Most advertising and marketing companies suffered in 2020 as customers reduced spending during the pandemic, but 2021 is a different story. In particular, performance-based marketing companies are on fire as investors anticipate an economic rebound as the world re-opens. Fluent, Inc. (FLNT), for example, is up 27% so far this year. Other strong performers in this industry niche include ChannelAdvisor Corporation (ECOM), Digital Media Solutions, Inc. (DMS), and QuinStreet, Inc. (QNST), all of which are up by double-digits year-to-date.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

2021 will be a particularly interesting year for digital marketing as Alphabet (GOOGL) plans to phase out third-party cookies on Chrome, the most-used internet bowser, by the end of the year. This decision follows Apple’s move to allow users to block third-party cookies on its Safari browser back in March 2020.

This is a big deal for digital advertising companies as many of them depend on cookies to collect user information. However, Fluent should not be unduly impacted by the shifting landscape. The company has amassed a large proprietary database of first-party insights and preferences by using its own digital media properties, which boast approximately 900,000 daily registrations and reach 13% of the U.S. digital population monthly.

Recent Performance

Advances in ad serving logic have resulted in higher margins in Q3’20 with year-over-year (adjusted) EBITDA growth of 167%. Expectations are for another quarter of strong growth in Q4’20.

Fluent also saw impressive year-over-year revenue growth of 21%, although this is measured against a low bar as the company struggled in 2019.

In addition to improved ad serving algorithms, Fluent has announced the launch of a new enhanced marketing platform, built on Amazon.com (AMZN) AWS. This move is expected to improve the company’s ability to scale as the market expands and navigate through a quickly evolving digital landscape.

Legal Woes

While the world of digital marketing is enjoying a rebound, not all is rosy for Fluent. The nature of the business demands that personal information be collected and exploited. Privacy laws are becoming more difficult to navigate as time goes on and digital marketing companies such as Fluent tend to push the boundaries of what is acceptable.

As a result, Fluent has several ongoing legal battles with various US governmental entities, including the New York Attorney General’s Office, Federal Communication Commission, and the Federal Trade Commission. The results of these legal disputes are unpredictable, along with the settlements, which could be substantial.

Wall Street’s Take

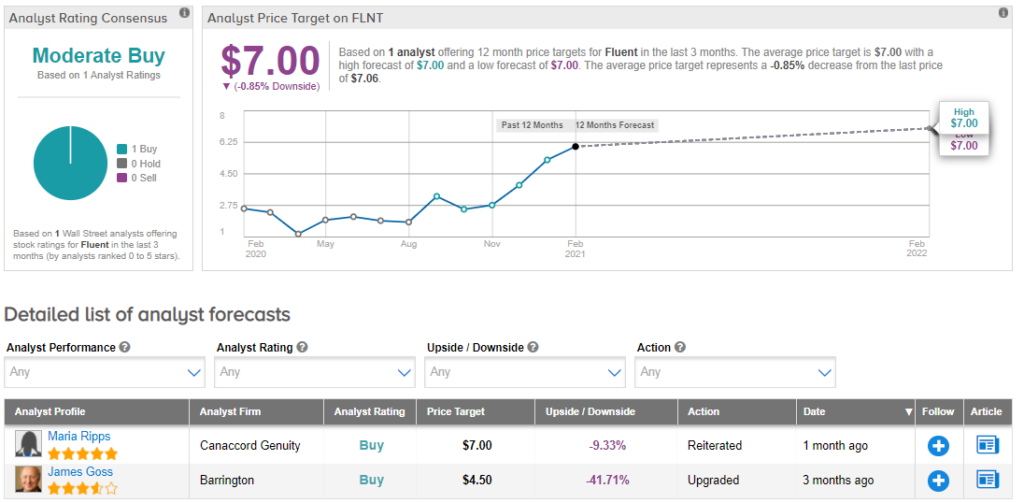

Only one analyst, Canaccord Genuity’s Maria Ripps, has thrown an opinion into the mix recently, rating the stock a Buy. Based on her $7 price target, 1% downside potential could be in store. (See Fluent stock analysis on TipRanks)

Summary and Conclusions

Fluent is an industry leader in performance-based digital marketing services for over 500 high-value advertising clients and brands. The company owns digital media properties that are used to collect first-party consumer data, providing a means for advertising clients to connect with the consumer.

The company has recently improved its ad serving logic and as a result, the company delivered a strong financial performance in Q3’20, with year-over-year revenue growth of 21% and adjusted EBITDA growth of 167%. Fluent has now launched a scalable marketing platform on AWS and is positioned for new areas of growth including international expansion and new client verticals.

According to company guidance, Fluent is expecting a strong improvement in earnings in Q4’20, with results set to be announced on March 12, 2021. Results should be tempered by ongoing legal challenges with regards to privacy laws.

Disclosure: On the date of publication, Steve Auger did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.