Goldman Sachs (NYSE:GS) will release its Q3 financials on October 17, 2023. However, analysts’ earnings estimates suggest that Q3 earnings may continue to be disappointing. Investors should note that Goldman Sachs’ CEO, David Solomon, said during the Q2 conference call that the activity levels in various areas of investment banking are near the lowest points in the past decade.

Speaking at the Barclays 21st Annual Global Financial Services Conference, Solomon said the “environment for capital markets activity is improving.” However, “It’s still way off, what I’ll call cycle averages, but definitely improving.” These statements suggest that Goldman Sachs continues to face challenges and could deliver lower sales and earnings in Q3.

With this backdrop, let’s look at analysts’ consensus estimates for Q3.

Analysts Expect Goldman’s EPS to Decline

Wall Street analysts expect Goldman Sachs to post earnings of $5.42 per share in Q3 compared to the EPS of $8.25 in the prior-year quarter. The year-over-year decline in earnings reflects lower sales due to the challenging backdrop, primarily in the investment banking segment. Analysts expect Goldman Sachs to post revenue of $11.15 billion in Q3 compared to $17.48 billion reported in the prior-year quarter.

Ahead of the Q3 earnings, on October 10, JMP Securities analyst Devin Ryan lowered the price target on Goldman Sachs stock to $440 from $450. The analyst expects Goldman’s Q3 earnings to remain subdued. However, he maintained a Buy recommendation on Goldman Sachs stock, believing that most of the negatives are already priced in.

In a similar move, Oppenheimer analyst Chris Kotowski also lowered the price target on GS stock to $450 from $461 on September 26. The analyst expects the new capital standards will increase capital requirements for banks and add uncertainty. Nonetheless, Kotowski maintained his Buy rating on Goldman Sachs stock.

With this backdrop, let’s consider analysts’ recommendations for Goldman Sachs stock ahead of the Q3 print.

Is Goldman Sachs Stock a Buy, Sell, or Hold?

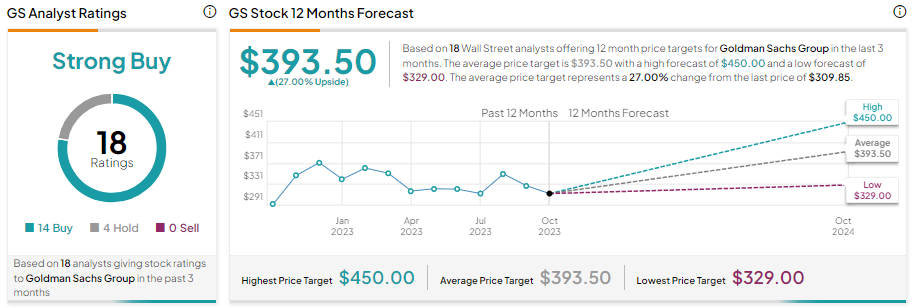

Despite the ongoing pressure on its revenue and earnings, Wall Street analysts are bullish about Goldman Sachs stock. The stock’s underperformance implies the market has already factored in the existing negatives.

With 14 Buy and four Hold recommendations, Goldman Sachs stock has a Moderate Buy consensus rating. Analysts’ average 12-month price target of $393.50 implies 27% upside potential from current levels.