Last year was tough for technology stocks, with the tech-oriented NASDAQ index falling 33% by the end of 2022. The index has seen a sharp turnaround these last few months, however, and has posted a 16% gain year-to-date so far. And, with the overall index, there have been some consistent overperformers – which brings us round to the semiconductor chip stocks.

Don't Miss our Black Friday Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The global chip spending reached $570 billion last year and is projected to reach $1 trillion per year by the end of the decade, indicating a strong growth trajectory for the chip sector as we enter the second half of 2023.

In JPMorgan’s sector coverage, chip expert and 5-star analyst, Harlan Sur, provides insights: “Despite growing concerns on a slower economic backdrop, our positive view on semis/semicap/EDA fundamentals remains largely unchanged… demand fundamentals in CY23 continue to be constructive for strategic infrastructure (cloud/datacenter, telco, enterprise) and auto/industrial… Overall, we see the fundamental setup for 2023 progressing as we had anticipated, and we believe our covered companies are well-positioned to navigate through the current downcycle w/ a 2H inflection in fundamentals.”

So let’s dip into the TipRanks database, and check out the details on 3 semiconductor stocks that Sur sees set to fly higher in 2023.

GlobalFoundries, Inc. (GFS)

We will get started with GlobalFoundries, one of the major chip designers and makers in the US. GlobalFoundries provides contract services for customers across multiple industries, from automotive to computing to IoT to wired networking and everything in between. The company has a global reach, befitting its name, with design centers, R&D labs, and chip foundries located around the world.

A look at GlobalFoundries’s recent acquisition and partnership moves will show how the company is continuing to strengthen its position. In early February, GlobalFoundries acquired Renesas Electronics’s Conductive Bridging Random Access Memory (CBRAM) technology, a proprietary technology that offers low power memory solutions and is applicable in home and industrial smart mobile devices and IoT. Later that month, GlobalFoundries entered into an agreement with General Motors to provide a US ‘production corridor’ for the automaker’s chip supply. And in late March, GlobalFoundries announced a joint research and workforce development initiative with the Georgia Institute of Technology, a leading public research university.

GlobalFoundries has achieved strong results in this business. The company’s revenues and earnings have shown steady increases since it went public in the fall of 2021. In the latest report for Q4 and full year 2022, the top line reached $2.1 billion, up 14% year-over-year, and exceeded estimates by more than $28 million. At the bottom line, the non-GAAP EPS was $1.44, compared to 18 cents in the prior year, and surpassed the forecast by 12 cents.

Covering this stock for JPMorgan, analyst Harlan Sur lays out a clear case for investor to go long on GFS.

“Given its differentiated technology, new business engagements, and increasing mix of LTAs, the team is benefitting from continued pricing increases even as we move into a weaker demand environment. 90% of design wins were single-sourced in 2022 and should continue to support strong pricing trends. As a result, we believe the strong gross margin trends are sustainable even as we head into a softer 1H23 demand environment and should re-accelerate in the 2H of the year as utilization/demand improves, in our view,” Sur opined.

Backing his view, Sur rates GFS an Overweight (equivalent to ‘Buy’), while his $80 price target on the stock indicates his confidence in a 23% growth potential for the coming year. (To watch Sur’s track record, click here)

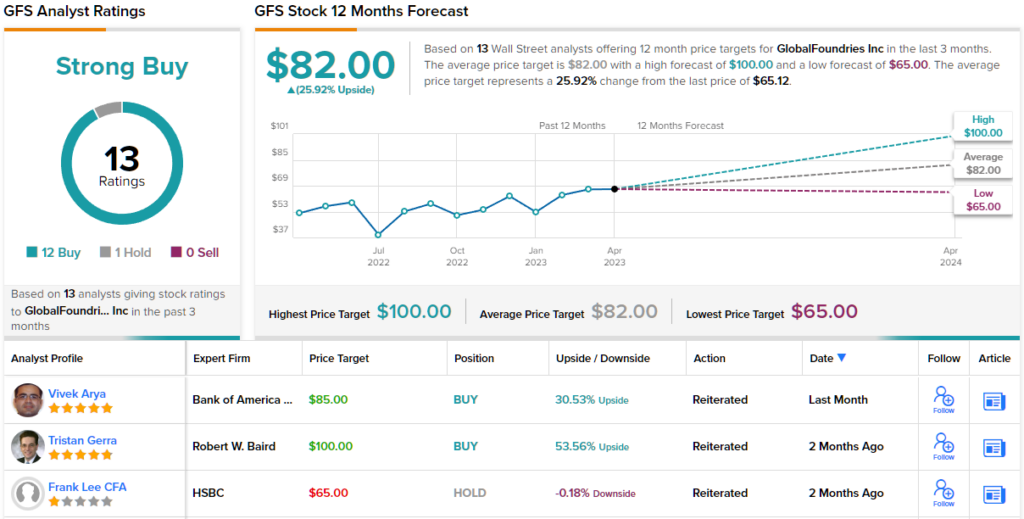

The JPMorgan view is hardly an outlier. GlobalFoundries’ stock has a Strong Buy consensus rating, based on 13 recent analyst reviews that favor Buys over Holds by 12 to 1. The stock’s $82 price target is slightly more bullish than Sur’s, suggesting a 26% one-year upside from the current trading price of $65.12. (See GFS stock forecast)

