Eli Lilly (NYSE:LLY) is a leading healthcare business that went on a tear last year in the stock market. Despite the company’s growth slowdown in the past year, the stock gained ~32% while the S&P 500 (SPX) languished in the red.

Investors are excited about what the future holds for the biotech firm, especially concerning its eye-catching pipeline. The company is rejuvenating its stellar lineup of medicines, which could effectively drive revenue and profitability growth for the foreseeable future. Therefore, we are bullish on LLY stock.

Eli Lilly’s share price appreciation is nothing short of impressive in a largely bearish market. However, its valuation, which comfortably exceeds the $300 billion mark at this time, comes into question. The question is, how far can its stock price go from here?

Well, according to analysts, LLY stock still has plenty of room to grow beyond its current market capitalization, as we’ll discuss below.

As discussed above, it all boils down to the firm’s long-term growth catalysts. There’s a solid reason to continue having faith in the company’s bull case, despite the so-so quarterly reports it’s dished out lately.

Adding to the bull case is LLY’s 8 out of 10 Smart Score, which implies that the stock can outperform the broader market from here.

A Blockbuster Pipeline

2023 could be a busy year for Eli Lilly, with multiple growth catalysts that could bolster its fundamentals and share performance. The company plans to launch four new products this year, including its dementia treatment called donanemab and other drugs covering ulcerative colitis, atopic dermatitis, and chronic lymphocytic leukemia.

Last year, it got its diabetes medicine Mounjaro approved, which promises to be mighty successful for a sustained period. The drug generated more than $480 million in revenues last year, which is an impressive feat, considering it got green-lit in mid-May. Drug sales could continue growing rapidly and potentially reverse course for the firm’s top-line growth.

On the flip side, donanemab failed to win approval from the U.S. Food and Drug Administration. Nevertheless, it still has a good shot at earning traditional approval. It’s currently running a phase 3 study for the drug, which could potentially clear out a pathway for traditional approval, with results slated for the second quarter of this year.

An Encouraging Outlook

Eli Lilly recently came out with its fourth-quarter results, where sales fell by 8.8% year-over-year. Naturally, the slowdown in sales from its coronavirus treatments, the negative foreign exchange impact, and the loss in the exclusivity of its oncology drug Alimta was to blame for the firm’s lackluster performance. However, despite the headwinds, the company expects sales to rise by a hefty margin this year.

Management expects 2023 revenue to land between $30.3 billion to $30.8 billion compared to the $30.6 billion consensus estimate and the $28.54 billion of revenue seen in 2022. Moreover, it adjusted its earnings-per-share forecast to $8.35 to $8.55, significantly ahead of the $8.31 consensus.

According to LLY’s CEO David Ricks, “2023 is an inflection point for Lilly – a chance to expand our impact on patients and growth potential as an R&D-driven biopharma company.”

Furthermore, the development bodes amazingly for income investors banking on a major dividend increase in 2023. Last year, the firm announced a 15% bump in payouts, making it the 9th straight year where it increased its payouts.

Is LLY Stock a Buy, According to Analysts?

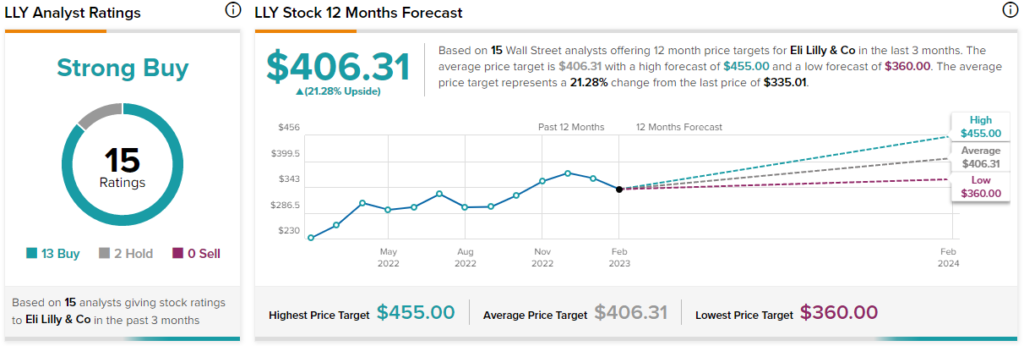

Turning to Wall Street, LLY stock maintains a Strong Buy consensus rating. Out of 15 total analyst ratings, 13 Buys, two Holds, and zero Sell ratings were assigned over three months.

The average LLY stock price target is $406.31, implying 21.3% upside potential. Analyst price targets range from a low of $360 per share to a high of $455 per share.

The Takeaway

Investing in expensive stocks like Eli Lilly (with a 50x P/E ratio) can be intimidating for some, but it is important to remember that sometimes investors must pay up for long-term growth potential.

Certainly, any investor should carefully monitor a company’s earnings multiple to get the most out of their investment. However, it’s important to consider that LLY can generate large amounts of revenue over time, thereby increasing its profits and causing the stock to become more affordable on an earnings basis.