The first quarter is almost behind us, and analysts are starting to discern the patterns that are shaping the year’s stock markets. Two key points are already standing out. One is the high levels of market concentration; the Magnificent 7 mega-cap tech firms are still soaking up a disproportionate share of the gains. The second, related to this, is a need to diversify – but to choose the diversification carefully.

Investors can’t rely on a general broadening of the market to lift a portfolio. Rather, what’s needed is a particular sector that will bring new opportunities by building on the Mag 7s’ existing gains. AI stocks fit this bill.

We all know how AI tech is altering the digital landscape. Writing from Goldman Sachs, chief US equity strategist David Kostin has some insight on the ways that AI will broaden investors’ options through the rest of this year: “US equity market concentration has jumped to the highest level in decades. While anxious investors have focused on the DotCom bust in 2000, other concentrated markets in the past 100 years often ended in ‘catch up’ rallies as the market broadened. Neither a ‘catch up’ nor a ‘catch down’ look very likely to us in the near-term in the absence of a major shift in interest rates or a deterioration in the outlook for mega-cap earnings.”

“AI has captured investor enthusiasm, but that trade appears to be broadening,” goes on to add. “Stocks in Phase 2 (AI infrastructure) and Phase 3 (AI-enabled revenues) have recently outperformed peers, and we eventually expect Phase 4 will capture those firms best positioned to enjoy increased productivity.”

Following this, Goldman’s stock analysts are telling us to ‘buy the AI beneficiaries beyond the high momentum stocks,’ and are specifically pointing out these 3 names for investors to consider. With help from the TipRanks database, we can also gauge general Street sentiment toward these names.

Pinterest (PINS)

First on our Goldman-backed list is Pinterest, the visually oriented social media platform that gives users an online bulletin board to display graphic content in the online social universe. Pinterest follows the usual social media model, with users publishing and sharing content, either publicly or privately. The graphic-based platform, which also supports video content, lets users sort their digital bulletin boards into categories, making it easier for viewers to find and browse the pages. The visual orientation of the Pinterest platform has lent itself to e-commerce, and users can set up their pages as online storefronts. Pinterest has invested heavily in AI technology, using it to power the search function, and to sort and curate users’ pins and posts.

As a social platform, Pinterest skews both young and female. The user base is approximately 60% women, and the 18 to 25 age demographic is the platform’s fastest growing. The company does not explicitly market itself to young women, but management can’t avoid catering to the platform’s largest audience – in June of 2022, the company acquired THE YES, an AI online shopping platform, for $87.6 million. The move expanded Pinterest’s capabilities in online commerce, and its appeal to its young and female core demographic.

Pinterest has seen recent strong gains in its user base. In the 4Q23 report, the last released, Pinterest reported 498 million global monthly active users (MAUs) as of December 31, 2023. This was up 11% year-over-year, and was an all-time high for the company.

For the full-year 2023, Pinterest had $3.055 billion in revenues, up 9% y/y; for Q4, the top line of $981 million was up 12% y/y – although it missed the forecast by $9.2 million. At the bottom line, Pinterest had non-GAAP earnings of 53 cents per share, a solid y/y gain from the 29 cents reported in 4Q22, and 2 cents per share better than had been expected.

All of this caught the eye of Goldman’s 5-star analyst Eric Sheridan, who took the measure of Pinterest’s activities, and came down with a bullish viewpoint: “In our view, PINS mgmt remains focused on building scale into a wider pool of ad budgets (advertiser diversity, new product iteration and better monetization of intent signals) to drive an improved revenue trajectory in the quarters and years ahead. In terms of margin structure, Q4 Adj EBITDA results continued to demonstrate how prior period investments are now building into forward year margin trajectory. Looking beyond the short-term narratives on rate of change in ad revenue growth rates in the coming quarters, we have a rising confidence interval in PINS mgmt long-term initiatives (shopping/commerce, depth of engagement across media types, international monetization, etc.) which would produce sustained above-industry average revenue growth over the next 2-3 years.”

