Updated on 12/22/2022

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Duolingo (DUOL) has consistently been one of the most popular education apps, with a large and engaged user base that peaked at 56 million monthly active users. Despite a recent drop in its stock price, Duolingo has demonstrated strong financial performance, with impressive revenues and a history of exceeding sales estimates. This has caught the attention of hedge funds looking to invest in the company.

However, like any company, Duolingo has its own set of risk factors that investors should consider before making a decision. This article will cover Duolingo’s background, its financial performance, insider trading activity, and potential risk factors in order to provide a comprehensive overview of the company for potential investors.

A Brief History of Duolingo: From Language Learning Startup to Global Education Leader

Duolingo is a language learning platform that offers a variety of language courses for users to choose from. The platform uses a gamified approach to language learning, making it fun and engaging for users of all ages. Duolingo offers courses in over 30 languages, including popular ones like Spanish, French, and German, as well as less commonly taught languages like Irish and Esperanto. The platform also offers language-learning resources such as vocabulary lists and grammar lessons.

In addition to its language learning courses, Duolingo offers language certification exams and tools for educators to use in the classroom. Overall, Duolingo aims to make language learning accessible and enjoyable for people around the world.

Duolingo’s Financial Performance

Duolingo has seen a significant increase in its revenue, with sales in the third quarter of 2022 reaching $95M, a significant improvement from its $73M in sales in the fourth quarter of 2021.

The demand for Duolingo’s language learning products and services, along with the company’s successful sales and marketing strategies, may be contributing to this growth. It is also possible that there has been a general increase in demand for language learning resources, which has benefited Duolingo.

Moreover, in comparison to the rest of the tech industry, which has only beaten its sales estimates 66% of the time, Duolingo has consistently exceeded its sales estimates, beating them 100% of the time in last 4 quarters, indicating strong overall performance and a tendency to outperform its competitors in terms of revenue growth.

Duolingo has a market capitalization of $2.89 billion and a Price to Earnings ratio of -45.1. Its negative P/E ratio indicates that the company is currently not generating profits. This could be due to a variety of factors, including investments in research and development or other expenses that have not yet resulted in income.

It’s also significant to note that Duolingo stock has experienced a significant drop in the past year, falling by 30%. This can be attributed to two main factors. First, the overall stock market has experienced significant volatility, leading to declines in many stocks. Secondly, Duolingo, like many other tech stocks that went public during the COVID lockdowns, was likely overvalued, contributing to the decline in its stock price.

Insider Trading and Hedge Fund Interest in Duolingo: What Does it Mean for Investors?

According to recent reports, Duolingo’s 10% owner, Durable Capital Partners LP, has been actively engaged in insider trading. Specifically, the firm has completed three informative Buy transactions in the amount of $19 million in the past week. This could be seen as a vote of confidence in the company’s future performance.

Also, Ray Dalio, the founder and co-chief investment officer of Bridgewater Associates, LP, and Richard Driehaus of Driehaus Capital Management LLC have both recently increased their holdings in Duolingo. Dalio is known for his success as a hedge fund manager and investor, and his firm, Bridgewater Associates, is one of the largest and most successful hedge funds in the world. Driehaus is also a well-respected investor and the founder of Driehaus Capital Management LLC. Their increased investments in Duolingo suggest confidence in the company’s future performance and potential for growth.

Is Duolingo a Good Buy Now?

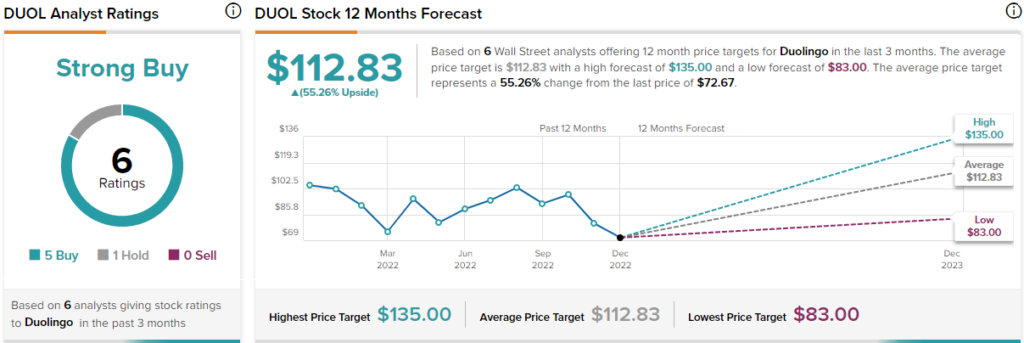

Based on TipRanks’ analysts rating, Duolingo is currently a Strong Buy, with 5 Buy ratings and 1 Hold rating. The average price target among analysts is $112.83, which represents a 56.26% upside potential from the current stock price. This indicates that analysts are bullish on Duolingo’s future performance and see significant potential for the company to continue growing.

Duolingo’s Risk Factors

Duolingo has reported a total of 57 risk factors in its last 10Q report. One risk factor that investors should be particularly aware of is the company’s reliance on advertising revenue. According to TipRanks’ Risk Factors tool, Duolingo derives 15.4% of its revenues from advertisements. This means that if the company is unable to continue competing for these advertisements or if any events occur that negatively impact its relationships with advertising networks, its advertising revenues and operating results could be negatively impacted.

Conclusion: Duolingo’s Strong User Base and Financial Performance Make it a Promising Investment Opportunity

In conclusion, Duolingo is a well-performing language learning platform with impressive revenue growth and a strong outlook, according to analysts. It offers a variety of language courses and resources, as well as tools for educators, making it a popular choice for language learners worldwide.

The 30% drop in Duolingo’s stock price presents a good opportunity for investors to buy the stock, as it may be undervalued at its current price.

While it is important for investors to consider the risk factors associated with the company, including its reliance on advertising revenue, Duolingo’s strong financial performance and positive insider trading activity suggest potential for continued growth in the future.