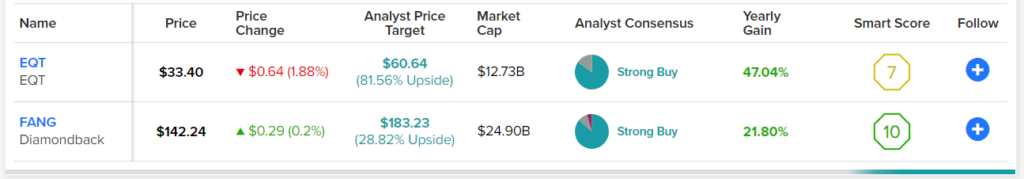

Energy stocks were the big winners in 2022, but there’s no consensus on what to expect from the sector in 2023. In this piece, I compared two energy stocks to determine which is better. EQT Corp. (NYSE:EQT) and Diamondback Energy (NASDAQ:FANG) are both up over the last 12 months, although EQT has skyrocketed by 47%, while Diamondback has “only” gained 21.8%. Energy stocks were among the few winners in 2022, and both companies are up so far in 2023.

Don't Miss out on Research Tools:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

However, such a large disparity in 12-month performance from two companies in the same sector bears closer analysis. A key difference is that EQT is more of a play on natural gas, while Diamondback focuses more on oil.

EQT Corp. (EQT)

EQT is the largest natural gas producer in the U.S. On one hand, EQT shares are hovering around oversold territory, which could signal more upside in the near term. However, warmer-than-usual temperatures in the U.S. and Europe have restrained demand for natural gas. Thus, a neutral view looks appropriate for EQT, at least for now.

The Energy Information Association boosted its forecast for natural gas production in the U.S. to 100.4 bcf/d (billion cubic feet per day) in 2023, up from 99.7 bcf/d a month ago. The organization expects Henry Hub spot prices to average $6/MMBtu (metric million British thermal unit) during the first quarter, a slight increase from November’s average of about $5.50.

However, the EIA also expects natural gas prices to start declining after January as storage levels in the U.S. approach their five-year average. The organization cites rising natural gas production as a key reason for falling prices. Mild winter weather may also restrain natural gas prices if it continues.

Setting the natural gas outlook aside, EQT has a lot of things going for it. The company’s new management wasted no time getting to work by cutting costs and paying off debt. EQT has also made some promising acquisitions and achieved an investment-grade rating for its debt, cutting its borrowing costs.

The company’s revenue jumped from $6.8 billion in 2021 to $12.4 billion on a trailing-12-months basis. EQT also returned to profitability, generating $1.9 billion in net income for the last 12 months, and it generated $2.18 billion in free cash flow. That’s a remarkable turnaround from 2021, when EQT generated only $607 million in free cash flow, and 2020, when it generated $495.5 million.

EQT’s fate hangs on natural gas pricing. If prices bounce back, EQT could be an attractive choice.

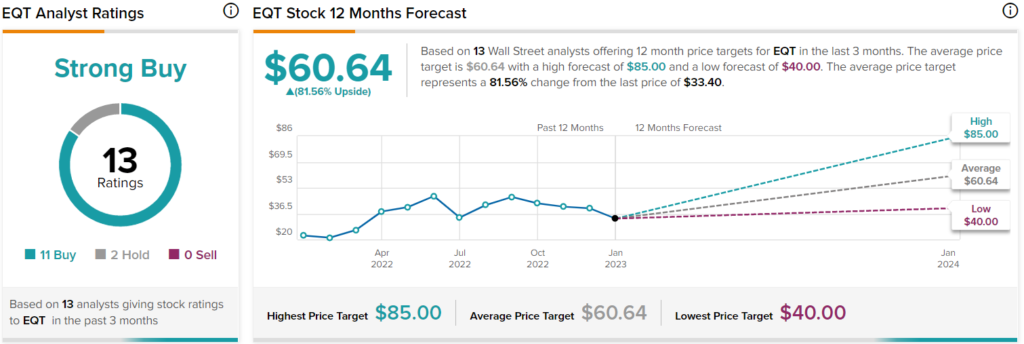

What is the Price Target for EQT Stock?

EQT Corp. has a Strong Buy consensus rating based on 11 Buys, two Holds, and zero Sell ratings assigned over the last three months. At $60.64, the average price target for EQT implies upside potential of 81.6%.

Diamondback Energy (FANG)

Diamondback Energy’s fate lies more in oil than natural gas, which gives it a leg up versus EQT as the sleeping giant China begins to reawaken. Diamondback’s fundamentals also look more attractive, suggesting a bullish view might be appropriate.

As the world’s largest oil importer, China will increase global demand for oil significantly as its economy reopens. On the one hand, China is one of the world’s few remaining importers of Russian oil, but on the other hand, its reopening will be quite bullish for oil demand. S&P Global’s (NYSE:SPGI) base case calls for $90/barrel oil in 2023 – or over $120/barrel if China reopens fully.

Oil pricing trends aside, Diamondback Energy simply looks better than EQT fundamentally. Diamondback is much more profitable than EQT, generating nearly $4.4 billion in net income on $9.6 billion in revenue for the last 12 months. Diamondback is also generating lots of cash: $3.2 billion in free cash flow for the last 12 months.

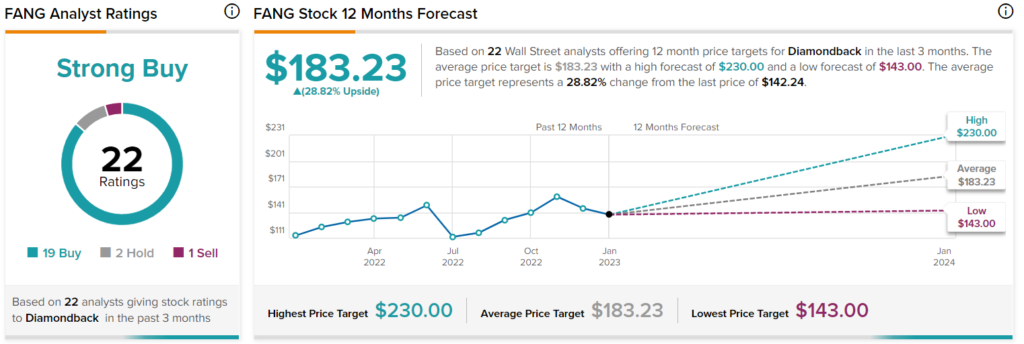

What is the Price Target for FANG Stock?

Diamondback Energy has a Strong Buy consensus rating based on 19 Buys, two Holds, and one Sell rating assigned over the last three months. At $183.23, the average price target for Diamondback Energy implies upside potential of 28.8%.

Conclusion: Neutral on EQT, Bullish on FANG

EQT and Diamondback both look like attractive energy plays, but for now, pricing trends favor oil, giving Diamondback a boost. Other tidbits add to its attraction versus EQT. For example, hedge funds boosted their holdings in Diamond Energy, scooping up 1.2 million additional shares while dumping 1.8 million shares of EQT in the last quarter. Diamondback also has a slightly better dividend yield at 2.1% versus EQT’s yield of 1.8%.

However, a global recession, especially a severe one, could weigh on both companies.