As Bitcoin (BTC-USD) continues its sizzling 2023 rally, soaring past $40,000, and other popular cryptocurrencies surge to massive year-to-date gains, many traditional market investors are flocking to crypto ETFs to gain exposure to the space. Crypto ETFs are some of 2023’s biggest winners.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

However, many of these ETFs feature high fees and lack diversification. One smart way to gain exposure to the upside of crypto in ETF form is the Fidelity Crypto Industry & Digital Payments ETF (NASDAQ:FDIG). I’m bullish on this ETF from Fidelity, as it features plenty of exposure to a diverse variety of crypto-themed stocks and a relatively low expense ratio compared to its peers.

What is the FDIG ETF’s Strategy?

FDIG is a $53.9 million ETF from Fidelity that launched in April 2022. According to Fidelity, its strategy is to invest “at least 80% of assets in equity securities included in the Fidelity Crypto Industry & Digital Payments Index.”

The index is “designed to reflect the performance of a global universe of companies engaged in activities related to cryptocurrency, related blockchain technology, and digital payment processing.”

As a firm, Fidelity has long displayed an interest in advancing the cryptocurrency space. Fidelity runs this ETF, it applied for a spot Bitcoin ETF this summer, and its Fidelity Crypto platform allows investors to buy, hold, and sell Bitcoin and Ethereum (ETH-USD).

FDIG has raced out to a massive 116.9% year-to-date gain, as many of its top holdings have surged thanks to the crypto market’s rebound.

FDIG’s Holdings

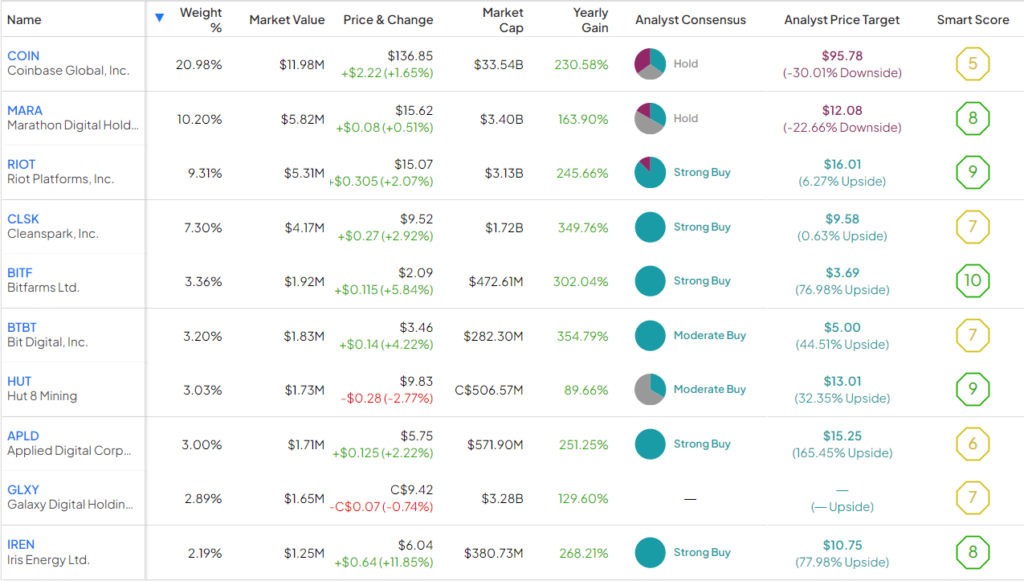

FDIG holds 37 stocks, and its top 10 holdings account for 65.5% of the fund. Below, you’ll find an overview of FDIG’s top 10 holdings using TipRanks’ holdings tool.

FDIG’s top holding is the preeminent pure-play crypto stock, Coinbase Global (NASDAQ:COIN), and it also has prominent positions in major Bitcoin miners like Marathon Digital (NASDAQ:MARA) and Riot Platforms (NASDAQ:RIOT).

Note that Coinbase accounts for 21.0% of the fund, primarily because shares of the crypto exchange have gained 307.1% year-to-date. Similarly, shares of Marathon Digital and Riot Platforms are up 358.5% and 346.0%, respectively, which has helped to drive their large weightings within the fund.

But FDIG also goes beyond the holdings usually found in the crypto ETF. It also holds stocks like Shopify (NYSE:SHOP). The e-commerce platform has increasingly waded further into crypto. It allows merchants to accept payment in cryptocurrency, facilitates the selling and minting of nonfungible tokens (NFTs), and more.

Card issuer Marqeta (NASDAQ:MQ) helps companies issue debit and credit cards that offer crypto rewards and also enables users to spend their crypto at real-world locations using its debit and credit cards.

