American multinational conglomerate General Electric (NYSE:GE) suffered huge losses in its renewable energy business in the third quarter. To address this, the company announced a restructuring plan and reduced its profit forecast for 2022.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Notably, GE has been able to raise the prices of its offerings to combat inflationary pressures. However, the challenges in the renewable energy business have offset the price rises and dragged down the overall profits.

GE Undertakes Restructuring Measures

The company’s restructuring plan will save costs by $450 million annually. Also, measures in its renewable energy business will save another $500 million a year. The segment is expected to be profitable in 2024. On the other hand, the restructuring measures will cost GE $1.3 billion.

GE Trims Guidance

GE maintained its full-year 2022 revenue growth target but lowered the adjusted profit forecast to fall between $2.40 to $2.80 per share. Also, free cash flows are expected to decline to $4.5 billion from the $5.5 billion projected earlier.

The company reported a third-quarter Fiscal 2022 adjusted loss of $0.35 per share, missing analysts’ estimates by $0.14 per share. On the contrary, quarterly revenue jumped 3% to $19.08 billion and also beat the consensus estimates by $330 million.

The Renewable Energy segment’s revenue fell 15% year-over-year to $3.59 billion. Also, its losses widened to $934 million from $151 million in the year-ago period. Further, GE’s Power segment’s revenue collapsed 12% year-over-year to $3.53 billion but losses improved to $141 million from the $204 million reported in the year-ago period.

On the bright side, GE’s aviation segment showed revenue growth of 24% to $6.70 billion and the healthcare business reported revenue growth of 6% to $4.61 billion.

Is GE a Good Stock to Buy?

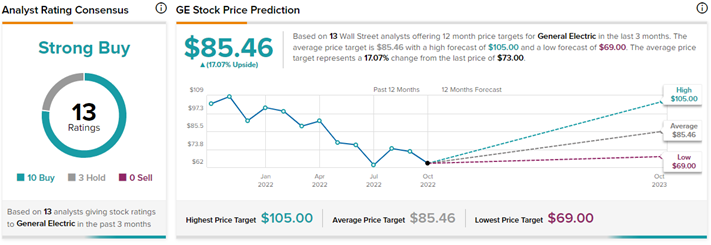

With ten Buys and three Hold ratings, General Electric stock commands a Strong Buy consensus rating. On TipRanks, the average General Electric price forecast of $85.46 implies 17.1% upside potential to current levels. Meanwhile, the stock has lost 23.9% year to date.

Concluding Thoughts

Currently, GE stock is trading at a 37% discount from its 52-week high of $116.17. Furthermore, analysts are highly optimistic about GE’s stock trajectory. Analysts set a modestly high price target, implying the likelihood of upside potential. Notably, GE’s restructuring efforts will take time to bear fruit. The company’s short-term challenges remain, but the long-term outlook looks bright.