Ford (NYSE:F) recently released its quarterly earnings results, and many traders decided to punish CEO Jim Farley for being honest about the company’s past mistakes. That’s unfortunate, and I am bullish on Ford stock because the iconic automaker is taking decisive action to address its problems.

It’s funny how investors can like a company but then turn around and hate it a few months later. Ford was a darling of the market in 2021, and the share price reflected Wall Street’s fervor for the company. Then, in 2022, financial traders decided they didn’t like Ford anymore.

Recently, investors and commentators have been unabashed in their aversion to Ford. For instance, Deutsche Bank analyst Emmanuel Rosner downgraded Ford stock from Hold to Sell and reduced his price target from $13 to $11. Additionally, traders pushed the Ford share price lower in the past week. Now, it’s time to consider what Ford’s critics are objecting to and whether there’s an opportunity for contrarian investors.

More Ford EVs Will Qualify for Tax Credits

Before we get to Ford’s quarterly financial data and the chief executive’s comments, we can’t ignore a major news event that’s definitely bullish for Ford stock. Specifically, the U.S. Treasury Department enacted changes that would allow more of Ford’s electric vehicles (EVs) to qualify for $7,500 tax credits.

Basically, the Treasury Department decided to lift the price caps for certain EVs to qualify for the tax incentives established by the Inflation Reduction Act. As a result, the Ford Mustang Mach-E and Escape Plug-in Hybrid EV models may now qualify for tax credits.

The retail price cap on those vehicle models has been lifted from $55,000 to $80,000. Consequently, more people might buy those Ford EVs due to the tax incentives, so this looks like a win-win scenario for the company and its customers.

Ford Posted an Earnings Miss, but Not All the News is Bad

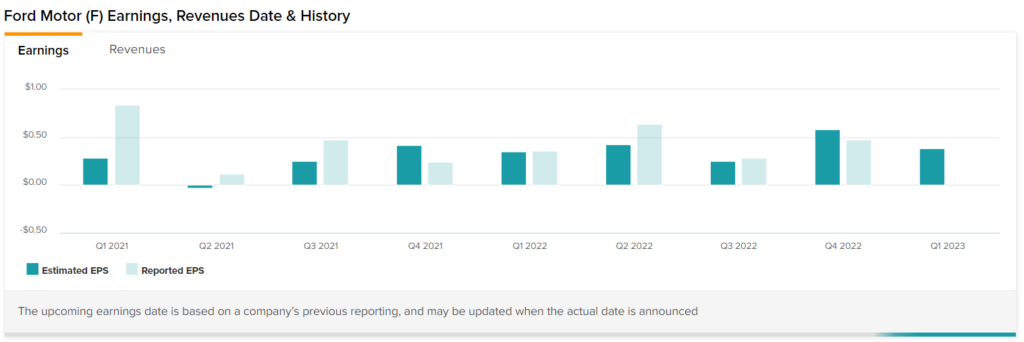

Now, for some bad news. There’s no denying that Ford posted an earnings miss for 2022’s fourth quarter. The company’s skeptics and short-sellers took advantage of this, sending Ford stock lower.

Here’s what happened. Ford reported adjusted earnings of $0.51 per share, which fell short of the consensus estimate of $0.62 per share. It’s understandable that some investors were disappointed with this result, but they should bear in mind that inflation was high during the quarter, and supply-chain disruptions were still a problem.

Besides, not all of the news was negative. Turning to the top line, Ford’s Q4-2022 revenue increased 17% to $44 billion, beating Wall Street’s forecast of $41.4 billion. Plus, income-focused investors should be glad to learn that Ford declared a first-quarter regular dividend of $0.15 per share. Currently, Ford pays a 4.5% dividend yield, which is a nice bonus for long-term shareholders.

Ford’s CEO Admits the Problems and is Ready to Address Them

Some bearish traders seem to think that Ford’s management isn’t aware of the company’s problems. Yet, it’s clear that Farley is aware of the company’s challenges and is fully prepared to deal with them.

Here’s what Farley said that bothered some investors: “We should have done much better last year…We left about $2 billion in profits on the table that were within our control, and we’re going to correct that with improved execution and performance.” It’s not every day that executives of giant companies accept responsibility for their mistakes, so Farley should be commended for this.

Furthermore, Ford is already taking action to address its financial issues. First, Ford is “monetizing” (i.e., unwinding) its share position in Rivian Automotive (NASDAQ:RIVN), which was partially responsible for Ford’s disappointing quarterly earnings result.

Second, Farley emphasized that Ford is and will continue to be “committed to disciplined capital allocation.” This is exactly what Ford’s investors should want to hear from the chief executive now. Stay tuned as further details on this may be forthcoming, perhaps in terms of workforce reductions and other cost-cutting measures.

Moreover, Ford is taking the EV revolution seriously. The company says that it is “significantly increasing” production of the Mustang Mach-E electric SUV model this year and is being proactive by reducing Mach-E prices.

Is Ford Stock a Buy, According to Analysts?

Turning to Wall Street, F stock is a Hold based on four Buys, five Holds, and two Sell ratings. The average Ford stock price target is $14.09, implying 4.8% upside potential.

Conclusion: Should You Consider Ford Stock?

Ford’s CEO isn’t ignorant of his company’s challenges. He’s aware of Ford’s past errors, and the company is taking steps to improve its bottom line in the coming quarters. So, there’s a setup for a potentially positive surprise in a few months when Ford reports its current-quarter results. Meanwhile, contrarian investors should consider Ford stock as the price is down, the dividend is intact, and Farley’s honesty is refreshing.