American multinational automotive manufacturing corporation General Motors Company (NYSE: GM) will release its financial results for the first quarter of 2022 today, April 26, after the market close. It is one of the world’s largest vehicle manufacturing companies engaged in designing, manufacturing, and selling cars, trucks, and automobile parts, with a market capitalization of $57.86 billion.

In the last quarter, General Motors posted stronger-than-expected earnings driven by solid growth in North America and Financial segments. However, revenues disappointed on macro issues.

Despite bearing the brunt of supply chain issues agitated by the Russia-Ukraine war, ongoing headwinds in the auto sector, labor challenges, macroeconomic factors, and pricing pressure squeezing profit margins, General Motors reported U.S. vehicle sales of 512,846 in the first quarter, up 16% sequentially. Production was supported by improved semiconductor supplies.

Encouragingly, EVP at GM North America, Steve Carlisle, commented, “Our ability to meet pent-up demand improved dramatically thanks to a tremendous effort by our supply chain and manufacturing teams to keep our plants operating at close to normal levels. Supply chain disruptions are not fully behind us, but we expect to continue outperforming 2021 production levels, especially in the second half of the year.”

Overall, GM’s production, deliveries, and inventory numbers were decent during the quarter, along with the rising demand.

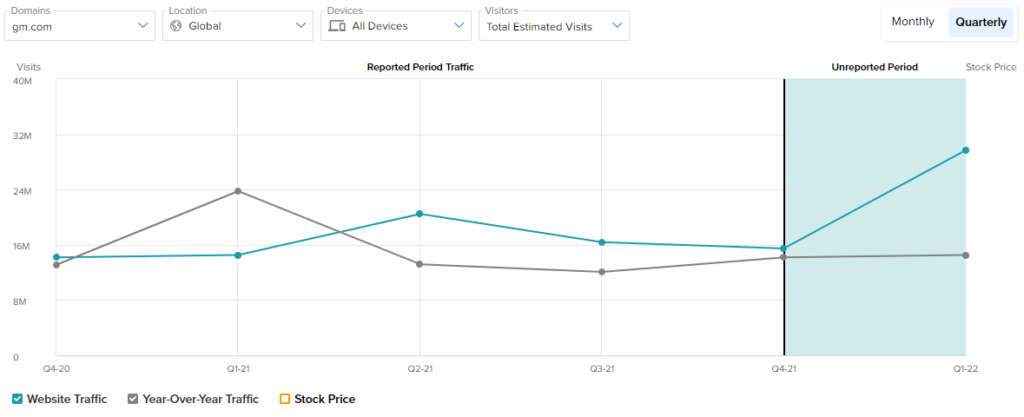

Therefore, prior to the Q1 2022 earnings release, with the help of TipRanks’ Website Traffic Tool, we can visualize how the company might have performed in Q1. This new tool measures and analyzes a company’s website visits over a specified time period.

We noticed an uptrend on the website traffic tool. In Q1 2022, total estimated visits on gm.com showed an increasing trend, on a global basis, representing a 91.9% jump from the fourth quarter and a 104.59% rise on a year-over-year basis.

Remarkably, for the first quarter, GM expects wholesale volumes to be up 20% to 25% sequentially. Therefore, the company might have recorded strong revenues in the first quarter.

However, anticipated commodities and logistics related costs of $2.5 billion year-over-year in 2022, mainly expected in the first half of 2022, might have acted as a headwind.

Wall Street’s Take

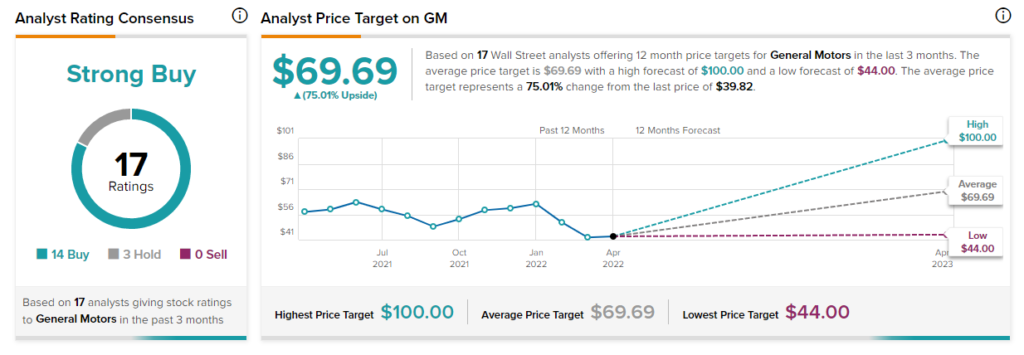

Despite cost challenges and lower volumes, Wall Street analysts seem optimistic about the GM stock, ahead of its Q1 print.

Recently, J.P. Morgan analyst Ryan Brinkman maintained a Buy rating on General Motors but lowered the price target to $71 (78.3% upside potential) from $75.

Lowered estimates by Brinkman reflect lower volumes and elevated costs, but the analyst considers the valuation attractive at current levels.

Overall, the stock has a Strong Buy consensus rating based on 14 Buys and three Holds. The average General Motors price target of $69.69 implies 75.01% upside potential from levels seen before market open on Tuesday. However, shares have decreased 31.59% over the past year.

On top of this, General Motors scores a “Perfect 10” from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Ending Words

Given the company’s long-term prospects, high analyst ratings, potential to withstand crises (the 2008-09 financial crisis and the COVID-19 outbreak in 2020), move towards EV push with innovative products on the back of a favorable regulatory backdrop and high consumer interest, along with favorable website traffic, General Motors is trending well among individuals in an improving consumer environment.

However, lower volumes and costs challenge may have hampered the first quarter’s performance to a lesser extent.

Learn more about the Website Traffic tool in this video by Youtube sensation Tom Nash.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure