Talk hydrocarbons, and most people will automatically picture oil wells in Texas or Montana. Today’s energy sector, however, includes crude oil and natural gas extraction, gas liquefaction, the huge web of the midstream transport and storage networks, the refineries that churn out usable fuels and chemicals, and the related petrochemical industry pervading most aspects of our lives. Such a diverse economic sector will bring along unparalleled arrays of investment opportunities.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

In a recent note on the refining sector, Goldman Sachs analyst Neil Mehta outlined the factors that investor should look at in energy stocks: “We believe this environment allows for companies with accelerating capital returns and strong operations to outperform, as well as those with steadier earnings contribution from non-refining segments and attractive capital returns profiles to outperform.”

Against the backdrop, Goldman Sachs analysts have pointed out potential two energy winners for the months ahead. Both are Buy-rated names with double-digit upside potential, and offer a small dividend as a bonus. Let’s take a closer look.

Phillips 66 (PSX)

First up is Houston-based Phillips 66, an oil major that saw total revenues exceed $111 billion in 2021 and jump to $170 billion in 2022. The company has a presence in most aspects of the oil and gas industries. Phillips brings crude oil and gas products to the refineries, and markets a wide range of fuel products, as well as lubricating oils, industrial chemicals, and petrochemicals.

Phillips currently operates 13 refineries, which together produce a wide range of fuels and fuel oils that the company markets under multiple brand names. The Phillips 66 shield – the ubiquitous gas station sign modeled on interstate highway numbers – is recognized across the country, as are names like Conoco and 76. In addition, Phillips produces fuels for the aviation industry, and its chemical products can be found in industry, agribusiness, and the medical and pharmaceutical sectors.

Turning to Phillips’ financial results, the company saw non-GAAP EPS of $4 in 4Q22, up 35% year-over-year. While impressive, that figure came in below the consensus estimate of $4.35. The company has plenty of cash resources, and finished 2022 with $12.8 billion in liquid assets, including $6.1 billion in cash. This total included the $4.8 billion in operating cash flow generated in Q4.

Management authorized a $5 billion increase to the firm’s share repurchase program, and in the most recent declaration the company raised its dividend payment by 8 cents, or 8.2%, to $1.05 per common share. The annualized dividend now yields 4%.

Among the bulls is Goldman’s Neil Mehta, who writes of Phillips: “Our top pick in the group remains Phillips 66, which is on the Americas Conviction List. On our 2024 estimates, PSX trades at only 8.3X P/E compared to the sector average of 10.6X P/E, representing an attractive entry point…”

“We see room for investors to get more positive on the outlook for medium and longer term business transformation, with potential upside in earnings forecasts to the extent the company delivers on its cost reduction targets and any potential uplift from the recently announced DCP transaction,” the analyst added.

To this end, Mehta rates PSX shares a Buy along with a $125 price target. The figure implies shares will be valued 22% higher in a year’s time. (To watch Mehta’s track record, click here)

Overall, PSX shares have a Moderate Buy rating from the analyst consensus, based on 10 recent analyst reviews with a breakdown of 6 Buys to 4 Holds. The stock’s average price target stands at $128.80 and implies a 25% upside from the current share price of $102.84. (See PSX stock forecast)

Shell plc (SHEL)

Shell is one of the world’s largest oil companies, a mega-cap firm with a $200 billion market cap. Shell is also one of the oil sector’s most diversified companies, with its operations divided into four segments: Upstream, Integrated Gas, Renewables & Energy Solutions, and Downstream. Operations in these segments include everything from exploration and extraction activities, to natural gas liquefaction and delivery, to renewable hydrogen and low-carbon power production, to fuel and energy delivery to more than 32 million customers.

Outside of these activities, Shell also has a Projects & Technology division that drives the company’s research and innovation projects into new solutions for energy tech. In addition, Projects & Tech also provides needed technical capabilities and services in the operational divisions.

These combined operations brought Shell a total of $101.3 billion in top-line revenues for 4Q22, the most recent period reported, up 18% year-over-year – and beating the forecast by an impressive $59.97 billion.

At the bottom line, Shell had $9.8 billion in adjusted earnings for 4Q22, up 3.1% y/y. Drilling down, this income gave an adjusted EPS of $1.39. The bottom-line EPS compares favorably to the $0.83 from 4Q21 – but even so, the 4Q22 EPS was 92 cents below expectations.

Even with the mixed quarterly results, Shell saw fit to raise its dividend in Q4, bumping it up from 25 cents per common share to 28.75 cents, an increase of 15%. The new payment annualizes to $1.15 and yields 2%.

Covering this stock for Goldman, analyst Michele Della Vigna writes: “We believe the company has the highest quality combination of assets in the sector, with a leading global LNG and marketing businesses and strong chemical presence. We see material upside to operational performance in both deepwater and LNG assets, while the company’s strong balance sheet might allow it to veer towards the upper end of the sector’s new 30-40% cash distribution range…”

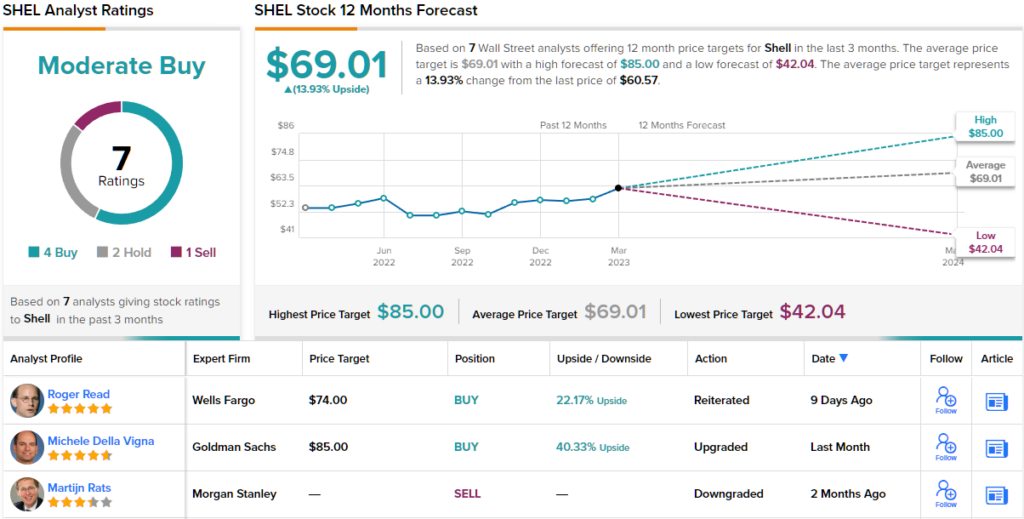

Della Vigna goes on to rate SHEL as a Buy, and he sets a price target of $85 to suggest a 40% potential upside on the one-year time frame. (To watch Della Vigna’s track record, click here)

Overall, we’re looking at a stock with a Moderate Buy consensus rating from the Street. The rating is based on 7 recent analyst reviews, including 4 Buys, 2 Holds, and 1 Sell. The shares have an average price target of $69.01, implying ~14% upside from the current trading price of $60.57. (See SHEL stock forecast)

To find good ideas for energy stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.