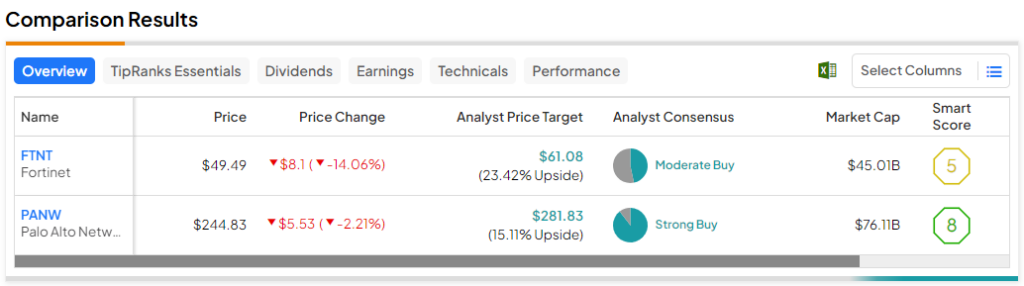

In this piece, I evaluated two cybersecurity stocks, Fortinet (NASDAQ:FTNT) and Palo Alto Networks (NASDAQ:PANW), using TipRanks’ comparison tool to determine which is better. A deeper analysis suggests the massive gap in valuations between these two companies just isn’t warranted, so a buy-the-dip opportunity may be presenting itself.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Fortinet is a cybersecurity firm that develops and sells intrusion detection systems, firewalls, endpoint security, and other security solutions. Palo Alto Networks is also a cybersecurity firm; its core product is a platform that combines advanced firewalls with cloud-based security solutions that extend those firewalls to cover other security aspects.

Shares of Fortinet are up 2% year-to-date after falling more than 20% at one point after last night’s earnings report. Meanwhile, Palo Alto Networks stock has surged 77% year-to-date.

With such a massive difference in their stock-price performances, it’s no surprise that Palo Alto Networks is trading at an incredibly huge premium to Fortinet. We’ll look at their price-to-earnings (P/E) ratios to compare their valuations to each other.

Fortinet (NASDAQ:FTNT)

At a P/E of 37, Fortinet is trading at a steep discount to Palo Alto Networks. Based on the company’s solid fundamentals, the fact that it’s been profitable for years, and its long-term stock price appreciation, a bullish view seems appropriate.

First, it’s important to realize that Fortinet shares are up 112% over the last three years and 284% over the last five years. Going even further back, the stock is up 1,343% over the last 10 years, so Fortinet is clearly a juggernaut in the cybersecurity space.

Importantly, Fortinet has generated solid profits for years, reporting net income margins of 21% over the last 12 months, 19% in 2022, and 18% in 2021. Meanwhile, the company has continued to put up attractive revenue growth over the years, including a 32% pop in 2022 and a 29% rise in 2021, following steady revenue gains of 20% each in 2019 and 2020.

Further, these revenue gains are coming on top of an already-large base of $3.3 billion in 2021 and $4.4 billion in 2022, reaching $5 billion over the last 12 months. Thus, the recent sell-off appears to have presented an attractive buying opportunity.

That sell-off was triggered by earnings-related disappointments in August and yesterday. Regarding yesterday’s report, revenue guidance was lowered slightly, although EPS guidance was actually raised. Still, this is one company that won’t be going anywhere anytime soon, and its long-term stock-price appreciation and attractive growth rates demonstrate that its stock is worth buying and holding for an extended period, even in the event of a temporary setback.

