Despite the early recovery seen at the start of the year, following 2022’s resolute bear, a sustained bull rally has failed to materialize since. Weighed down by an uncertain global economic backdrop and the prospect of a recession, market conditions have been volatile, with investors seeking clear signals on the market’s direction.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Well, according to Carson Group chief market strategist Ryan Detrick, there are plenty of them flashing brightly right now. In contrast to those predicting rough days ahead, Detrick believes there are just too many positive signs indicating more upside is in the cards.

“I’ve done this for more than two decades and I’ve never seen a time that nearly everyone agrees a recession is coming and stocks will crash, yet the data isn’t showing this at all,” Detrick said.

The economy is adding jobs by the truckload, technical signals are bullish, and the solid start to the year – when the S&P 500 delivers positive returns in January, 86% of the time, the rest of the year pushes higher– all, along with other signs, combine to paint a bullish picture.

So, with a potential surge on the horizon, let’s take a look at three names which could be in line for a well-deserved bounce, at least according to some Street analysts. These are stocks which have retreated significantly this year, with all down by 50% or more. Yet, according to TipRanks’ database, each also features a Strong Buy analyst consensus rating and a powerful upside potential.

Semtech Corporation (SMTC)

We’ll start in the chip sector with Semtech, a leading provider of analog and mixed-signal semiconductors along with advanced algorithms. These offerings are designed to be used in commercial applications, and target various segments, including consumer, communications, enterprise computing, and industrial end-markets. Semtech operates via four distinct business units; Signal Integrity Products Group, Advanced Protection and Sensing Products Group, IoT System Products Group, and IoT Connected Services Group.

Semtech shares have been under severe pressure over the past year and are down 66% as a series of disappointing quarterly outlooks have riled investors.

That was the case again, in the most recently reported quarter – for the fourth quarter of fiscal year 2023 (January quarter). Revenue fell by 12.1% year-over-year to $167.51 million, yet beat the consensus estimate by $16.05 million. Adj. EPS of $0.47 met the forecasts. So far, so good. However, as was the case in the prior two quarters, shares subsequently sold off on the soft outlook. In the first quarter of fiscal year 2024 (FY24), Semtech’s organic business is anticipated to decline by 40% to 50%. Moreover, the CEO announced his retirement, and the company closed a big acquisition that will increase the debt load.

That said, while Northland analyst Gus Richard sees “a mess,” he also recognizes the value.

“We believe there are multiple catalysts moving forward,” the 5-star analyst explained. “An activist shareholder with deep semiconductor experience is appointing 2 board members, a new CEO will likely be announced this year, estimates are hopefully conservative, there is likely a 2H recovery driven by new design wins, and longer-term there are likely avenues for value creation combining LoRa and Sierra Wireless product offerings. SMTC is trading at 2.3x EV/FY24 sales and 15x EV/FY24 EBITDA. We rarely see semiconductor companies at such low multiples.”

Snap up shares now, appears to be Richard’s take, whose Outperform (i.e. Buy) rating on SMTC is backed by a $32 price target, indicating potential upside of ~54% from current levels. (To watch Richard’s track record, click here)

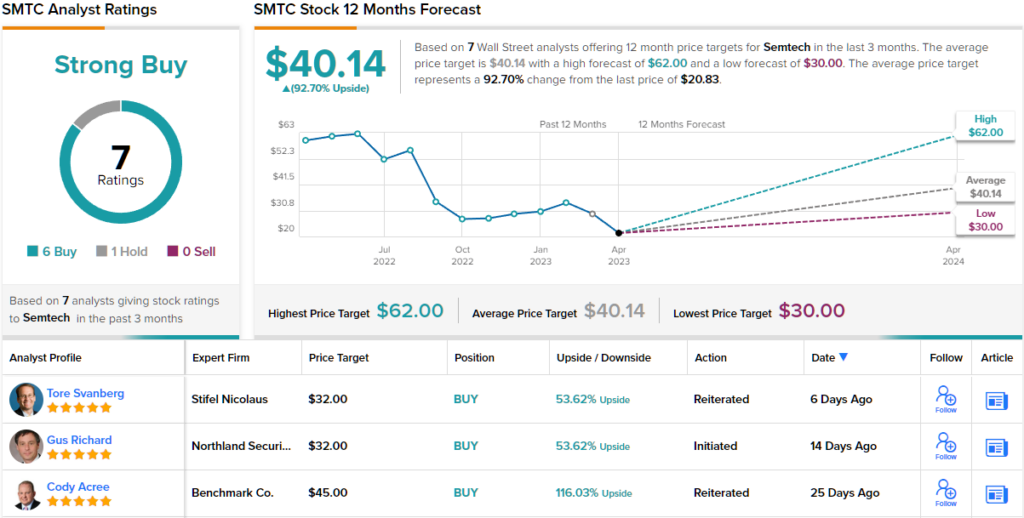

Richard, while bullish on the stock, is somewhat conservative compared to the general Wall Street view here. SMTC has a Strong Buy analyst consensus rating, based on a unanimous 7 Buys set in recent weeks. The average price target is higher than Richard’s, at $40.14, and implies a stronger upside potential of ~93% from the $20.83 share price. (See SMTC stock forecast)

Endava plc (DAVA)

For our next beaten-down stock, we turn to Endava, a digital consulting firm based in London, UK. The company offers technology services that cater to clients’ digital transformation needs across various industries, including payments, media, financial services, retail, healthcare, and telecoms. In a nutshell, Endava helps businesses with their modernization efforts to stay competitive.