Microchip Technology (MCHP)

Next up is Microchip Technology, a major player in the chip industry with a market capitalization of $44 billion. Microchip’s product line encompasses a diverse array of memory and data chips, connectivity interfaces, power management chips, microprocessors, and microcontrollers, covering the full range of the semiconductor chip sector. The company’s chips and chipsets can be found in various applications, from the automotive and industrial sectors to aerospace manufacturing, IoT, and data centers.

Drilling down into Microchip’s product offerings, we find that in addition to high-profile applications, the company also produces chips for lower-profile, yet equally vital uses. These include MEMS oscillators and active hydrogen masers used in clock and timing devices, high-speed low-power data conversion devices, LED driver and backlighting solutions commonly found in automotive dashboards, and power over ethernet technology. In short, Microchip is at the forefront of semiconductor development and is the only major supplier consistently innovating on 8-bit, 16-bit, and 32-bit microcontroller units.

On the financial side, in February, Microchip released its results for Q3 of fiscal year 2023. The quarterly top line reached $2.17 billion, surpassing the forecast by $20 million and showing an impressive 23% year-over-year increase. The company’s non-GAAP EPS result of $1.56 was just above the forecast by 2 cents, but it was a solid 30% improvement compared to the year-ago result.

Looking forward, Microchip’s guidance has exceeded expectations. For fiscal Q4, the company predicts revenues between $2.19 billion and $2.25 billion, with an adjusted EPS in the range of $1.61 to $1.63. This surpasses the consensus estimates of $2.19 billion in revenue and $1.58 in EPS.

In the view of Harlan Sur, all of this gives Microchip plenty of staying power. He writes: “We believe many of Microchip’s MCU and FPGA products are the golden screw components (central compute, sticky software, highest dollar content) in many embedded systems, thus less susceptible to customer inventory build-up. Even in a potential slowdown in CY23, we believe the team can manage a soft landing (we model revenues increasing 9% in CY23). The team continues to drive 70%+ incremental gross margins and delivered GM and OPM upside demonstrating solid operating leverage.”

Following from this, Sur rates MCHP an Overweight (equivalent to ‘Buy’), and his price target, at $110, implies a one-year share gain of 36%.

Overall, the 20 recent analyst reviews on Microchip include 14 Buys and 6 Holds, giving the stock a Moderate Buy consensus rating. The shares are selling for $80.77 and have a $98.30 average price target, suggesting an upside of ~22% on the one-year time horizon. (See Microchip stock forecast)

Applied Materials (AMAT)

Lastly, on our list of JPM semiconductor picks, we have Applied Materials. The company is involved in designing and producing the software and equipment that enable semiconductor chip production. Their integrated circuits are used in chip design, flat panel displays, and other electronic devices.

Applied Materials reinforces its business with a significant investment in protecting its intellectual property. The company has filed more than 17,000 patents and has dedicated over $2.8 billion to product research and development. This investment has resulted in an industry-leading position and a notable 7% year-over-year increase in quarterly revenue, as reported in the latest financial report for Q1 of the 2023 fiscal year.

That top line hit $6.74 billion, beating the forecasts by over $83 million. Moreover, the company’s non-GAAP EPS of $2.02 also exceeded expectations by 12 cents.

In addition, AMAT saw a total cash from operations in the quarter of $2.27 billion, which funded a $470 million capital return policy. That total included $250 million buybacks and $220 million in dividend payments. We should note that in the last dividend declaration, on March 13, the company announced a 23% increase in the common share payment, from 26 cents per share to 32 cents. The current dividend annualizes to $1.28, but the yield is modest, at 1.1%.

JPMorgan’s Sur focuses on this firm’s strong product line in his comments, and predicts strong growth, saying, “Given Applied’s strong advanced product portfolio that will benefit from the aforementioned semi technology inflections, supported by a strong revenue/profitability foundation from its AGS (services) business, we believe the team is poised to deliver a revenue profile that grows faster than WFE over the next several years.”

Supporting his positive outlook, Sur rates AMAT as Overweight (equivalent to ‘Buy’), and sets a confident price target of $80 for the stock, implying a potential growth of 26% in the upcoming year.

This is another stock with a Moderate Buy consensus rating from the Street, based on 21 analyst reviews that break down to 16 Buys, 4 Holds, and 1 Sell. With an average price target of $135.77 and a trading price of $111.27, the stock shows a 22% one-year upside potential. (See AMT stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.