Farfetch (NYSE:FTCH) stock is gaining steam ahead of its Q3 earnings announcement. Shares of this online retail platform for luxury fashion have gained over 24% in one week, primarily due to the easing of inflation. Moreover, the resiliency of luxury brands amid the economic slowdown is a positive. Further, TipRanks’ Website Traffic screener shows a slight sequential improvement. However, the weakness in China, the exit from Russia, and currency headwinds could remain a drag and stall the pace of recovery.

Let’s Dig Deeper

Farfetch will announce its Q3 financials on November 17. Analysts expect the company to continue to report a loss. The Street’s consensus estimate stands at a loss of $0.21 a share, which is higher than the prior-year quarter’s loss of $0.14 a share. The widening of the losses reflects the impact of adverse currency movements.

As for the top line, our Website Traffic tool shows that the number of visits to farfetch.com and its two other websites (harrods.com and off-white.com) increased slightly by about 2.7% sequentially in Q3.

Improvements in traffic and higher full-price sales will support its revenue growth. However, currency headwinds, challenges in China, and the closure of its Russian operations could remain a drag. Learn more about FTCH’s financials here.

While the company faces near-term challenges, its growth is expected to accelerate in 2023, which could drive its stock price higher. FTCH’s CEO, Jose Neves, is bullish for 2023 and expects to benefit from the large deals signed this year with Neiman Marcus, Reebok, and Salvatore Ferragamo. Furthermore, an expected recovery in China will act as a tailwind.

Is FTCH Stock a Buy?

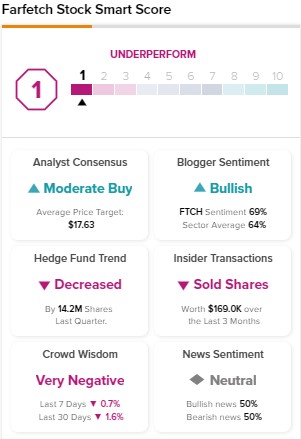

Analysts are cautiously optimistic about its prospects. It has received six Buy and one Hold recommendations for a Moderate Buy consensus rating. Moreover, due to the correction, the analysts’ price target of $17.63 implies 71.8% upside potential.

Bottom Line

Despite the recent recovery in price, FTCH stock is down about 70% year-to-date and is trading cheap (at a price-to-sales multiple of 1.97). While its low valuation and expected reacceleration in growth in 2023 point to a recovery in stock, FTCH has negative signals from hedge funds (find out which stock the biggest hedge fund managers are buying right now) and insiders who sold its stock last quarter. Overall, FTCH stock scores one out of 10 on TipRanks’ Smart Scoring system, implying a weak outlook.