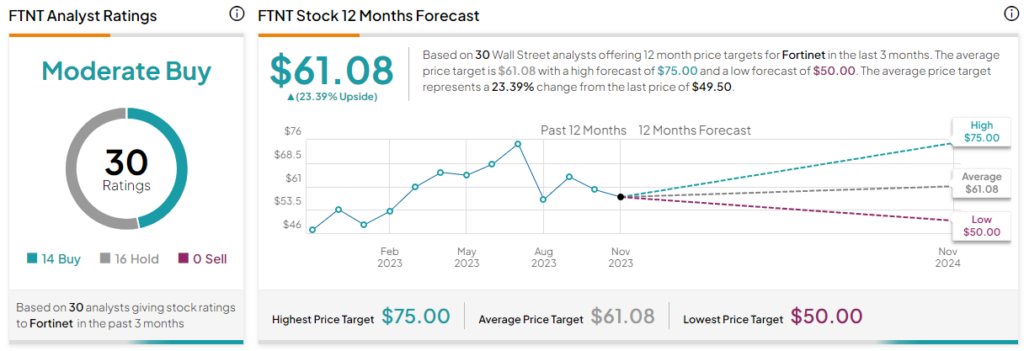

What is the Price Target for FTNT Stock?

Fortinet has a Moderate Buy consensus rating based on 18 Buys, eight Holds, and zero Sell ratings assigned over the last three months. At $73, the average Fortinet stock price target implies upside potential of 27.38%.

Palo Alto Networks (NASDAQ:PANW)

Meanwhile, Palo Alto Networks is trading at a P/E of 191, and its stock shows no sign of slowing down. Given the rapid rise in the stock, the fact that it’s trading around its 52-week high, and the meaningful number of insider sales, a bearish view looks appropriate for Palo Alto Networks — pending a better entry point.

Like Fortinet, Palo Alto Networks has put up some impressive long-term stock-price appreciation. The stock is up 222% over the last three years, 300% over the last five years, and 1,670% over the last 10 years. However, Palo Alto is trading not far from its 52-week high of $265.90, suggesting the possibility of a near-term ceiling for the stock price.

In fact, insiders have unloaded $2.1 million worth of shares in Palo Alto Networks through Informative Sell transactions over the last three months. However, that doesn’t include the significant number of uninformative Auto Sell transactions over the same time frame.

A large number of Auto Sell transactions by insiders is a red flag because when creating their preset trading plans, they can set prices at which to automatically sell shares, enabling them to avoid allegations of trading on non-public information. A large number of these transactions in a short time suggests insiders don’t expect the stock to rise much further from where it is now, which is another indication of a potential near-term ceiling for the shares.

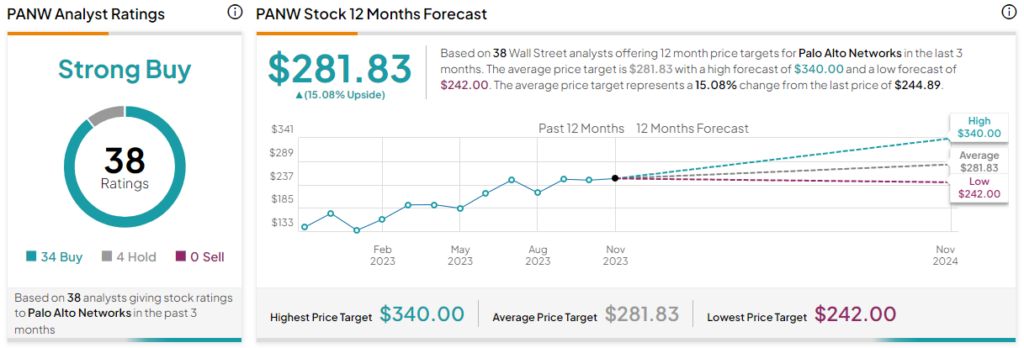

What is the Price Target for PANW Stock?

Palo Alto Networks has a Strong Buy consensus rating based on 34 Buys, four Holds, and zero Sell ratings assigned over the last three months. At $281.83, the average Palo Alto Networks stock price target implies upside potential of 15.1%.

Conclusion: Bullish on FTNT, Bearish on PANW

Importantly, the different ratings on both companies are entirely due to their valuations rather than any potential issues with either of them. It’s hard to imagine any more near-term upside in Palo Alto Networks because the stock has skyrocketed so much in a short time, and even insiders are unloading shares.

On the other hand, it looks like the sell-off in Fortinet shares could be overdone. Even if there is a temporary setback in Fortinet’s bookings, the massive valuation gap between these two companies just isn’t warranted.