The Detroit-based automaker General Motors (GM) reported strong second-quarter results on July 23, exceeding both top and bottom-line estimates and achieving record revenues. However, I maintain a neutral stance on GM shares because the investment thesis has been more focused on the company’s arduous progress in transitioning to electric vehicles (EVs) rather than its operational strength and profitability.

Since hitting a low of just above $26 per share in November last year, GM shares rallied nearly 90% until mid-July. Yet, the Q2 earnings report caused the stock to lose momentum, and now it’s down to $44 per share.

General Motors’ Q2: A Strong Quarter

General Motors had a strong Q2, continuing its impressive streak. For the eighth quarter in a row, it beat EPS estimates, reporting $3.06 per share compared to the expected $2.70—a 60.2% year-over-year increase.

On the revenue front, GM also exceeded expectations for the seventh consecutive quarter, delivering $47.97 billion versus the anticipated $45.41 billion.

A big part of this success comes from GM’s non-EV segment. The company reported $4.4 billion in adjusted EBIT, which is arguably the most important operating metric in the auto industry. This figure is up 37% from last year, driven by the strong performance of internal combustion engine (ICE) trucks and SUVs in both volume and margin.

Plus, GM has raised its guidance for adjusted EBIT and free cash flow for the second quarter in a row (see the image below). It now expects full-year EBIT to be between $13 billion and $15 billion, up by $500 million from previous forecasts. Free cash flow is projected to range from $9.5 billion to $11.5 billion, an increase of $1 billion on both ends. Overall, these are solid positives for GM’s Q2 performance.

Headwinds in China and Autonomous Vehicle Project Hurt Momentum

The restructuring in China, a key market for GM, really hurt the company’s post-earnings performance. Investors were let down by a $104 million loss from its joint venture with state-owned SAIC, compared to a $78 million gain in Q2 last year. This loss was somewhat surprising, as CEO Mary Barra had hinted that the quarter would be profitable in China. However, the headwinds were stronger than anticipated.

In Q2, GM sold 373,000 vehicles in China, down from 526,000 in the same quarter last year. Sales are dropping due to fierce competition from local manufacturers, who get a boost from the Chinese government’s support.

Another issue is GM’s decision to scrap its robotaxi project, Cruise Origin, which was supposed to be its big autonomous vehicle play. Now, GM is shifting focus to using the next-generation Chevrolet Bolt EV platform for its self-driving efforts. As a result, GM wrote off $583 million of its investment due to the restructuring of Cruise.

GM’s EV Plans: High Hopes Meet Harsh Realities

Overall, investors were focused on whether GM would continue to scale back its EV plans. General Motors has lowered its EV production outlook for the year from a range of 200,000 to 300,000 units to a new range of 200,000 to 250,000 units.

The concern is that GM has invested heavily in EV production capacity, which means it will take longer to use up this capacity. When this capacity sits unused, it will eventually hurt earnings upfront. According to GM management, it expects to be profitable if it can sell at least 200,000 EVs.

Back in October 2023, GM postponed production of the all-electric Chevrolet Silverado EV and the GMC Sierra EV pickup trucks due to slow EV demand. In the most recent quarter, GM delivered 21,930 EVs out of a total of 696,086 vehicles—which is a very small percentage.

These figures and the revised guidance suggest that EV demand isn’t meeting expectations, not just for GM but for the industry as a whole.

Beware of the Low Valuation Multiples

High valuation multiples usually mean investors are expecting a lot from a company’s future performance, while low multiples often signal that they’re not holding their breath.

For instance, General Motors is trading at 4.4 times its forward P/E (assuming a 30% EPS increase in 2024), while Ford (F) is at 5.7 times. In contrast, Tesla’s (TSLA) forward P/E is a whopping 90x. While comparing Tesla with GM might not be entirely accurate, this discrepancy highlights just how low expectations are for U.S. legacy automakers.

This can be frustrating because, despite GM’s significant efforts in EVs and new revenue streams from connected vehicles, these companies often don’t get much credit for their high investment and operating costs.

Another big concern is political risk. For instance, the U.S. government has been tightening fuel efficiency standards. Depending on who’s in power next, GM could face trouble if it doesn’t meet fleet average requirements. GM’s previous promise to electrify 50% of its fleet by 2030 and 100% by 2035 will now be guided by consumer demand, according to the CEO.

Overall, these risks are tough to pin down, leaving GM stock in limbo. That’s why I believe investors are left wondering if it’s worth paying a lower multiple for a solid player in an industry that is clearly expected to lose momentum in the long term.

Is GM Stock a Buy, According to Analysts?

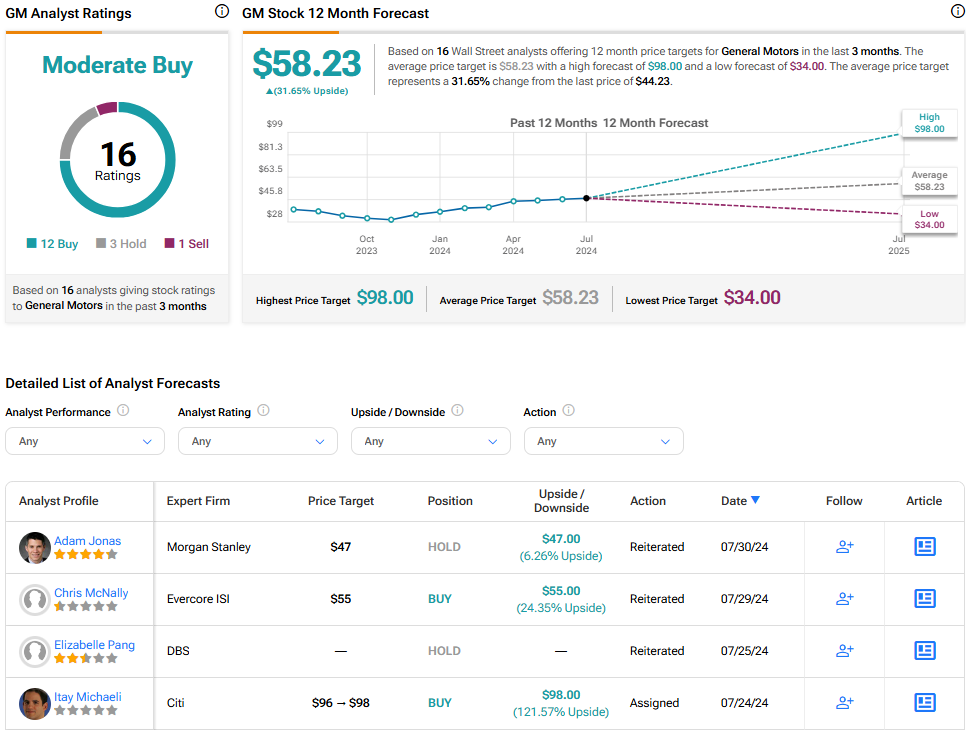

In general, analysts appear to be pretty bullish on GM shares, with a Moderate Buy consensus rating. The average GM stock price target is $58.23, which represents upside potential of 31.7% based on the latest share price.

The Takeaway

There was nothing seriously wrong with General Motors’ Q2 results to justify the sharp drop in the stock’s bullish momentum. However, headwinds in China and issues with its autonomous vehicle division have acted as negative short-term drivers.

The main concern with the investment thesis is GM’s slow progress in transitioning to electric vehicles (EVs), both in terms of pace and scale. Adding to the complexity are the influences of policies and regulations. All of this combines to create a valuation that seems de-risked but suggests a lack of enthusiasm from investors to support a bullish outlook.