Go-Ahead Group (GB:GOG) is looking forward to a busy holiday season as bus travel rebounds in the UK post-pandemic – and the company expects to generate operating profits to beat 2020 levels this year.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Traveller numbers have already surpassed pre-COVID levels in certain busy areas, such as Manchester.

Christian Schreyer, CEO of the company, said, “There will be particularly strong demand across tourist hotspots during the coming months, with bus travel in certain areas of the UK already exceeding pre-pandemic volumes.”

The company’s share price has increased by 135.4% over the last six months.

Go-Ahead Group is a passenger transport company with operations in the UK, Ireland, Singapore, Norway, and Germany.

Takeover on the cards

Last month, Go-Ahead accepted a £650 Million takeover bid from a consortium including Australian bus operator Kinetic Holding, infrastructure manager Globalvia Inversiones, and Canadian pension manager OPTrust.

Rival Kesian has not ruled out a competing bid and says it is still considering options.

View from the City

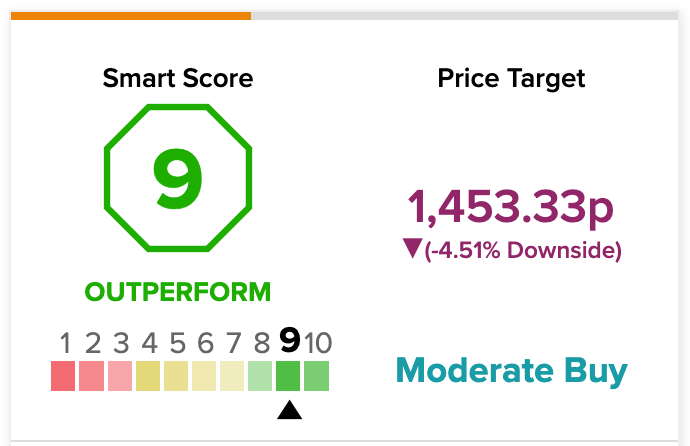

According to TipRanks’ analyst rating consensus, Go-Ahead stock comes in as a Moderate Buy.

Out of three analyst ratings, there are two Hold recommendations and one Buy recommendation.

As per the TipRanks Smart Score Tool, the company has a score of 9, which means the stock has the potential to outperform the market. Smart Score uses analyst rating and other fundamental data to pick out stocks which are likely to perform well.

Conclusion

Go-Ahead shares have performed strongly in the last six months. Though the 2022 numbers are not out yet, analysts expect performance to be in line with expectations.