Airline stocks, including Southwest Airlines (NYSE:LUV), have trailed the broader markets since the onset of the COVID-19 pandemic. Today, Southwest Airlines stock trades 58% below all-time highs, valuing the company at a market cap of $16 billion. However, I don’t believe Southwest Airlines stock is a good buy at its current valuation. I am bearish on Southwest Airlines due to its exposure to Boeing (NYSE:BA), narrowing earnings, and high balance sheet debt.

In early 2020, governments all around the world were forced to shut their borders to limit the spread of the dreaded virus. To remain operational, airline companies increased balance sheet debt while revenue and cash flows fell significantly.

While global travel resumed by late 2021, central banks hiked interest rates to offset inflation, both of which touched multi-year highs in 2022. The triple whammy of high debt, interest rates, and inflation has impacted the profitability of Southwest Airlines and its peers, even though travel demand staged a remarkable comeback in a post-pandemic world.

An Overview of Southwest Airlines

Southwest Airlines is among the largest airline companies in the world. It operates and manages a fleet of passenger aircraft. Moreover, it offers ancillary services such as early bird check-in, upgraded boarding, and transportation of pets and unaccompanied minors.

The ongoing pullback has meant that LUV stock has returned just 19% to shareholders in the past decade (see below), trailing the S&P 500 Index (SPX), which has more than tripled investor returns after adjusting for dividends.

Southwest Airlines Has Massive Exposure to Boeing

Southwest operates an all-Boeing fleet and relies heavily on the aircraft manufacturers’ line of 737 planes. However, the 737 aircraft have wrestled with a range of issues in the last five years. For instance, several countries grounded 737 Max 8 jets in 2019 and 2020 after two fatal crashes were reported in a span of six months, raising concerns over the safety of these jets.

Earlier this year, Boeing came under fire again after an Alaska Airlines flight (a Boeing 737 Max 9) landed 10 minutes after takeoff because a window panel blew out.

In fact, over a dozen equipment problems involving Boeing have been reported since 2012 as it continues to lose market share to Airbus.

Now, Boeing is wrestling with production delays and pressure from regulators, which is hurting companies such as Southwest Airlines.

Southwest Misses Estimates in Q1 of 2024

Last month, Southwest Airlines announced its Q1 results for 2024, reporting a wider-than-expected loss, and warned that airplane delays from Boeing would hamper near-term growth. Southwest Airlines reported revenue of $6.33 billion and a loss of $0.36 per share. Comparatively, analysts forecast Q1 revenue at $6.42 billion and a loss of $0.34 per share.

The airline expects to grow its capacity by 4% in 2024, lower than its previous guidance of 6%. It also estimates revenue to decline by 3.5% year-over-year in Q2 of 2024.

Southwest Airlines emphasized that it now expects to receive 20 737 Max 8 planes from Boeing, much lower than its previous forecast of 46 planes. So, Southwest will have to delay retiring older jets as it also looks to reduce costs amid a challenging operating environment.

Additionally, Southwest Airlines announced it would shut down operations at airports such as Houston’s George Bush International and New York’s Syracuse. The airline carrier is also scaling back operations in Atlanta and Chicago.

In its earnings release, Southwest CEO Bob Jordan explained, “The recent news from Boeing regarding further aircraft delivery delays presents significant challenges for both 2024 and 2025. We are reacting and replanning quickly to mitigate the operational and financial impacts while maintaining dependable flight schedules for our customers.”

Southwest Airlines stated that it has re-planned its capacity for the next two years due to Boeing’s delivery delays. However, it warned investors and explained that there is no assurance that Boeing will meet its most recent delivery schedule.

Southwest Stock Has High Debt

Southwest Airlines ended Q1 with $8 billion in total outstanding debt and $11.5 billion in liquidity. Southwest must generate enough cash flow to service its debt and make regular interest payments. However, the company reported a free cash outflow of almost $700 million in Q1, making investors nervous.

A negative free cash flow figure limits Southwest Airlines’ ability to reinvest in growth or lower balance sheet debt. If Southwest Airlines continues to report negative free cash flow, it would reduce total liquidity levels and drive its valuation lower.

What Is the Target Price for LUV Stock?

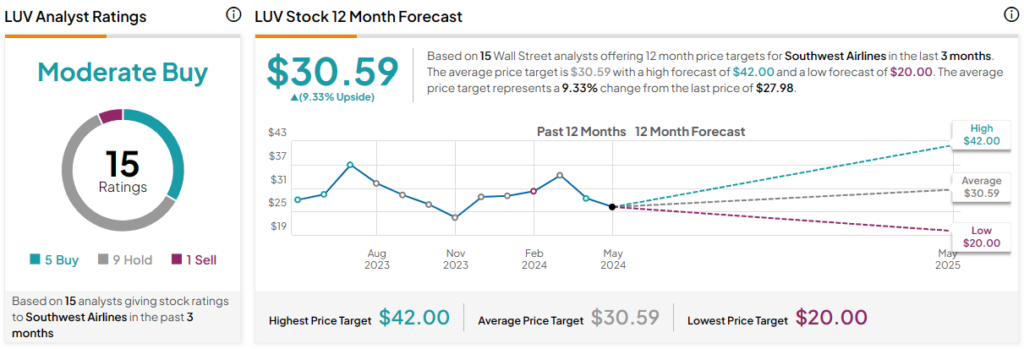

Out of the 14 analyst ratings given to LUV stock, five are Buys, nine are Holds, and one is a Sell, indicating a Moderate Buy consensus rating. The average LUV stock price target is $30.59, indicating upside potential of 9.3% from current levels.

Nonetheless, LUV stock is forecast to end 2024 with adjusted earnings of $1.16 per share, indicating a forward earnings multiple of 23.7x, higher than the sector median of 19x.

The Takeaway

Prior to the pandemic, Southwest was one of the best growth stocks in the airline sector. While it remains a well-run business, its exposure to Boeing and other macro headwinds makes it a high-risk investment right now.

Investors looking to gain exposure might want to consider other companies instead of buying LUV stock on the dip.