Endava’s most recent quarterly report – for the second quarter FY 2023 (December quarter) – was solid with few surprises. The company reported EPS of 0.57 pounds on revenue of 205.2 million pounds, representing a year-over-year increase of 23% for EPS and 30% for revenue. Both results aligned with the analyst forecasts. However, the company’s outlook did not meet expectations, and for the third quarter of FY 2023, the call for 14% to 15% revenue growth disappointed investors.

Shares fell in the aftermath as they have often done since reaching an all-time high in 2021. In total, over the past 12 months, the shares have shed 51% of their value as the pandemic-era winner has been a victim of the shift in market sentiment.

Nevertheless, taking the long-term view, Morgan Stanley analyst James Faucette sees plenty to like about the company. He writes: “We continue to believe that DAVA is among the best-positioned IT Services companies to benefit from secular digital transformation tailwinds given its 100% exposure to digital engineering capabilities, strong hiring, expansion with clients, and pricing power, all of which reinforce our confidence in the durability of DAVA’s headcount and revenue growth, relative to our broader IT Services coverage.”

Putting these thoughts into grades and numbers, Faucette rates the shares an Overweight (i.e. Buy) while his $105 price target makes room for one-year returns of 87.5%. (To watch Faucette’s track record, click here)

There’s a sense on Wall Street that this is a stock to own. All 5 recent analyst ratings are positive, naturally making the consensus view here a Strong Buy. The average target is an upbeat one, too; at $98.40, the average target suggests gains of ~76% could be in the cards over the next 12 months. (See Endava stock forecast)

Gray Television (GTN)

Our next destination for a deeply discounted investment is Gray Television, a television broadcast company based in Atlanta, Georgia. Gray prides itself on being the U.S.’s biggest owner of top-rated local television stations and digital assets and owns and/or operates stations in 113 markets. Collectively, these reach around 36% of American households. The company also boasts of taking first or second place in market share in 89% of these markets and is affiliated with all of the big-4 networks.

The story of the company’s latest quarterly statement is a familiar one: Strong results tempered by a lackluster outlook. In 4Q22, GTN generated revenue of $1.1 billion, representing a 52.6% year-over-year increase and outpacing consensus by $60 million. Likewise, EPS of $1.88 trumped the $1.76 forecast. However, for Q1, Grey sees revenue coming in between $777 million and $796 million. Consensus was looking for $798.44 million.

The shares have not been able to recover since and it all adds up to a stock that has toned down by 60% over the past 12 months.

That said, for Benchmark analyst Daniel Kurnos, the opportunity now skews heavily in GTN’s favor.

“Investors will likely begin to shift valuations to 2023/2024 in the coming months, making Gray look substantially more attractive from a valuation perspective while also beginning to call some initial attention to what we believe is a fundamental mismatch relative to the opportunity set,” the analyst explained. “We acknowledge that there are a slew of variables between now and next year (2023 guidance also does not include any early 2024 campaign money but neither does it assume a recession) but we see the blended average as meaningfully de-risked.”

These comments underpin Kurnos’s Buy rating and back a $19 price target. The implication for investors? Potential upside of a robust 141% from current levels. (To watch Kurnos’s track record, click here)

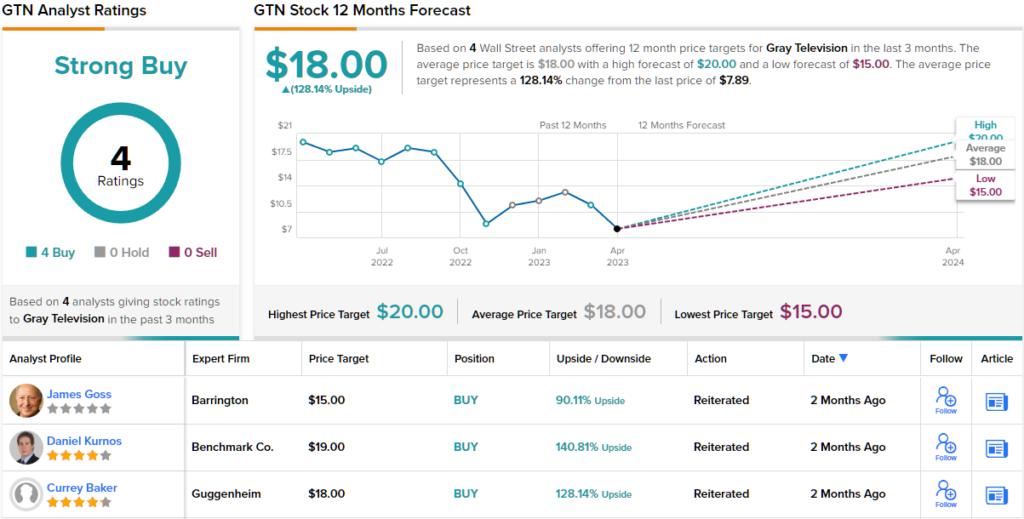

It appears the rest of the Street sees plenty of upside, too. Based on Buys only – 4, in fact – the analyst community rates GTN a Strong Buy. The average price target hits $18, and implies potential upside of ~128% over the coming months. (See GTN stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.