Tesla (NASDAQ:TSLA) shares might have more than doubled in value this year, but the strong market performance has come against a difficult backdrop. The year has been defined by ongoing price cuts as Tesla has fought against waning demand. Those have provided a boost to volumes but have had a negative effect on margins.

With Q4 and the full year about to come to an end, Deutsche Bank analyst Emmanuel Rosner thinks that story could repeat itself.

Rosner expects Tesla to announce the delivery of 476,000 units in the quarter, reflecting a 17% year-over-year increase and a 9% sequential uptick – aligning with his previous forecast. This performance would also contribute to Tesla’s pursuit of its 2023 guidance of delivering 1.8 million units.

But given lower expectations for ASPs (average selling prices), Rosner is now calling for Q4 revenue of $24.7 billion, slightly below his prior $24.9 billion forecast. At the same time, despite higher volumes, Rosner expects auto gross margins to be down by 10bps quarter-over-quarter to 16.2%.

The end result is also a reduction of EPS expectations with Rosner now anticipating Q4 EPS of $0.69 compared to $0.74 beforehand ($0.74 is also the Street’s forecast).

The problem is that moving forward, Rosner does not expect the overall picture to improve. Due to a significantly lower volume outlook than the market is currently factoring in, Rosner sees “considerable downside risk to earnings expectations.”

Anticipating only muted volume growth of 300,000 units for 2024 (up 17% y/y), and particularly taking into account the elimination of consumer tax credits for the Model 3 in the U.S (with there also being indications that the Model Y might also experience a decrease in consumer credits), Rosner also factors in a ~6% year-over-year price drop.

For those looking for some optimism amongst the depressed outlook, beyond 2024, Rosner sees Tesla’s next-gen platform as key for long-term success. While the timing of the launch and the initial capacity are still unknown, the next-gen platform is “by far Tesla’s largest growth opportunity.”

All told, Rosner rates Tesla stock a Buy, while slightly trimming his price target from $275 to $260, implying shares are almost fully valued. (To watch Rosner’s track record, click here)

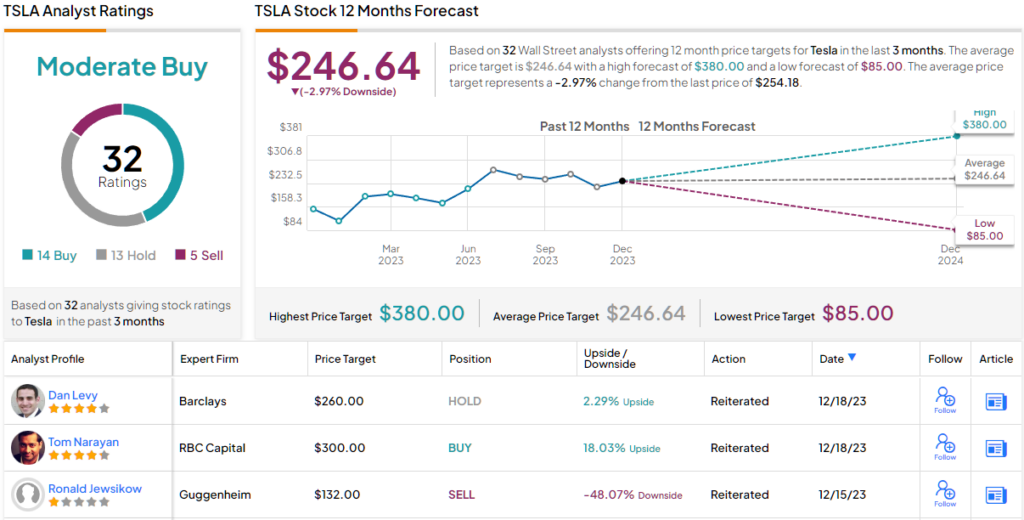

On balance, TSLA stock receives a Moderate Buy consensus rating, based on a combination of 14 Buys, 13 Holds and 5 Sells. The $246.64 average target also suggests the shares will remain rangebound for the foreseeable future. (See Tesla stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.