Gold, which has traditionally been considered a hedge against inflation, has not been doing so well lately. Gold futures have slid more than 2% this year. Spot Gold prices have been pretty much range bound in the past three months, hovering between $1600 and $1800 per ounce.

There are several reasons behind gold gathering dust recently. Interest rates in the United States are on an upward trajectory after the Federal Open Market Committee (FOMC) hiked interest rates again by 75 basis points (bps) earlier this month.

Federal Reserve Bank Chairman Jerome Powell has warned that the bank is likely to increase interest rates further as it tries to rein in inflation. Inflation in the United States has now jumped to 7.7% in the month of October.

However, if gold prices are any indication, investors have not turned to gold to hedge against inflation this time. The reason? The U.S. dollar has strengthened against all major currencies with higher interest rates. A rising dollar makes buying gold more expensive, which reduces an investor’s appetite to invest in this glittery metal.

However, there still exists an upside to investing in gold. According to a CNBC report, citing data from UBS, gold prices are expected to surge by 13% by next year. The report cited a research note by UBS, which stated that historically, gold prices have increased by 19% for every 1% decline in “real rates.”

Here, real rates refer to an interest rate adjusted for inflation. According to UBS, the Federal Reserve is likely to halt rate hikes by February next year. As a result, “gold should benefit and therefore holding a long gold position would offer an attractive risk-reward as the tightening cycle ends.”

Against this backdrop, it may be beneficial for investors to invest in gold stocks. Investing in gold stocks is better than holding on to the physical asset as it consists of lesser risk and could generate higher returns over the long term.

Using the TipRanks stock comparison tool, we looked at two precious metal mining stocks that offered more than 30% potential upside at current levels and were trading at a lower price-to-earnings ratio than the average precious metal mining industry P/E ratio of 29.37.

Barrick Gold (NYSE: GOLD)

Shares of Barrick Gold have plunged by more than 13% this year, and the stock is currently trading at a price-to-earnings ratio of over 15. Barrick Gold’s portfolio includes six of the top Tier One gold mines in the world. Tier One gold mines are assets with “a reserve potential to deliver a minimum 10-year life, annual production of at least 500,000 ounces of gold, and a total cash cost per ounce over the mine life that is in the lower half of the industry cost curve.”

The company operates mines in 18 countries, including North and South America, Africa, Papua New Guinea, and Saudi Arabia.

The mining company is also looking at capitalizing on increasing its exposure to copper to take advantage of the decarbonization trends globally through its Lumwana mine in Zambia and Jabal Sayid mine in Saudi Arabia.

In the third quarter, the company posted revenues of $2.5 billion, down by 11% year-over-year but still beating analysts’ estimates by $60 million.

Moreover, adjusted earnings per share dropped to $0.13 in Q3 versus $0.22 in the same period last year.

The company stated in its press release that the softer Q3 results were the result of “some short-term operational challenges and rising input costs.” However, Barrick reiterated that it was on track to achieve the lower end of its gold production guidance in 2022.

The company has forecasted its gold production in 2022 to range between 4.2 and 4.6 million ounces, while production of copper is anticipated to be in the midpoint of its 2022 production range of 420 million pounds to 470 million pounds.

Barrick delivered operating cash flow of $758 million in Q3, plus the sale of its non-core royalty assets. The company declared a dividend of $0.15 per share in Q3, payable on December 15 to shareholders of record as on November 30. This indicates an annualized dividend yield of 3.7%.

The company purchased $322 million worth of shares during Q3, with total shareholder returns of $1.2 billion this year when including dividends.

Is Barrick Gold a Buy?

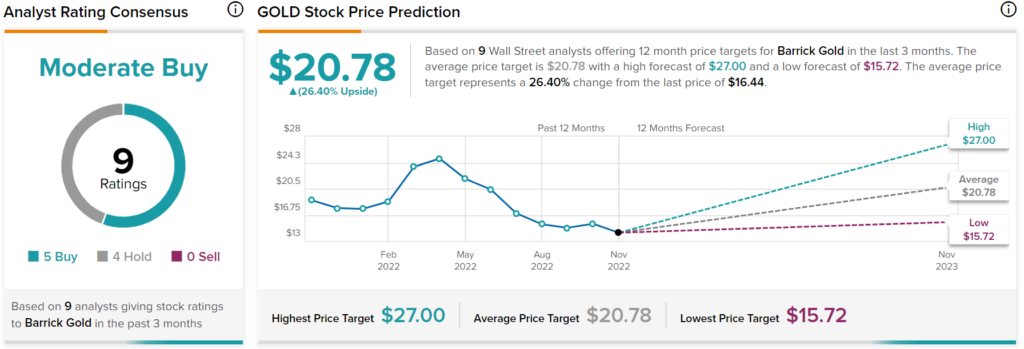

Wall Street analysts are cautiously optimistic about Barrick Gold, as it remains confident about actively managing inflation and controlling its operating costs. Analysts have a Moderate Buy consensus rating on Barrick Gold stock based on five buys and four Holds. The average Barrick Gold price target is $20.78, implying an upside potential of 26.4%.

Kinross Gold Corp. (NYSE: KGC)

Kinross Gold Corp. has seen its stock lose more than 25% of its value this year. Kinross is a gold mining company based out of Canada with operations and projects in the United States, Brazil, Mauritania, Chile, and Canada.

The mining company reported its Q3 results on November 9 with revenues of $856.5 million, a jump of 47.1% year-over-year. Adjusted net earnings came in at $0.05 per share, falling short of Street estimates of $0.06.

Kinross Gold’s gold equivalent production increased 17% sequentially to 529,155 Au eq. oz (gold equivalent ounce). However, the fall in gold prices did affect the company even as production ramped up. Indeed, the average realized gold price from continuing operations fell to $1,732 per ounce in Q3 from $1,792 per ounce in the same period a year earlier.

J. Paul Rollinson, President and CEO of Kinross Gold, commented, “During the quarter, our operations increased production and lowered costs, primarily driven by higher grades at Paracatu, enhanced seasonal recoveries from our U.S.-based heap leaches, and the ramp-up at La Coipa, which progressed well and is expected to continue trending upwards with the mill averaging throughput levels of approximately 9,500 tonnes per day in October.”

More importantly, KGC’s Tasiast 24K mine in Mauritania is on track to reach 24,000 tonnes of production per day by the middle of next year.

In Q3, the company’s Board of Directors declared a quarterly dividend of $0.03 per share payable on December 15 to shareholders of record as on December 1, 2022. So far, the company has bought back $180 million worth of shares, or nearly 60% of its planned stock buyback of $300 million.

Reassuringly, the company is on track to achieve its production target of 2 million Au eq. oz in 2022, up from 1.4 million Au eq. oz, a year back. KGC expects to incur capital expenditures of $750 million in 2022 versus $822 million in 2021.

Will KGC Stock Go Up?

Wall Street analysts are bullish on KGC stock with a Strong Buy consensus rating based on six Buys and one Hold. The average price target for KGC is $5.91, implying an upside potential of 37.12% from current levels.

Key Takeaway

Even as gold mining companies are facing lower gold prices and higher costs of production, there are signs that these difficulties may ease soon. As these companies actively try to rein in their production costs and ramp up production, higher gold prices could benefit these stocks. This would make these stocks worth their weight in gold.