After the Japanese Nikkei Index quietly returned 28% in 2023, Japanese stocks could be ready for more gains in 2024, based on ongoing corporate reforms in Asia’s largest stock market and the relatively inexpensive valuation of Japanese equities. The Franklin FTSE Japan ETF (NYSEARCA:FLJP) is a great way to capitalize on Japan’s upside potential. Thanks to its diversified portfolio, attractive dividend yield, and best-in-class expense ratio, I’m bullish on this underrated ETF.

What is the FLJP ETF’s Strategy?

According to fund sponsor Franklin Templeton, FLJP “provides targeted exposure to large- and mid-sized companies in Asia’s largest stock market,” Japan. It “seeks to provide investment results that closely correspond, before fees and expenses, to the performance of the FTSE Japan Capped Index.”

The fund launched in 2017 and has $1.6 billion in assets under management (AUM).

A Wave of Positive Changes

The Nikkei’s 28% gain in 2023 was its best since 1989. A big part of the reason for this resurgence was the Tokyo Stock Exchange’s effort to address many of the factors that have held the Japanese market back over the years.

The reforms are focused on undervalued companies, particularly those that are trading below book value. The Tokyo Stock Exchange has compelled these companies to increase their earnings and valuations, and stocks can be delisted if they don’t show that they are using their capital efficiently.

These changes have management teams more focused on increasing their return on equity and should incentivize companies to stop hoarding cash and put it to work in more productive ways that are beneficial to investors, such as returns to shareholders.

This reform is already making a real impact, as a record 992 Japanese companies announced share buybacks in 2023.

Furthermore, the reforms are cutting down on the high levels of cross-shareholding (many Japanese companies hold large positions in other companies they do business with to burnish and maintain their business relationships). High levels of cross-shareholding can decrease liquidity and damage perceptions of corporate governance, so this is another positive change.

Net investment in Japanese stocks by foreign investors hit its highest level since 2013, and the Japanese market is surging. This means that companies are rewarded for making these changes, making them more likely to continue adhering to additional shareholder-friendly reforms in the year ahead. These shareholder-friendly reforms will help to unlock more value for Japanese stocks, going forward.

FLJP’s Portfolio

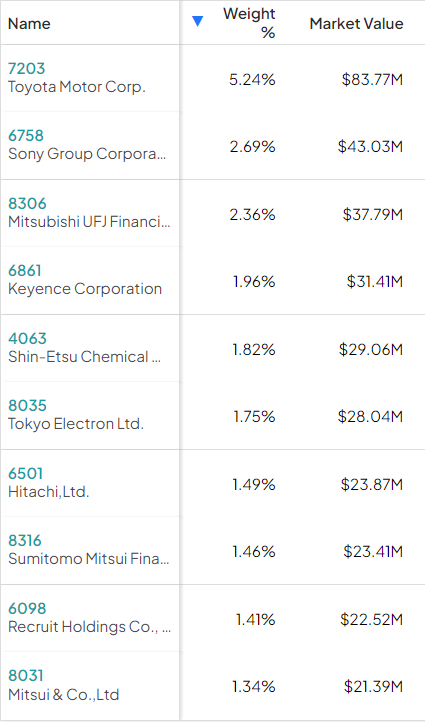

FLJP offers investors strong diversification. The fund holds 511 stocks, and its top 10 holdings account for just 21.8% of assets. Below is an overview of FLJP’s top 10 holdings from TipRanks’ holdings tool.

FLJP’s top holdings include many of Japan’s best-known companies, like Toyota (NYSE:TM), and Sony (NYSE:SONY). FLJP’s portfolio also includes many of the Japanese conglomerates that Warren Buffett famously invested in earlier this year, like Sumitomo (OTC:CMTDF), Mitsubishi (OTC:MBFJF), and Mitsui (OTC:MITSF).

Other interesting holdings include semiconductor manufacturing equipment maker Tokyo Electron (OTC:TOELY), video game pioneer Nintendo (OTC:NTDOF), and drug maker Takeda Pharmaceutical Company (NYSE:TAK).

