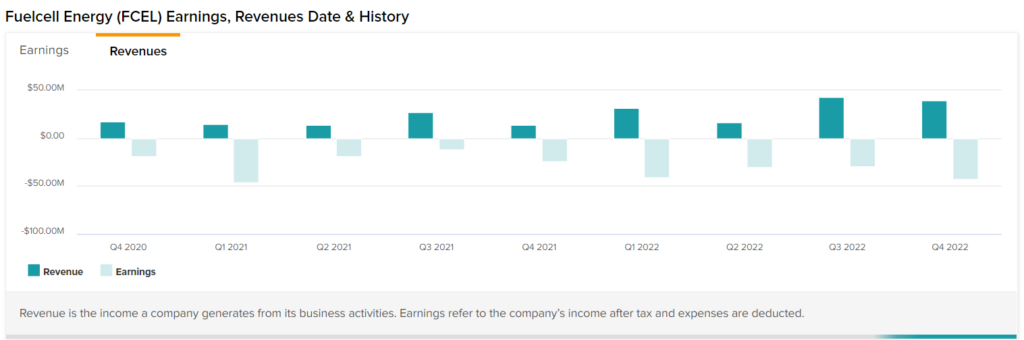

Fuelcell’s Revenue Looks Great, but Its Profitability Needs Improvement

Clearly, Fuelcell Energy has advantages with its government tie-ins. Turning to the financial side of the equation, however, there’s a “good news, bad news” scenario. The good news has to do with Fuelcell’s top-line results, but the bottom-line earnings picture is far from ideal.

Here’s something for the FCEL stock bulls to celebrate. During the fourth quarter of Fiscal 2022, Fuelcell Energy managed to generate $39.2 million in revenue. That’s impressive, considering the economic problems that have beset American businesses this year. Furthermore, this result is nearly triple the $13.9 million that Fuelcell Energy generated in the year-earlier quarter.

However, Fuelcell Energy spent a lot of money to expand its business strategy recently. Throughout Fiscal Year 2022, Jason Few noted that the company “advanced platform commercialization and investment, increased engineering capability, as well as expanded sales and marketing talent and activities.”

Spending money on these types of upgrades came with a heavy cost: poor bottom-line performance. Thus, Fuelcell Energy’s net loss widened from $25 million in the prior-year quarter to $43.3 million in Q4 FY2022. Going forward, investors should insist that Fuelcell’s management focus on fiscal discipline, as widening net losses shouldn’t be allowed to continue for too long.

Is FCEL Stock a Buy, According to Analysts?

Turning to Wall Street, FCEL stock is a Hold based on five unanimous Hold ratings. The average Fuelcell Energy price target is $3.62, implying 42% upside potential.

Conclusion: Should You Consider Fuelcell Energy Stock?

There are risks involved if you’re planning to invest in FCEL stock, so don’t “load the boat” even if you’re a proponent of clean energy. That being said, it’s encouraging to see Fuelcell Energy working with the U.S. Navy while also having a representative on a government committee.

If Fuelcell’s management is willing to focus on cost-cutting, this should make it easier for investors to envision a long-term future for the company. In the meantime, anyone who’s bullish on the domestic hydrogen market should seriously consider a position in FCEL stock.

Special end-of-year offer: Access TipRanks Premium tools for an all-time low price! Click to learn more.