Widely recognized for its leading real-time non-structured data search capabilities, Elastic N.V. (ESTC) counts companies such as Uber (UBER), Lyft (LYFT), and Match Group (MTCH) as customers. Despite the ongoing pandemic, Elastic put up some pretty impressive numbers in Q3’21, with year-over-year revenue growth of 39% and a net expansion rate of 130%. Given that the business model is consumption-based, Elastic should thrive in the coming year as the economy opens back up.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

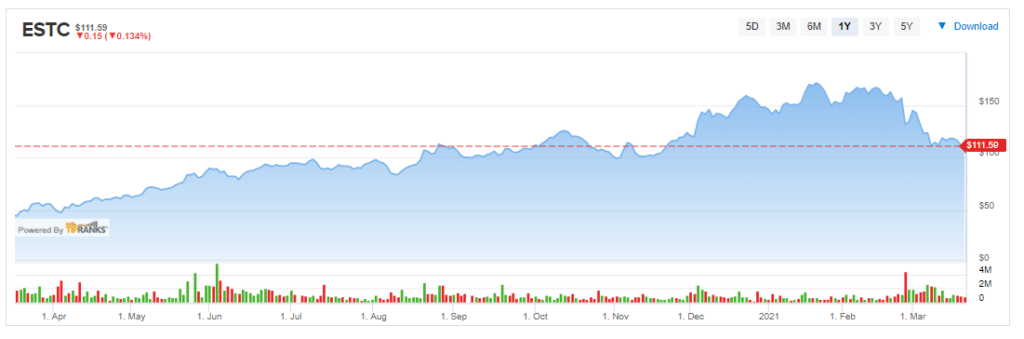

But Mr. Market doesn’t necessarily agree, and the price of Elastic stock has fallen this year from an all-time high of $171 in January to $111.59 currently, for a drop of 35% in a little more than two months, partially due to the tech market sell-off, but also because of company-specific factors.

Factors Impacting The Stock Price

One major factor contributing to Elastic’s downtrodden stock price is the soft guidance issued for Q4’21, with forecasted year-over-year revenue growth of 28% and non-GAAP operating margin in the range of -8.5% to -7.5%.

The revenue growth appears to be on the light side, and margins are also a concern, especially given that management has indicated during the last earnings call that operating margin is expected to fall in 2022 as the economy opens up. “Given the higher investment profile and the return of travel and event expenses, we are currently expecting that our operating margin in fiscal 2022 will be a few percentage points lower than in fiscal 2021,” the company said.

Apart from weak guidance, Elastic is expanding into observability and endpoint security, two extremely competitive market niches. While Elastic is clearly an industry leader in search, it is a small player in the other markets.

The investment community is likely skeptical about Elastic’s ability to compete in observability and endpoint security given that Wall Street darling and endpoint security leader, CrowdStrike (CRWD), is now entering the observability market with the acquisition of Humio, announced back in February.

Finally, a recent change to Elastic’s licensing model has developers concerned that the company may be moving away from an open-source business model. The licensing has been modified to address occurrences such as Amazon’s (AMZN) use of Elasticsearch and apparent brand and trademark abuse. Now, the licensing model restricts how cloud service providers can use Elasticsearch and Kibana in their own products.

Wall Street’s Take

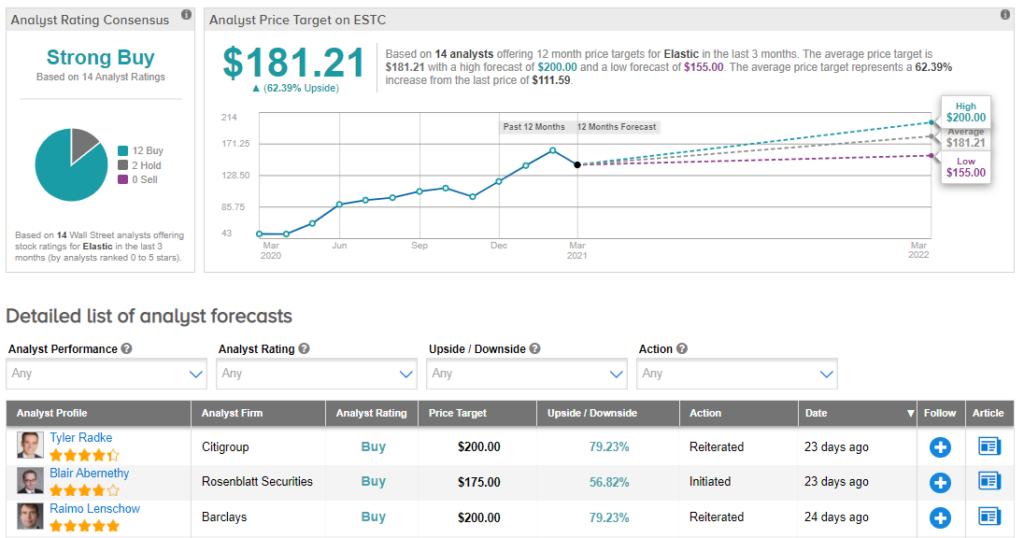

From Wall Street analysts, Elastic earns a Strong Buy consensus rating, based on 12 Buys and 2 Holds. Additionally, the average analyst price target of $181.21 puts the upside potential at 62%. (See Elastic stock analysis on TipRanks)

Summary And Conclusions

Elastic is an industry leader in real-time non-structured data search applications, and has an extensive list of customers. However, in spite of its excellent financial performance in Q3’21, the stock has underperformed due to weak guidance for the remainder of FY’21 and expected margin compression in FY’22.

In addition, there is also concern that competition in Elastic’s secondary markets, observability and endpoint security, may intensify, especially given CrowdStrike’s apparent entry into the observability market niche.

Despite these concerns, the depressed stock price may present an opportunity to investors amid the economic reopening.

Disclosure: On the date of publication, Steve Auger did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.