The stock market tends to go up in an escalator, and down in an elevator. That’s how it’s supposed to work. However, for companies like Upstart Holdings (UPST), going up in an elevator can provide a very interesting experience for investors.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

I remain bullish on Upstart (though my thesis had changed somewhat at the $300+ range, given valuation concerns). Now that Upstart is back near the $200 level, it’s certainly an intriguing stock to dive into. Investors should remember that only last month, this stock hit $400 per share.

Let’s take a look at why Upstart could be a great company to consider following this impressive decline. (See Analysts’ Top Stocks on TipRanks)

A Business Model Worth Considering

There are companies looking to compete in an established industry against large players, and then there are companies looking to create their whole new sector. The latter would include Upstart.

In 2012, Upstart began as an AI platform that focused on consumer lending. This company utilizes a proprietary algorithmic process to assess the creditworthiness of borrowers. Unlike traditional credit ratings agencies which have a rather simplistic model using only a few factors, Upstart brought in a range of extraneous factors that can more accurately assess a borrower’s risk.

What this means is that borrowers that may not otherwise be approved based on their credit scores (but are otherwise credit-worthy individuals) could be extended credit. Not only this, borrowers with decent credit scores (but perhaps not as great as they should be) may be eligible for better rates from lenders.

For lenders, being able to be more aggressive with rates and increase one’s loan book is a key revenue driver. Additionally, better understanding the true risk of one’s loan portfolio has a tremendous amount of value.

Growth investors looking for truly disruptive companies have jumped on UPST stock, and rightfully so, over the past year. This is a stock that started the year around $50 per share, only to skyrocket to more than $400 per share last month.

However, since the company’s mid-October spike, Upstart has lost nearly half of its value. Currently, shares of this tech company can be had for around $210 per share.

Why’s that?

Well, Upstart’s valuation got a little aggressive. That’s putting it mildly. Currently, the company’s price-sales multiple sits at around 27. That’s extremely expensive to begin with, and to think this multiple was around 50 not so long ago, one can see why a sell-off may have been necessary.

What’s Next?

Every company is valued on the basis of its fundamentals. Right now, Upstart’s valuation still looks steep.

However, one of the things I like about Upstart is the fact that this isn’t some unprofitable company. Rather, Upstart produces earnings which have grown over time. Currently, Upstart trades at roughly 106x forward earnings.

Now, compared to the market average of around 17x earnings for most companies, that’s a high valuation. However, those bullish on Upstart’s ability to outperform the market in terms of growth for the next decade or two may consider this stock a reasonable investment at these levels.

Upstart’s price-sales multiple and price-earnings multiple highlight the rather impressive margins this business produces. Given the amount of operating leverage with Upstart’s business model, investors can certainly envision a future in which Upstart continues to not only grow its top and bottom lines, but increase its margins along the way.

In other words, the company’s profitability could grow faster than its revenue. That’s something to consider.

What are Analysts’ Saying about UPST Stock?

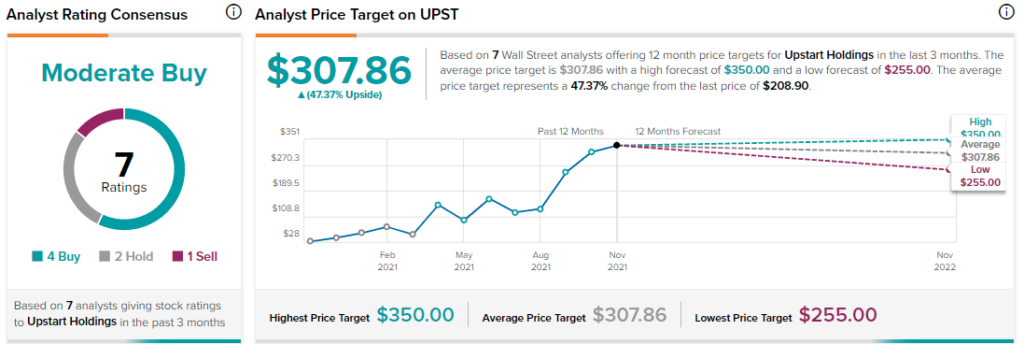

As per the TipRanks’ analysts rating consensus, Upstart Holdings is a Moderate Buy. Out of 7 analyst ratings, there are four Buy recommendations, two Hold recommendations, and one Sell recommendation.

The average Upstart price target is $307.86. Analyst price targets range from a high of $350 per share to a low of $255 per share.

Bottom Line

Given the hyper-growth market we’ve been in of late is cooling somewhat, it’s perhaps unsurprising to see UPST stock take a breather. However, investors looking for top-notch growth stocks may want to keep an eye on Upstart.

Disclosure: At the time of publication, Chris MacDonald did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >