The Starbucks (NASDAQ:SBUX) brand is iconic with juicy margins and a new medium-term strategy promises to grow earnings quite rapidly. These are some great elements and catalysts that should contribute quite positively to the company’s results moving forward. That said, the stock’s current valuation appears elevated and can only be justified if management’s strategy is executed as expected. Thus, there is a rather thin margin of safety for investors. Accordingly, I am neutral on the stock.

Starbucks Remains Essential to Consumers

One would reasonably imagine that with inflation raging and mortgages on the rise, consumers would be discouraged from spending $5 for a latte. Yet, in its latest results, Starbucks once again proved that its coffee remains an essential part of its customers’ daily routine.

In its Q3 results, Starbucks reported revenue growth of 9% year-over-year to a quarterly record of $8.2 billion. Each business segment contributed notably to Starbucks’ results, while the company retained fantastic pricing power.

In fact, North American comparable store sales rose 9%, supported by an 8% increase in average ticket and a 1% increase in comparable transactions. This included U.S. comparable store sales growth of 9%, mainly pushed by an 8% increase in average ticket. Thus, we see that consumers are willing to spend a lot of money at Starbucks despite the current highly-inflationary environment.

It’s worth noting that Starbucks’ average ticket reached an all-time high once again, with the increase supported by increased spending on food, along with strategic pricing actions. I think food is going to continue to be a great growth driver for the company as pricing on coffee already appears to be reaching a glass ceiling. Thus, seeing consumers receive Starbucks’ new food products well is certainly encouraging.

Starbucks’ overall sales growth is also quite impressive, considering that COVID lockdowns across China kept Shanghai, which is the company’s largest China market, mostly closed for two months. Specifically, with the exception of China, where the government’s strict Zero COVID policy resulted in mobility constraints and inflexible store operations, each one of Starbucks’ international regions expanded revenues by double digits during the quarter.

In my view, this is an extraordinary achievement, highlighting both the strength of the Starbucks brand and the resilient demand for Starbucks coffee all across the world.

Inflationary pressures did counterbalance the company’s higher top line, but profitability still remained quite strong. The operating margin fell by 230 basis points to 22% and was mainly caused by elevated commodity and supply chain costs and investments in labor.

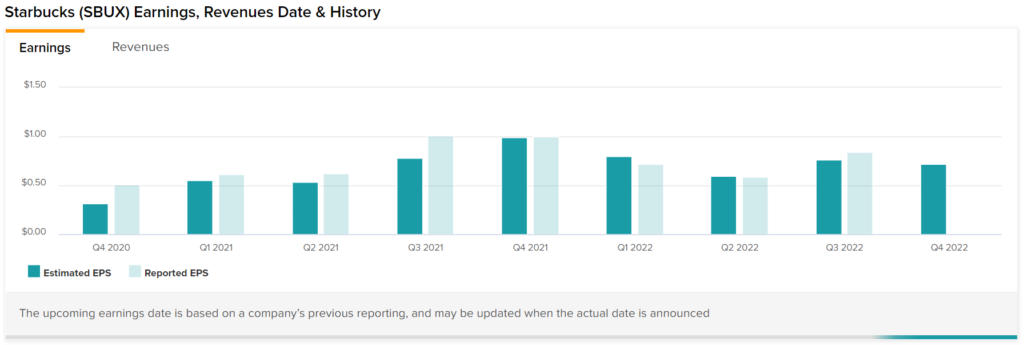

Still, that’s quite a juicy number considering the circumstances. Lower margins can have a powerful impact on the bottom line, nonetheless. Thus, Starbucks’ adjusted earnings-per-share fell 15.2% to $0.84, with lower net income being partially uplifted by a lower share count.

While the management did not provide full-fledged guidance, it was noted that margins and earnings-per-share will decline further in Q4. This was attributed to a later-than-expected recovery in China and various one-off items that boosted results recently but won’t continue in Q4.

Accordingly, consensus EPS estimates by Wall Street analysts forecast that the company will end Fiscal Year 2022 with earnings-per-share at $2.87, implying a year-over-year decline of around 11.3%.

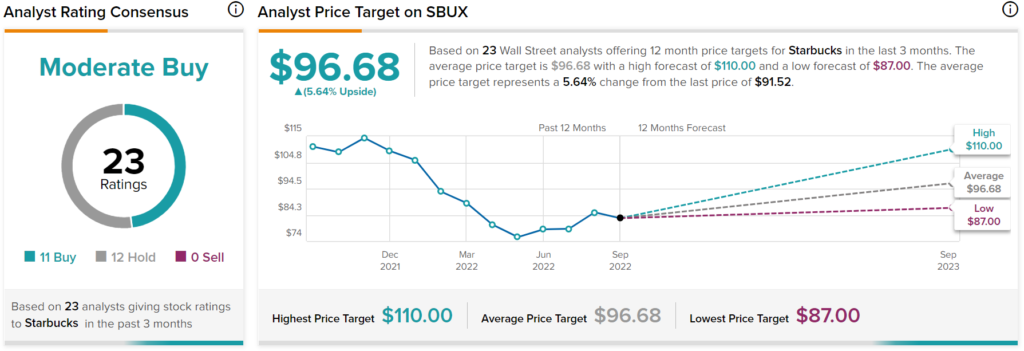

So why would the market remain so optimistic about Starbucks’ earnings growth? After all, this earnings-per-share projection implies a hefty P/E of 31.7 at the stock’s current price levels. Well, besides the fact that the company’s top-line momentum remains robust, Starbucks appears to be entering a new phase of growth over the coming years.

Starbucks introduced a three-year road map, targeting an annual comparable store sales growth of 7-9%, annual revenue growth of 10-12%, and annual adjusted earnings-per-share growth of 10-12%. These are quite bold and exciting targets, which have rightfully rallied investors behind the stock.

What is the Target Price for SBUX Stock?

Turning to Wall Street, Starbucks has a Moderate Buy consensus rating based on 11 Buys and 12 Holds assigned in the past three months. At $96.68, the average Starbucks price target implies a 5.6% upside potential over the next 12 months.

The Takeaway – Promising Growth Roadmap, but Priced to Perfection

Starbucks’ operating results continue to surprise positively. Top-line growth exhibits with certainty that its overall momentum remains vigorous, with record revenues and ticket prices. Management’s three-year roadmap also seems to be exciting. Still, even if the company does achieve double-digit adjusted EPS growth, I find the stock’s valuation multiple too rich. I am not even sure whether double-digit earnings-per-share growth is even enough to justify a P/E in the 30s in the current environment.

My best guess is that the stock is basically priced to perfection, and thus investors should not be surprised if shares were to plunge following even the slightest miss on its targets.