Fastly, Inc. (FSLY) is literally at the leading edge of an emerging technology called edge computing, which promises to significantly improve the performance of many cloud-based applications such as online gaming and augmented reality. While the concept of edge computing is fairly new, it is based on the mature technology, Content Delivery Networks (CDNs). A CDN consists of a network of hundreds or thousands of points-of-presence (PoP) spread out around the world that are used to cache static images, videos, and data, thus reducing latency and offloading the data center from repetitive tasks.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Edge computing is the next step in the evolution of CDNs. Extremely fast processors and solid-state-disks are placed in the PoPs, resulting in a significant improvement in bandwidth and cloud-based application response time.

Fastly is a pioneer in edge computing and arguably provides one of the best overall solutions. Edge computing competitors include legacy CDN providers such as Akamai Technologies (AKAM) and Cloudflare (NET), as well as large cloud platforms such as Amazon’s (AMZN) Lambda@Edge and Microsoft’s (MSFT) Azure Edge Zones.

Despite the competition, Fastly’s annual revenue increased by 45% in 2020. This is a pretty astounding performance considering that TikTok, a major customer representing more than 10% of its business, stopped using Fastly’s platform due to political events in the U.S.

Foray Into Cybersecurity

Fastly provides a best-of-breed edge computing technology, but it offers limited cybersecurity features, an area where competitors such as Akamai have an advantage.

While the Fastly network of PoPs has local Distributed Denial of Service (DDoS) protection, it does not have other capabilities such as a Web Application Firewall (WAF), which prevents hackers from injecting malicious code onto a website. However, that changed last summer with the acquisition of WAF supplier Signal Sciences. The deal will not only improve Fastly’s competitive posture, but it will also provide new opportunities for cross-selling between the edge computing and cybersecurity applications.

Is Fastly A Compelling Investment?

There is no question that Fastly is in a good position to grow into its extremely large total addressable market. Fastly should make a great long-term investment, but is now the best time to invest?

The company’s business model is consumption-based, and its recent achievement of 45% revenue growth will be difficult to match as the world emerges from the pandemic. Employees will return to work, students will go back to school, and internet traffic will likely decrease. On the other hand, next generation applications such as autonomous vehicles, virtual reality, and the Internet-of-Things (IoT) are on the horizon and may pick up the slack when it comes to internet traffic.

Another issue, though, is the high valuation that the stock commands, keeping in mind that the company is not profitable. The best financial metric for high-growth companies is the price/sales ratio, and for Fastly, it is 25. The high figure is substantiated by the annual revenue growth of 45%, but one miss-step and the stock price could fall dramatically.

Wall Street’s Take

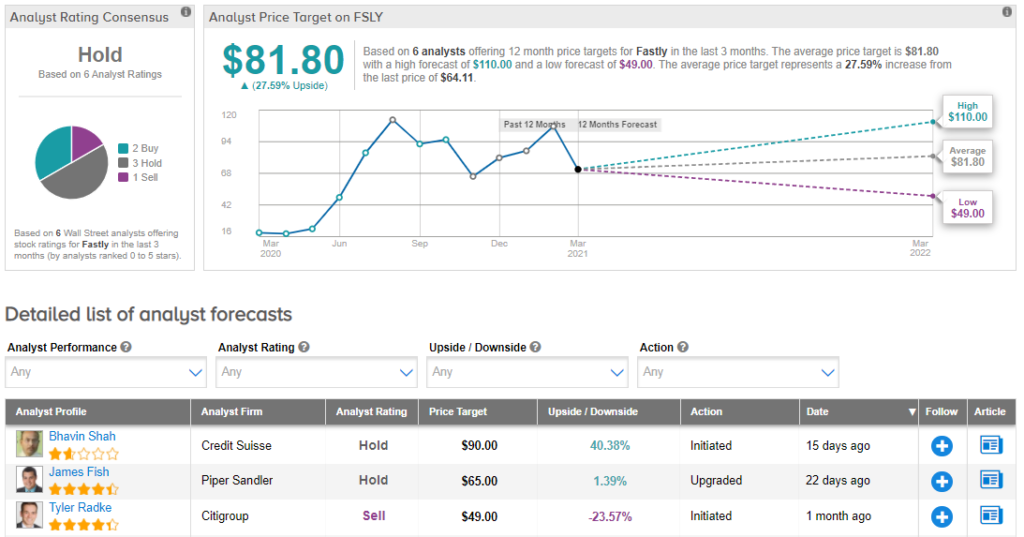

From Wall Street analysts, Fastly earns a Hold consensus rating, based on 2 Buys, 3 Holds, and 1 Sell. Additionally, the average analyst price target of $81.80 puts the upside potential at 28%. (See Fastly stock analysis on TipRanks)

Summary And Conclusions

Fastly is an industry leader in edge computing, a technology that offloads traffic from data centers and other cloud platforms, while providing significantly improved latency and bandwidth for web applications. The total addressable market is huge, and we are still in the early innings.

Fastly is capturing market share with its strategy and this is evident from its recent financial performance. That said, while promising, investors need to be aware that Fastly might have trouble matching recent performance as the world emerges from the pandemic. The share price is also quite frothy, par for the course for high-growth companies. Expectations are high and if the company does not maintain its 40%-plus growth, the price may fall.

Disclosure: On the date of publication, Steve Auger did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.