In my endeavor to pinpoint the most promising income plays in the oil & gas midstream industry, Enterprise Products Partners L.P. (NYSE:EPD) has distinctively stood out among its peers.

The partnership’s advantageous features, including a tremendous asset base and experienced management team, coupled with its unparalleled distribution growth track record and low-volatility attributes, make Enterprise Products’ investment case compelling. Accordingly, I am bullish on the stock.

What Differentiates Enterprise Products Partners?

Enterprise Products stands out amongst its oil & gas midstream peers for a number of reasons summarized below.

1. A Critical Asset Base

Enterprise Products’ enormous core asset base consists of about 50,000 miles of natural gas, natural gas liquids, crude oil, and refined product pipelines. The partnership also owns 24 natural gas processing facilities, 18 fractionators, seven splitters, 11 condensate distillation facilities, and 20 deepwater docks that handle NGLs, petrochemicals, crude oil, and refined products, among other mission-critical assets.

The commodities that Enterprise Products handles and transports are essential for the world to run every day. Further, given that the partnership’s midstream asset base is the second-largest in North America — only behind Enbridge (NYSE:ENB) — Enterprise Products is an irreplaceable player in the industry.

2. Dependable, Growing Cash Flows

Due to Enterprise Products’ association with commodities, some investors mistakenly think that the company’s revenues and profits tend to fluctuate wildly along with the underlying commodity prices. However, this is hardly the case. Enterprise Products has a history of signing long-term contracts with its customers, including producers, refiners, and petrochemical companies.

These contracts typically require the customer to use Enterprise Products’ pipelines, terminals, or storage facilities for a specified period and at a fixed or variable fee per unit of product transported or stored. The contracts can also include minimum volume commitments, which require the customer to transport or store a certain amount of product over the life of the contract.

As a result, the partnership’s results tend to be significantly less correlated to commodity prices over time. To illustrate this, Enterprise Products’ EBITDA was $4.85 billion in 2015 and $4.82 billion in 2016, despite the energy crisis at the time.

Further, the partnership’s EBITDA has grown at a compound annual growth rate of 7.6% over the past decade, demonstrating the growing demand for transporting commodities. Remember, the world constantly demands higher energy volumes despite the prices of each underlying commodity.

3. Unparalleled Distribution-Growth Track Record

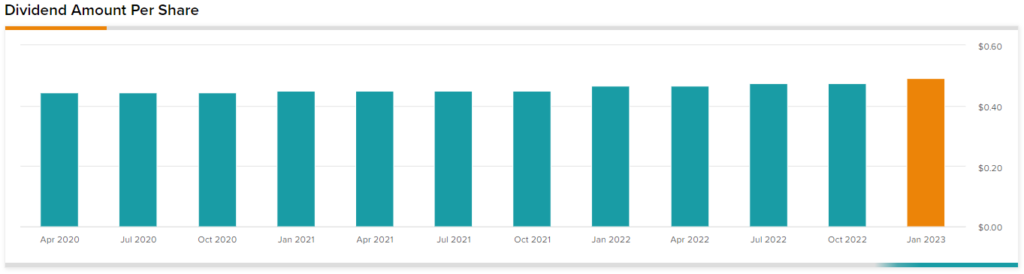

Enterprise Products’ distribution-growth track record is truly unparalleled. (I refer to dividends as distributions because Enterprise Products is a partnership, not a corporation). Specifically, the partnership boasts the lengthiest period of consecutive annual distribution increases among its American midstream peers, numbering 24 successive years.

The ability to continue increasing distributions through such a prolonged period is due to Enterprise Products’ critical asset base and long-term contracts, as mentioned previously, which shield its cash flows against short-term headwinds, allowing management to plan for the long term.

Units of Enterprise Products are currently yielding a hefty 7.4%, while distributions are very well covered. In FY2022, the partnership generated distributable cash flow (DCF) of $7.8 billion, up 17% year-over-year.

On a per-unit basis, DCF equaled $3.52, which implies a safe payout ratio of 55.6% based on the current distribution run rate of $1.96 per unit per annum.

Enterprise Products’ rich yield, comfortable payout ratio, and remarkable track record of growing distributions do not just set it apart from its industry peers. Coupled with the partnership’s unique characteristics mentioned earlier, they also form a compelling investment case for income-oriented investors.

4. Low-Volatility Returns

Enterprise Products is considered to be a low-volatility stock because all the points discussed contribute to a concrete investment case. Investors can relatively accurately assess the stock’s future total return profile. This is unlike many of its peers, whose asset bases generate more volatile results, causing their shares and units to fluctuate considerably. Over the years, the partnership’s stock has remained relatively stable.

This is mirrored in the stock’s beta, which has historically averaged below 1.0, illustrating that Enterprise Products’ financial performance is significantly less correlated to that of the overall market. Given the high uncertainty in the ongoing environment, this is another reason Enterprise Products stands out among its less predictable peers.

Is EPD Stock a Buy, According to Analysts?

Regarding Wall Street’s view on EPD, the stock has a Strong Buy consensus rating based on 10 unanimous Buys assigned in the past three months. At $31.80, the average EPD stock forecast implies 20.55% upside potential.

The Takeaway

Enterprise Products features a tremendous asset base, which along with the partnership’s ability to secure these assets under long-term contracts, has resulted in robust results over the years. This has allowed management to reward its unitholders with growing distributions for nearly 2.5 decades, along with forming a low-volatility investment case.

These factors, combined with Enterprise Products’ hefty distribution yield and well-covered payouts, which should enable further distribution growth, suggest the stock could serve investors well moving forward – especially those seeking high-yielding stocks with low-volatility attributes.