French stocks are inexpensive and collectively pay some attractive dividends. Now, they could also have a potential catalyst in the form of France’s ongoing elections.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

French politics received a major shakeup based on the results of this weekend’s legislative elections, and the atmosphere of change could benefit the French stock market and the iShares MSCI France ETF (NYSEARCA:EWQ).

I’m bullish on EWQ based on its diversified portfolio of inexpensively-priced French equities (which has a very different composition than the U.S.’s S&P 500 (SPX)), its 3.0% dividend yield, and the potential of France’s election to give the market a jolt. Additionally, Wall Street analysts see significant potential upside ahead for this France-focused ETF.

What Is the EWQ ETF’s Strategy?

EWQ ETF has been around since 1996 and has $620.5 million in assets under management (AUM). According to iShares, EWQ gives investors “exposure to large and mid-sized companies in France” by investing in an index of French equities.

EWQ’s Portfolio: Quite Different Than the S&P 500

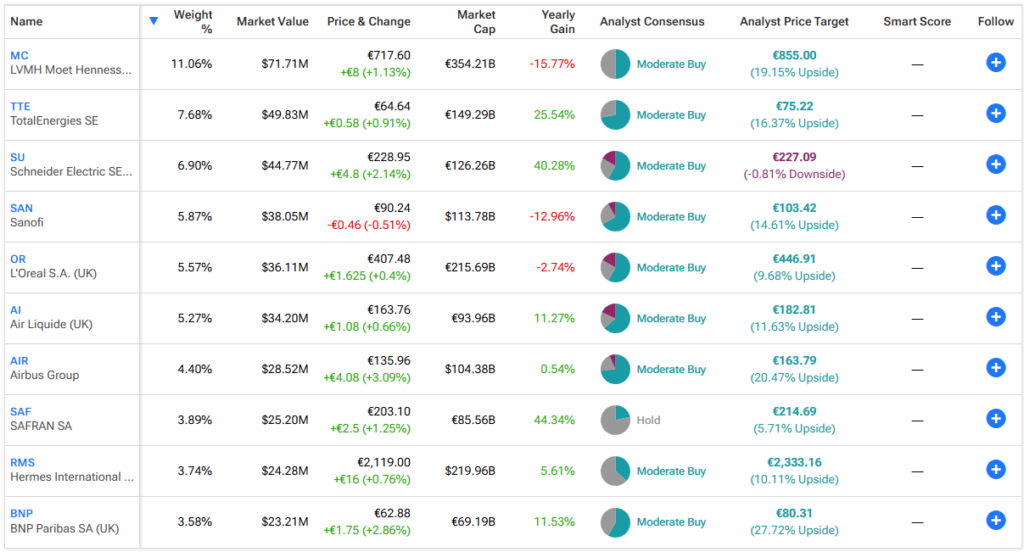

EWQ holds 61 stocks, and its top 10 holdings account for 58.1% of the fund. Below, you’ll find an overview of EWQ’s top 10 holdings from TipRanks’ holdings tool.

Unlike the top of the U.S.’s S&P 500, which is largely the purview of mega-cap technology stocks, the makeup of France’s top companies is quite different. Within EWQ’s top holdings, you’ll find luxury holdings like LVMH Moet Hennessey (OTC:LVMUY) (the fund’s largest position, with a weighting of 11.1%) and Hermes International (OTC:HESAF). You’ll also find major industrials like Airbus Group (OTC:EADSF) and Schneider Electric (OTC:SBGSY), as well as TotalEnergies (NYSE:TTE), one of the world’s largest oil stocks.

Indeed, the EWQ ETF is well-diversified across sectors. Its largest exposure is to Industrials (with a weighting of 25.0%), followed by Consumer Discretionary (19.8% weighting) and Healthcare (10.4% weighting). No other sector accounts for a double-digit weighting within the fund.

Technology has just a minuscule 4.5% weighting, which stands in stark contrast to the Technology sector’s 30.6% weighting within the S&P 500, giving EWQ quite a different look than that of U.S. markets. For investors looking to diversify away from tech-centric U.S. indices, EWQ is an intriguing option.

French stocks are also appealing because they are significantly cheaper than their U.S. counterparts. The S&P 500 currently trades well above its historical average, at 24.1 times earnings, whereas EWQ’s holdings trade at a considerably more modest valuation of 16.6 times earnings.

Decent Dividend

French equities are cheaper than U.S. stocks, and they also feature a better yield. EWQ sports a dividend yield of 3.0%, which is more than double the S&P 500’s yield of 1.3%. EWQ is also a reliable dividend ETF, as it has paid dividends for 18 consecutive years.

French Election Results Mean a Shakeup Could be in Store

As you can see, French stocks are cheap and feature a solid dividend yield. And they may also benefit from the results of France’s ongoing legislative elections.

France just held first-round legislative elections, and the results are widely viewed as a major rebuke to France’s current leader, Emmanuel Macron and his Renaissance Party.

The right-leaning National Rally, led by Marine Le Pen and Jordan Bardella, led with 33% of the vote, while a coalition of further left-leaning parties also topped the incumbent party with 28% of the vote. Macron’s party came in third with just 20% of the vote, so the results can be seen as an emphatic rejection of the status quo.

The French market had been falling after Macron called for snap elections (for example, EWQ is down 8.7% over the past month), but this seems to have been an overreaction. French stocks responded positively to the actual results, and the country’s CAC 40 Index rallied as much as 3% on Monday, July 1, the day after the elections.

Some of this rally may be a favorable reaction to the potential gridlock resulting from such split results, and some of it can likely be attributed to investor optimism over the National Rally’s strong showing. The party has numerous platforms that would likely behoove the French economy and stock market, including lowering the personal income tax and decreasing the VAT tax on electricity and fuel. Plus, the right-leaning party would likely be eager to roll out the welcome mat for large corporations.

Furthermore, there is also probably some degree of relief among investors that the far-left coalition didn’t win, as they would potentially usher in economic policies unfavorable to the market.

If nothing else, recent times have shown that unexpected wins by outsider candidates who challenge the status quo can positively impact markets. Think back to Donald Trump’s surprise 2016 win in the U.S. presidential election, which caused U.S. markets to rally, or more recently, Javier Milei’s “shock” 2023 win in Argentina’s presidential election, which has driven Argentina’s market higher over the past few months.

It should be noted that this is just the first round of legislative elections for France, and the next round will occur on Sunday, July 7, so nothing is in stone. That said, the results show that change is likely coming, in one way or another, which could invigorate the country’s stock market.

Expense Ratio: Not Cheap, But Not Out of Line

EWQ’s expense ratio of 0.5% is on the higher side. This means that an investor allocating $10,000 into the fund will pay $50 in fees annually. However, international ETFs are typically more expensive than U.S. index ETFs, so this fee is not really out of line.

Is EWQ Stock a Buy, According to Analysts?

Turning to Wall Street, EWQ earns a Moderate Buy consensus rating based on 46 Buys, 16 Holds, and zero Sell ratings assigned in the past three months. The average EWQ stock price target of $44.89 implies 14.9% upside potential from current levels.

Looking Ahead

I’m bullish on EWQ based on its portfolio of inexpensive stocks, which are diversified across sectors and considerably cheaper than their U.S. peers, as well as its attractive 3.0% dividend yield. Furthermore, the prospects of major changes to France’s government could be an additional catalyst for the ETF, going forward.