Summing up, Sheridan gives PINS a Buy rating, with a $41 price target that points toward a 20.5% gain in the coming months. (To watch Sheridan’s track record, click here)

Overall, Pinterest has a Moderate Buy rating from the consensus of the Wall Street analysts, based on 30 recent reviews with a 21 to 9 breakdown of Buy vs Hold. The shares are trading for $33.98 and their $42.90 average price target is slightly more bullish than the Goldman view, suggesting a one-year upside potential of 26%. (See Pinterest’s stock forecast)

Coupang (CPNG)

Next on our list is the Korean e-commerce player Coupang, a strong market leader in the Asian country’s online retail sector. Coupang aims to ‘wow’ its customers, and offers an e-commerce platform on which customers can buy virtually anything. The company also provides home delivery services, and even an online streaming service, Coupang Play. The breadth of products and services, and the guaranteed delivery, have led some to call the company ‘South Korea’s Amazon.’

The online service is complemented by a network of physical infrastructure, designed to facilitate the company’s warehousing and delivery services. Coupang has over 100 fulfillment centers, based on the Amazon model, housing its products and totaling more than 47 million square feet. The warehouse and logistic network is dense; it’s estimated that 70% of South Korea’s population lives within 7 miles of a Coupang facility.

Along with the warehouse network, the company uses top-end software systems, including AI-powered machine learning, to back up the e-commerce side and coordinate the physical deliveries. The software systems can predict demand spikes, route products into the delivery network, and ensure efficient handling of all orders, so that customers have more choices at a lower cost.

In an interesting development, Coupang in January completed its acquisition of the online luxury retailer Farfetch. Farfetch, which is based in the UK, provides a worldwide customer base with access to a wide range of luxury goods. Coupang acquired the company for $500 million, a surge in capital for Farfetch, that will allow the company to continue serving its 4-million-strong customer base. Coupang will also make its logistic expertise available to the new acquisition – and will gain access to Farfetch’s product lines of luxury goods and its worldwide presence.

Turning to financial results, we find that Coupang reported revenues of $6.56 billion in 4Q23, for a 23% year-over-year gain. The quarterly top line also came in $150 million above the forecast. At the bottom line, the company had a non-GAAP EPS of 8 cents per share, 2 cents ahead of the pre-release estimates. Coupang complemented this quarterly performance with solid cash generation; for the full year 2023, the company reported $2.7 billion in operating cash flow and $1.8 billion in free cash flow.

Eric Cha follows Coupang for Goldman Sachs, and reiterates his belief that investors are not appreciative enough of CPNG’s benefits. He writes, “We maintain our positive view on the stock: We note some market concerns on potential overhang from selling by large shareholders (as seen post prior quarterly results), but we continue to be positive on fundamentals given Coupang’s differentiated moat driving multi-year market share gain momentum in the domestic retail space. Coupled with scale-driven operating leverage and GMV mix shift towards more profitable business model (i.e. FLC), we expect substantial scaling of FCF for the company, which we believe is still being under-appreciated.”

These comments support Cha’s Buy rating here, and his price target, set at $30, implies a gain of 64.5% on the one-year horizon. (To watch Cha’s track record, click here)

