Although we are only over one quarter into 2021, it will be interesting to see if any other story tops the GameStop (GME) short squeeze mania this year. The struggling video game retailer has provided no end of headlines in 2021 after retailers re-wrote the stock market rulebook.

That said, the mighty gains – up by 721% year-to-date even after pulling back by 55% from the January madness highs – have caused a huge chasm between fundamentals and valuation.

Accordingly, Ascendiant’s Edward Woo believes that over the long run GameStop’s “current elevated share prices will come back down to match its current weak results and outlook.”

That said, Woo expects the company to benefit from new video game consoles sales from Sony and Microsoft. The new PlayStation and Xbox consoles, respectively, were launched in November and so far, sales have been “very strong.”

As it is still the early phase of the new console launches, Woo says GameStop anticipates “continued strong growth over the next year.”

Woo also thinks the arrival of Chewy co-founder Ryan Cohen who joined GameStop’s board in January and has been behind the effort to transition to a more e-commerce centric approach has helped fuel the rally.

However, GameStop is faced with a threat it will find very difficult to counter: the continuous rise of digital sales. Even with the pivot toward e-commerce, Woo thinks it will be hard for GameStop to compete.

“Recent reports by the video game publishers shows that digital revenue is increasing at a fast pace (~90% or more of publishers’ revenues),”, so concerns are increasing that digital game sales (which GameStop has very low market share) is beginning to be a bigger factor (~70% of a game’s total sales are now full game digital downloads),” Woo said. “We remain very concerned about the long-term prospects for its video game business especially once hardware sales temper as the installed base matures.”

With this in mind, Woo rates GME shares a Sell, along with a $10 price target. The implication for investors? A very painful 93% drop. (To view Woo’s track record, click here)

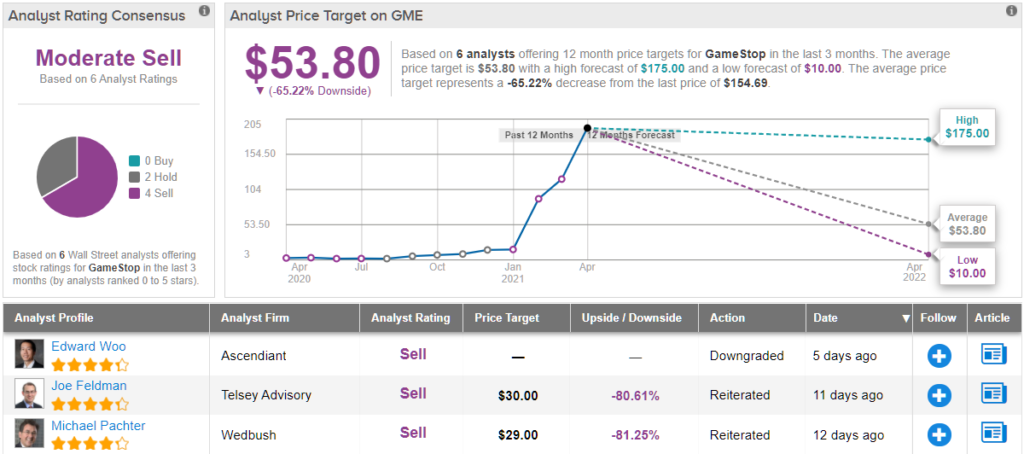

The rest of the Street’s take is hardly more reassuring. Shares are expected to be changing hands for a 65% discount a year from now, given the average piece target stands at $53.80. Based on 2 Holds vs. 4 Sells, the analyst consensus rates GME stock a Moderate Sell. (See GME stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.