The ETF is also well-diversified by sector. Industrials account for the largest weighting in the fund, at 22.8%. Consumer discretionary is the fund’s second-largest allocation, weighing 18.8%. Information Technology and Financials account for 13.4% and 11.9% of the fund, respectively. No other market sector has a double-digit percentage weighting.

As mentioned above, Japanese stocks are attractive because they are relatively cheap compared to their U.S. peers. The average P/E ratio for FLJP’s holdings is just 15.2 versus a much higher P/E ratio of 21.6 for the S&P 500 (SPX).

Long-Term Performance

FLJP launched in 2017, so it doesn’t have an incredibly long track record to evaluate. The fund has produced a relatively ho-hum performance, with annualized returns of 1.0% of 4.4% over the past three and five years, respectively (as of November 30th, 2023).

However, given the reforms discussed above and the momentum that Japanese stocks gained last year, it seems feasible that we are at an inflection point where future returns accelerate and improve upon these lackluster past results.

A Very Low Expense Ratio

One of the best things about FLJP is that it offers investors an extremely favorable expense ratio of just 0.09%. This expense ratio looks even better when considering that international ETFs are typically significantly more expensive than ETFs that invest in domestic equities.

This 0.09% expense ratio means an investor will pay $9 in fees on a $10,000 investment in FLJP annually. Assuming that FLJP returns 5% per year from here and maintains this low expense ratio, an investor putting $10,000 into the fund would pay just $116 in fees over the course of a 10-year investment.

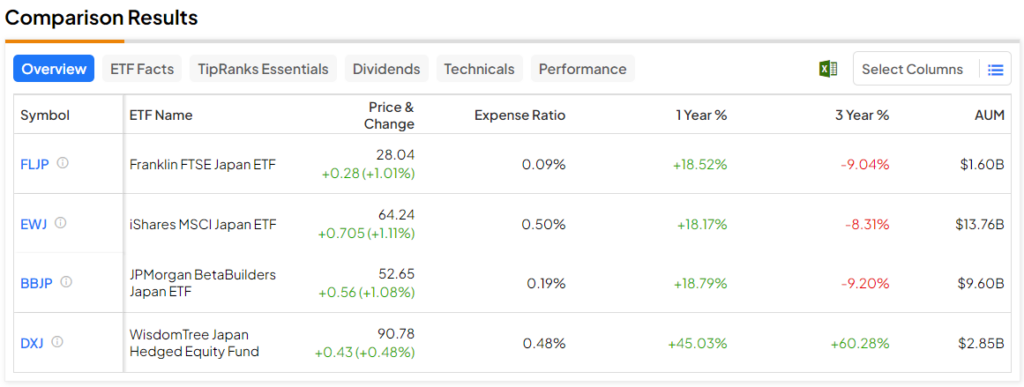

FLJP is significantly more cost-effective than other prominent Japan ETFs. For example, the iShares MSCI Japan ETF (NYSEARCA:EWJ), the largest Japan ETF with $13.8 billion in AUM, charges a much higher 0.50%, more than five times what FLJP charges.

Another popular fund, the JPMorgan BetaBuilders Japan ETF (BATS:BBJP), charges 0.19%, while the WisdomTree Japan Hedged Equity Fund (NYSEARCA:DXJ) charges 0.48%.

Below, you’ll find a comparison of FLJP and these other prominent Japan ETFs using TipRanks’ ETF Comparison Tool. This tool enables investors to compare up to 20 ETFs at a time based on various customizable data points.

Does FLJP Pay a Dividend?

FLJP further enhances its attraction to investors by sporting an attractive 3.0% dividend yield. This is double the yield of the S&P 500 and higher than that of the aforementioned iShares MSCI Japan ETF, which yields 2.0%, FLJP’s yield is on par with BBJP’s dividend yield and slightly lower than DXJ’s yield of 3.4%.

U.S. investors should note that FLJP pays this dividend semiannually, in June and December, as opposed to on a quarterly basis like most U.S. stocks and ETFs.

The Takeaway: A Great Way to Invest in Japan

Japanese stocks look like a good place to invest in 2024, thanks to the shareholder-friendly reforms taking hold in the Japanese market and the cheap valuations of Japanese stocks. FLJP is a great way to take advantage of this opportunity due to its ample diversification, solid dividend yield, and investor-friendly expense ratio.