Arm Holdings (NASDAQ:ARM) stock is down 20% over the last 30 days, but it is still trading with elevated multiples. Despite the possible tailwinds emanating from the artificial intelligence revolution (AI), the British firm’s valuation metrics are still very hard to justify. While I’d love to be bullish on this AI enabler, I’m just not sure I can put my own money behind it. That’s why I’m neutral on Arm Holdings.

Arm Holdings Has a Competitive Edge

Arm designs the architecture of semiconductors. These are the building blocks for the chips that power our world. Because it doesn’t build the semiconductors itself, it’s a very high-margin business. In fact, Arm’s gross margins are mind-bogglingly high, often above 90%. That would be nearly impossible in any other industry.

It’s also a company that is growing earnings and expanding its market share, which is evidence of its competitive advantage. Here are some key takeaways from Arm’s Form F-1 from August 2023, which highlights the company’s market share expansion between 2020 and 2022.

- The market share for Arm semiconductors in mobile applications remained steady at 99% across the three years.

- Cloud computing experienced significant growth, jumping from a 7.2% market share in 2020 to 10.1% in 2022.

- Arm’s market share in the automotive sector grew from 33% in 2020 to 40.8% in 2022.

- Arm’s market share in the networking equipment market grew from 18.8% in 2020 to 25.5% in 2022.

- Finally, Arm’s market share in the Internet of Things (IoT) and embedded chip market grew from 58.4% to 64.5%.

Can Arm Holdings Stock Keep Rising?

For Arm Holdings stock to keep rising, the company has to continue expanding. In several respects, Arm’s stock price reflects a gamble on its ability to maintain and expand its market dominance in a rapidly evolving technological landscape. It’s very expensive, but its growth in existing markets is impressive.

One issue is that the sector in which it is most dominant — smartphones — is also the most mature. While the sector recently returned to growth, it’s a slow-moving sector. Nonetheless, there are tailwinds here. Arm’s v9 product garners roughly 2x the royalty rate of the equivalent v8 product, and adoption is gathering pace. Additionally, whereas in the previous quarter, that was about 10% of the company’s revenue for royalties, it’s since moved to 15%.

Despite this, Arm’s position in the development of new technologies like efficient processors for AI will be crucial. Royalties from the sector are expected to grow significantly over the medium and long term. While many of us may think that the AI revolution has happened, the reality is that it’s barely started. Long-term demand for AI-enabling semiconductors is forecast to go through the roof, but Arm will need to build market share.

Some analysts are confident that this is happening already. Evercore’s Mark Lipacis claims that Arm has gained significant traction with major hyperscalers. Its market share has grown from 0% in 2018 to 5% in 2023. Given developments in the sector, Evercore expects Arm to reach 40-50% server CPU market share over the next 10 years.

The issue, however, is that Arm Holdings is currently trading at 85x forward earnings. That’s always going to be hard to justify. While the growth rate is extraodinanarily strong — earnings are expected to grow at 42.3% annually over the medium term — it’s just got strong enough.

My favorite metric for valuing stocks like this is the forward price-to-earnings-to-growth (PEG) ratio. Typically, a ratio under one suggests that a stock is undervalued, but that’s very hard to find in the current market. The PEG ratio is calculated by dividing the forward price-to-earnings ratio (85x) by the forecasted annual growth rate for the next three-to-five years (42.3%).

The result is a forward PEG ratio of 2.01. Normally, that’s too high for me, but I accept Arm is likely to benefit from long-term tailwinds. This is why I’m sitting on the fence with this one.

Is Arm Holdings Stock a Buy, According to Analysts?

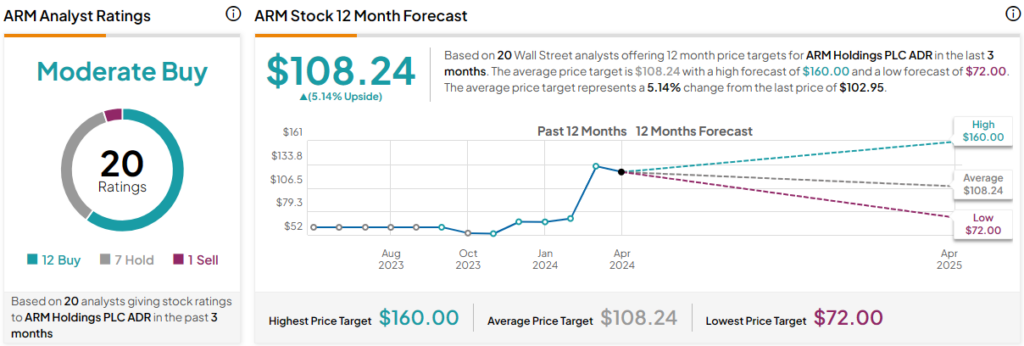

Arm Holdings stock is currently rated as a Moderate Buy based on 12 Buys, seven Holds, and one Sell assigned by analysts in the past three months. The average Arm Holdings stock price target is $108.24, implying 5.1% upside potential.

The Bottom Line on Arm Holdings Stock

Arm Holdings is a difficult stock to understand purely because we need to look further into the future to justify its valuation. Its earnings are expected to grow rapidly in the coming years, but the stock is incredibly expensive at 85x forward earnings and with a forward PEG ratio of 2.01.

This growth is also somewhat dependent on its ability to continue growing its market share, especially in important sectors like cloud servers and AI. While I’d like to back this stock, I find it hard to put my money behind it, given the variables involved.