It seems that Alphabet (NASDAQ: GOOGL), the technology giant, is not immune to macroeconomic volatility. In an email accessed by Bloomberg, Alphabet’s CEO, Sundar Pichai, told staff that the company will go slow on hiring for the remainder of the year and will focus more on hiring for “engineering, technical and other critical roles” this year and next.

The macro headwinds have prompted many Wall Street analysts, including Evercore analyst Mark Mahaney, to lower their estimates for technology companies like GOOGL. However, the top-rated analyst continues to be bullish about the stock with a Buy rating. Let us look at the reasons behind Mahaney’s optimism.

GOOGL’s Travel Search Vertical – A Bright Spot in Online Advertising

Top-rated analyst Mahaney’s intra-quarter checks have indicated that with the travel sector on a rebound, travel search trends are also improving. Citing data from Kayak Flight Search Trends, the analyst pointed out that while domestic flight search trends in the United States were either flat or had been in decline since April, international search trends were steadily improving.

Alphabet’s Initiatives to Monetize YouTube Shorts

The analyst is also positive about Alphabet’s initiatives to monetize YouTube Shorts – short-form videos on YouTube, particularly since his time-spent tracker indicated that YouTube’s average monthly time-spent per user has been growing “sequentially in April and May, closing the gap with TikTok time spent – potential evidence that YT has been able to hold its own in the TikTok storm.”

The Impending Slowdown in Advertising Revenue for GOOGL

The analyst, however, pointed to a slowdown in the Internet advertising sector. Advertising is a primary source of revenue for GOOGL and comprised around 80% of its total revenues in Q1.

Mahaney pointed out, citing data from Rockerbox, that GOOGL had the same market share as Meta Platforms (META) regarding ad spending until the middle of last year, after which “Google started gaining wallet share post the Apple ATT changes.”

The analyst is referring to Apple’s privacy initiatives, namely its App Tracking Transparency (ATT) that came into effect last year.

However, Mahaney stated that this gap, when it comes to market share, has modestly narrowed now and has begun to stabilize. Even on the basis of advertising dollars spent in absolute terms, the analyst added that there has been a “modest sequential Ad spend decline since late May for Google and the overall ad spend across all channels.”

As a result, the analyst has projected Alphabet to generate around $55.7 billion in advertising revenues in Q2, up by 10.5% year-over-year but still slightly below the Street estimates of $56.4 billion.

Macro Volatility Warrants Lower Estimates for GOOGL

The analyst has also lowered Alphabet’s FY23 gross revenue and operating income estimates by 4% and 6%, to $335.5 billion and $101.1 billion, respectively.

Mahaney pointed out that this lowering of estimates was “driven by our more cautious outlook on the Internet advertising sector, given intra-quarter data points pointing to a softening macro environment and consumer discretionary spending pullback.”

Alphabet is expected to announce its Q2 results on July 26.

Mahaney considers GOOGL “the most recession-resilient among Internet Ads names.” However, the analyst lowered his price target to $3,110 from $3,300. The analyst’s price target implies an upside potential of 39.7% at current levels.

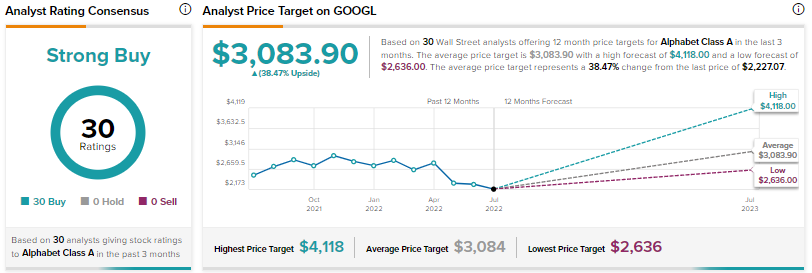

Wall Street analysts continue to be bullish about Alphabet with a Strong Buy consensus rating based on a unanimous 30 Buys. The average GOOGL price target of $3,083.90 implies an upside potential of 38.5% at current levels.

Conclusion

Even as GOOGL slows down on hiring amid other macro headwinds, it appears that the stock will still sail through, judging by Wall Street analysts’ bullish stance.

Interestingly, Alphabet’s website traffic trends are a bit worrying. The TipRanks Website Traffic tool indicates that total unique visitors on all devices for GOOGL are down 21.5% year-over-year in Q2.

Learn how Website Traffic can help you research your favorite stocks.