Shares of GameStop (NYSE:GME) tumbled ~18% in Thursday’s trading session after the meme stock king delivered a disappointing set of quarterly results, although the performance is only partly to blame for the decline.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

GameStop missed both on the top-and bottom-line. Revenue fell by 1.1% year-over-year to $1.24 billion, whilst coming in $120 million below expectations. Adj. EPS of -$0.14 also fell shy of the analysts’ -$0.12 forecast.

More surprisingly, the company announced that the board had decided to fire CEO Matthew Furlong, only two years after the former Amazon exec was handed the role. He will immediately vacate his position, and in the meantime, activist investor, largest individual shareholder and board chairman Ryan Cohen will assume executive chairman duties.

No specific reasons for the termination were given but to Wedbush analyst Michael Pachter, the whole shebang reeks of mismanagement.

“Mr. Cohen’s top secret strategy was (apparently) to ‘be like Amazon’, and now that his Amazon executives are gone, it is unclear what strategy is guiding the company,” Pachter said. “We remain convinced that GameStop is doomed, with declining physical software sales and a shift of sales to subscription services and digital downloads sealing its fate.”

If ran properly so to “harvest profits,” Pachter thinks the videogame chain could be of some value, but without competent management, the analyst does not foresee a positive change taking place anytime soon. From Pachter’s perspective, the company should reduce the number of stores, effectively control expenses to generate profits, and maximize profit despite ongoing declines in sales. “However,” the analyst summed up, “we think that the lack of clear direction and the callous termination of Mr. Furlong all but ensures that Mr. Cohen will have difficulty attracting a qualified replacement.”

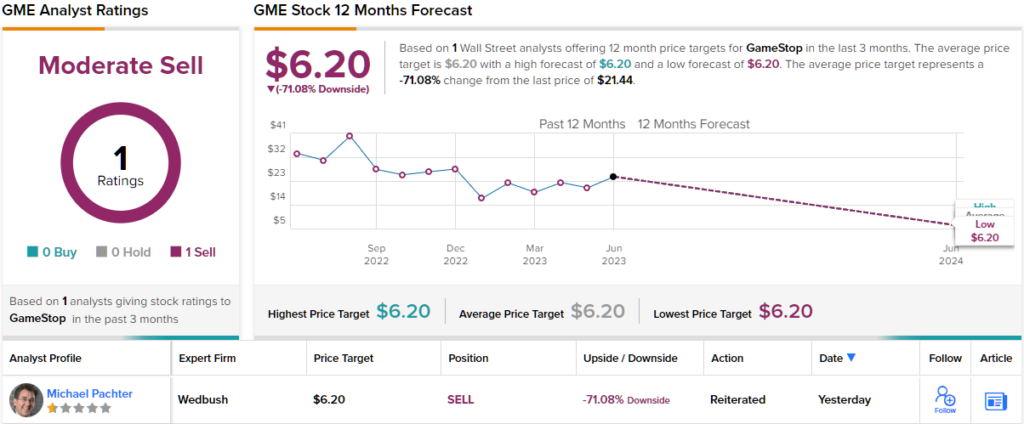

So, what does this all mean for investors? Pachter reiterated an Underperform (i.e., Sell) rating and lowered the price target from $6.5 to $6.20. That figure suggests shares will be changing hands for ~70% discount a year from now. (To watch Pachter’s track record, click here)

Overall, it looks like no other analysts are currently following GameStop’s activities, with Pachter’s review the sole one submitted over the past 3 months. (See GameStop stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.