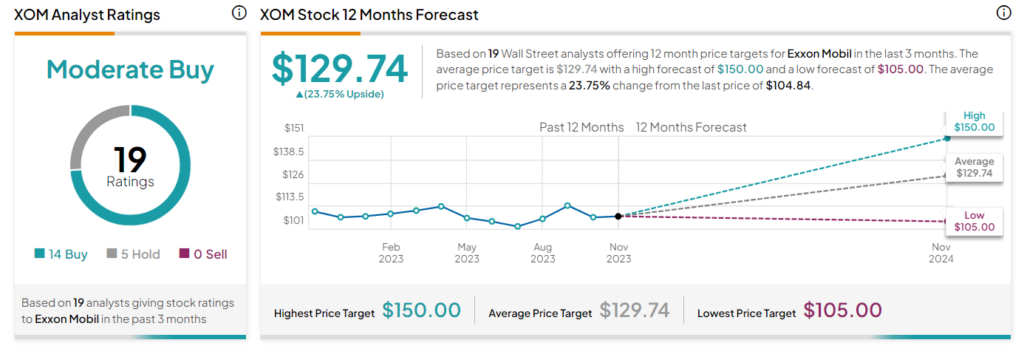

ExxonMobil (NYSE:XOM) has built a strong reputation as a dividend powerhouse within the energy sector. The company is referred to as a Dividend Aristocrat stock (companies that have increased their dividends for over 25 consecutive years). XOM’s uninterrupted streak of increasing dividend payments for the past 40 years highlights its reliability as an income-generating investment. In addition to this, Wall Street analysts see an upside potential of more than 20% in the stock’s price over the next 12 months.

Here’s What Makes XOM Stock Attractive

It is well known that the energy sector is highly cyclical, as commodity prices keep fluctuating, influenced by supply and demand forces. Nevertheless, XOM has diversified business offerings that help provide stability and support consistent cash flows.

Furthermore, ExxonMobil recently bolstered its productivity in the lucrative Permian basin with the acquisition of Pioneer Natural Resources (PXD). This deal would give Exxon a leading position in the Permian Basin, where the company has already made considerable investments.

Interestingly, the company recently announced plans to enter the lithium market. ExxonMobil is expected to commence lithium production in 2027 and projects to supply lithium for more than 1 million electric vehicles (EVs) annually by 2030. It is worth mentioning that the market demand for lithium continues to rise as it is a key component in EV batteries.

What is the Future Price of XOM?

Overall, the Street has a Moderate Buy consensus rating on ExxonMobil based on 14 Buys and five Holds. The average XOM price target of $129.74 implies a 23.8% potential upside from the current level.

Ending Thoughts

With XOM’s reliable dividend history and promising growth prospects, the company seems to be an appealing choice for income-focused investors seeking stability and long-term value within the energy sector.