Two more holdings, Visa (NYSE:V) and Mastercard (NYSE:MA), are two of the biggest names in traditional finance, but this hasn’t stopped them from exploring how they can increasingly leverage cryptocurrency and blockchain technology in their businesses.

This fall, Visa announced that it would use the Solana (SOL-USD) network to settle USDC (USDC-USD) stablecoin transactions. Visa believes that stablecoins like USDC can help to improve the cross-border payment process. It also has a partnership with Bitcoin rewards app Fold and has launched card programs with various crypto exchanges.

Mastercard has also become more involved in cryptocurrency, working with a variety of crypto-native companies, like crypto and NFT payments app Moonpay, and major crypto wallet providers like MetaMask and Ledger. In 2021, Mastercard acquired Ciphertrace, a crypto intelligence company, to help it improve its security and fraud detection capabilities.

Best-In-Class Expense Ratio

Additionally, FDIG is a smart way to gain crypto exposure in ETF form because of its comparatively favorable expense ratio of just 0.39%. This means that an investor putting $10,000 into FDIG will pay $39 in fees over the course of one year.

This likely isn’t the cheapest expense ratio you’ve ever seen, but it’s important to note that it is actually much cheaper than the expense ratios offered by most other crypto ETFs.

For example, the Bitwise Crypto Industry Innovators ETF (NYSEARCA:BITQ), which takes a fairly similar approach to FDIG in investing in a variety of crypto-related companies, features a much higher expense ratio of 0.85%, despite the fact that the two ETFs own many of the same stocks. This means that an investor in the much larger BITQ would pay $85 in fees in one year on a $10,000 investment.

The effect of these fees becomes more apparent over time. Assuming that each ETF returns 5% per year going forward and sticks with its current expense ratio, the aforementioned FDIG investor will pay $493 over the course of 10 years, while the investor putting the same amount into BITQ would pay an exceedingly higher $1,049 in fees.

This example illustrates the importance of picking ETFs with advantageous expense ratios.

This is just one emphatic example, but FDIG is also cheaper than other prominent crypto ETFs. These ETFs include the VanEck Digital Transformation ETF (NASDAQ:DAPP) and the Global X Blockchain ETF (NASDAQ:BKCH) (which both charge 0.50%), the iShares Blockchain and Tech ETF (NYSEARCA:IBLC) (0.47%), the First Trust Indxx Innovative Transaction & Process ETF (NASDAQ:LEGR) (0.65%), and the Grayscale Future of Finance ETF (NYSEARCA:GFOF) (0.70%).

Below, you can view a comparison of all of these crypto-themed ETFs using TipRank’s ETF Comparison Tool, which allows investors to compare up to 20 ETFs at a time based on a variety of customizable factors.

Is FDIG Stock a Buy, According to Analysts?

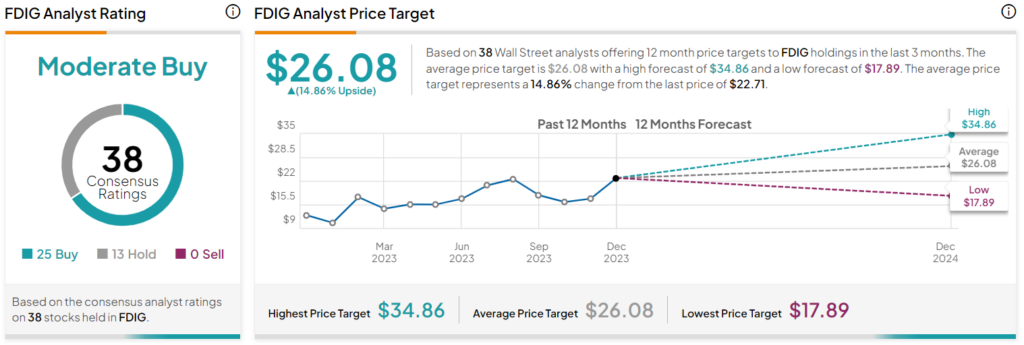

Turning to Wall Street, FDIG earns a Moderate Buy consensus rating based on 25 Buys, 13 Holds, and zero Sell ratings assigned in the past three months. The average FDIG stock price target of $26.08 implies 14.9% upside potential.

Investor Takeaway

In conclusion, the FDIG ETF offers a best-in-class expense ratio, offering investors a comparatively cheap way to gain exposure to the growth of the cryptocurrency industry in ETF form. It also offers a diverse approach to investing in the crypto industry by owning a variety of stocks involved in all different facets of it. Its holdings range from pure-play crypto investments, like Coinbase and the various Bitcoin miners, to traditional payment and fintech companies dabbling in crypto, like Visa, Mastercard, and Shopify.

For these reasons, I am bullish on FDIG as a smart and sensible way for investors to gain exposure to the space.