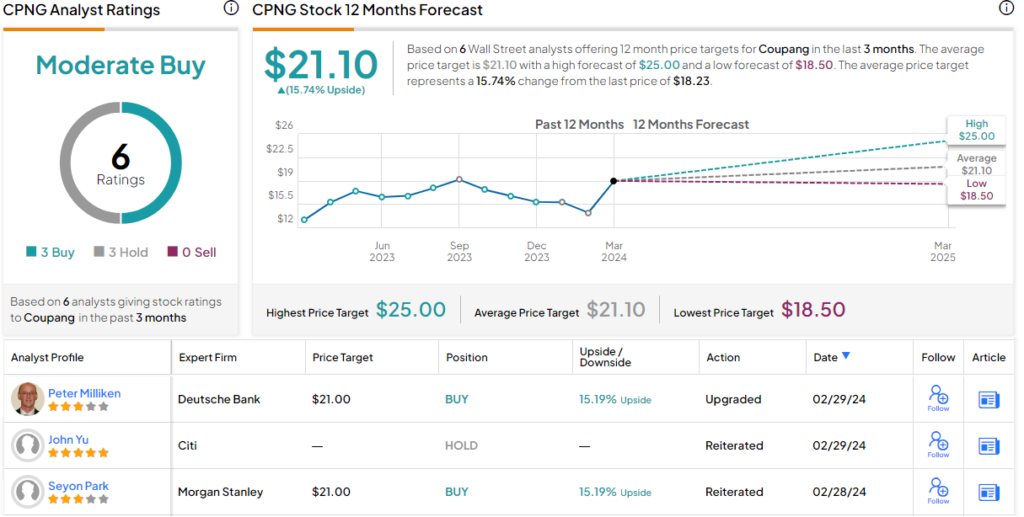

Once again, we’re looking at a stock with a Moderate Buy consensus rating – this one derived from an even split of 3 Buys and Holds, each. The shares have a trading price of $18.23, and the $21.10 average target price indicates potential for a 16% one-year upside. (See Coupang’s stock forecast)

Amazon (AMZN)

Last on our list is Amazon, the 800-pound gorilla of online commerce. Amazon is a company that has proven itself capable of rolling with whatever changes the market can throw at it. It survived the original dot.com bubble, it has expanded far beyond its origin as an online bookstore, and it has become the largest online retailer in the world, offering an unmatched line of products and acquiring a truly global reach.

As a result of becoming the world’s leader in online retail, Amazon has also become one of the world’s most valuable publicly traded companies. Amazon is one of the Magnificent 7 mega-cap stocks, and with its $1.81 trillion market cap, it is the fourth-largest public company on Wall Street. Amazon’s sheer scale is visible in another number, its daily sales volume of approximately $1.4 billion.

Like Coupang above, Amazon has a widespread network of brick-and-mortar fulfillment centers, warehouses, and logistic hubs to support its e-commerce business. The company boasts that it can guarantee rapid delivery nearly anywhere on the globe, and the warehouse network is geared to provide that. Some of Amazon’s facilities have more than 1 million square feet of workspace, giving the company a solid physical presence that brings the online world to life.

The e-commerce side of Amazon’s business is huge, and attracts some 2 billion monthly hits to the company’s website. And attracting customers is the bread and butter of Amazon’s business, especially when online retail can be seen as a lure. The company offers an array of additional services, available online, that more and more customers are finding that they cannot do without.

These services include cloud computing, the popular AWS that is available by subscription purchase, as well as TV streaming, the Kindle ebooks, online gaming for all ages, home automation, and even home delivery for online grocery orders. Amazon’s various services all combine to meet a common need, of solving customer problems in the real world.

Solving those customer problems has been lucrative for Amazon. In early February, the company reported its results for 4Q23, and showed $170 billion in revenue for the quarter. This was up 14% year-over-year, and was $3.74 billion ahead of the estimates. At the bottom line, Amazon generated $1 in EPS from its $10.6 billion net income. AWS, the cloud computing service that has proven so popular, generated $24.2 billion of the total revenue, for a 13% y/y segment gain.

We’ll check in again with Goldman’s Eric Sheridan, who sees Amazon as a long-term stock play, writing of the company, “Looking over a multi-year timeframe, we reiterate our view that Amazon will compound a mix of solid revenue trajectory with expanding margins as they deliver yield/returns on multiple year investment cycles. After trading in a range (& underperforming the broader market) for most of the past 2-3 years, we see AMZN as well positioned for future outperformance as eCommerce margins continue a trajectory of scaling over headwinds created in recent years and ongoing benefits from a more efficient logistics network, as its advertising business continues to achieve scale and as AWS can still benefit from a long-tailed structural growth opportunity in the shifting needs of enterprise customers (while producing a balance of growth and margins).”

Following the Q4 print, Sheridan summed up his stance on the stock with an upbeat outlook, saying, “…we continue to see Amazon positioned as a leader in all aspects of secular growth within our Internet coverage (eCommerce, digital advertising, media consumption, aggregated subscription offerings & cloud computing). In total, every key metric that Amazon is measured against exceeded expectations and we come away from this earnings report with an increased confidence interval in our medium/long term thesis of Amazon’s key platform drivers.”

The top-rated analyst gives AMZN a Buy rating, and he backs that up with a $220 price target suggesting a 26% share appreciation this year.

Amazon’s stock has 41 unanimously positive analyst reviews, for a Strong Buy consensus rating. The average target price of $209.23 implies that AMZN has a one-year potential upside of $20%. (See Amazon’s stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.