Ford (NYSE:F) stock once traded at $25, but now it’s near $10. A discount of this magnitude could only happen if there’s bad news. However, some of the bad news is due to an autoworkers strike that’s not meant to last forever. Consequently, I am bullish on Ford stock because the crisis situations that are creating problems for Ford will pass sooner or later.

Ford is a giant automaker with operations in Detroit, Michigan. For as long as I can remember, Ford stock has always come back to $10. That number is like a magnet for some mysterious reason.

Now, it’s happening again. Buying Ford stock at $10 is a rinse-and-repeat strategy for patient investors. Yet, today’s traders are dumping their Ford shares and behaving as if the company is toxic. In response to this, I recommend staying calm and finding out what all of the commotion is about and then considering Ford’s prospects of an eventual comeback.

Ford Finally Works Out a Deal with the Autoworkers’ Union

Did you ever imagine that the United Auto Workers (UAW) union strike would last for six weeks? Yet, that’s what happened, and there’s no denying that Ford will take a financial hit from the extended worker walkouts.

Still, the crisis seems to be coming to an end. Ford reached a tentative agreement with the UAW on Wednesday night that would end the strikes, with Ford CEO and President Jim Farley clarifying that the agreement “is subject to ratification by Ford’s UAW-represented employees.”

I expect that the employees will ratify the deal. UAW Vice President Chuck Browning touted the agreement on X (formerly known as Twitter), declaring, “We have won the most lucrative agreement for members since Walter Reuther was president” (i.e., many years ago).

Ford stock initially rose nearly 2% on the news in extended trading, but the damage to Ford’s business from the extended worker walkouts had already been done. Besides, Ford will now have to shell out more money to pay its workers. Specifically, the tentative UAW agreement allows for a 25% salary increment over the four-and-a-half-year life of the contract; workers will get an 11% jump in the first year alone.

Ford Gets Punished for Pulling Profit Guidance

Soon after Ford reached a tentative deal with the UAW, it was time for the automaker to release its third-quarter 2023 financial and operational results. Considering Ford’s ongoing challenges, an argument could be made that the company did pretty well during the quarter.

Here’s the good news. Revenue from Ford’s commercial vehicle unit, Ford Pro, grew 16% year-over-year. Meanwhile, sales of Ford Model e electric vehicles (EVs) grew by 26%. Not only that, but revenue from Ford Blue, a lineup of gas and hybrid vehicles, increased by 7%.

Overall, Ford’s quarterly sales grew by 11% year-over-year to $43.8 billion; this wasn’t too far off of the consensus estimate of around $44 billion. Turning to the company’s bottom line, Ford reported EPS of $0.39, up 30% year-over-year but below Wall Street’s call for $0.46 per share.

However, what really prompted an 11% drop in Ford stock, I believe, was that Ford suspended its full-year 2023 guidance. Ford CEO Jim Farley admitted during a conference call, “We were negatively impacted by the strike, and our cost and quality remain a drag on our business.”

Is Ford Stock a Buy, According to Analysts?

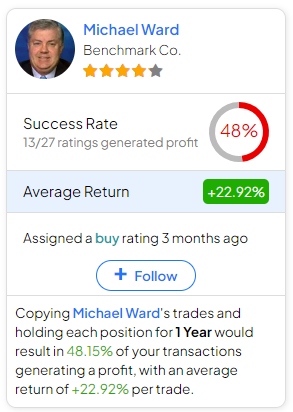

On TipRanks, F stock comes in as a Moderate Buy based on seven Buys, seven Holds, and one Sell rating assigned by analysts in the past three months. The average Ford price target is $14.43, implying 44.6% upside potential.

If you’re wondering which analyst you should follow if you want to buy and sell F stock, the most profitable analyst covering the stock (on a one-year timeframe) is Michael Ward of Benchmark Co., with an average return of 22.92% per rating. Click on the image below to learn more.

Conclusion: Should You Consider Ford Stock?

Right now, the market is expressing its consternation at Ford’s not-too-stellar results and withdrawn financial guidance. Yet, I expect the fallout from the UAW strikes, supply-chain disruptions, and other problems to diminish over time.

Today’s stock traders apparently weren’t willing to look that far down the road. However, if you’re a patient and non-panicky investor who likes to buy F stock near $10, I’d say it’s a great time to consider it.